Yield Suppression

Within the context of recent Federal Reserve headlines, I think it’s a good time to add more qualitative analysis to the drivers of our current fiat debasement environment. This style of analysis is not meant to inform any investments by itself, rather, it is meant to substantiate what we see in the data and the actions already being taken via fiscal and monetary policy.

I wrote about treasuries and gold and debasement last year. That piece outlines the measurable value of commodities and bonds. The following analysis is something I’m always performing to estimate if those pressures are building or waning.

The Debt Backdrop

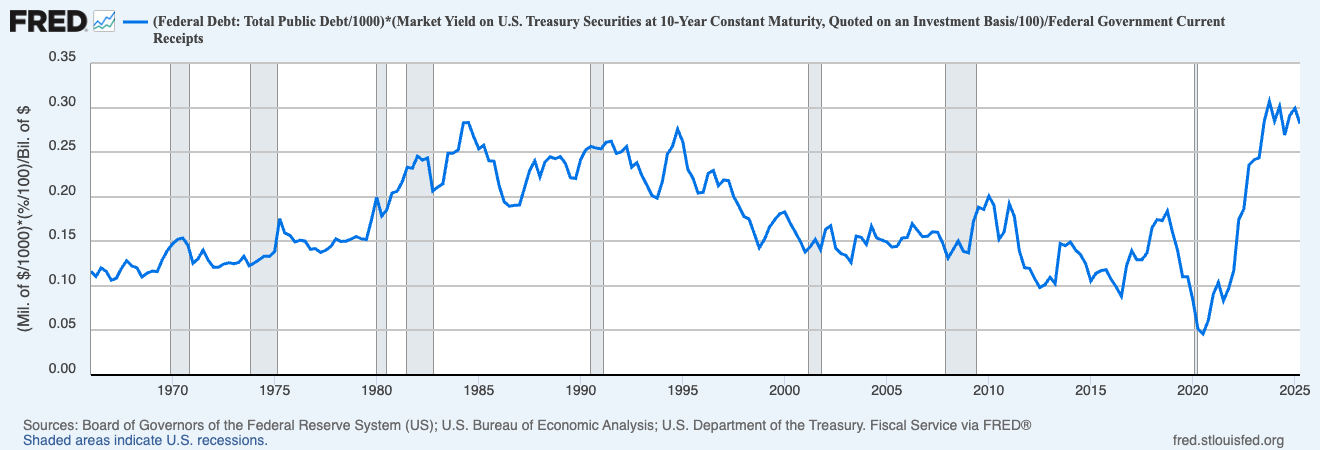

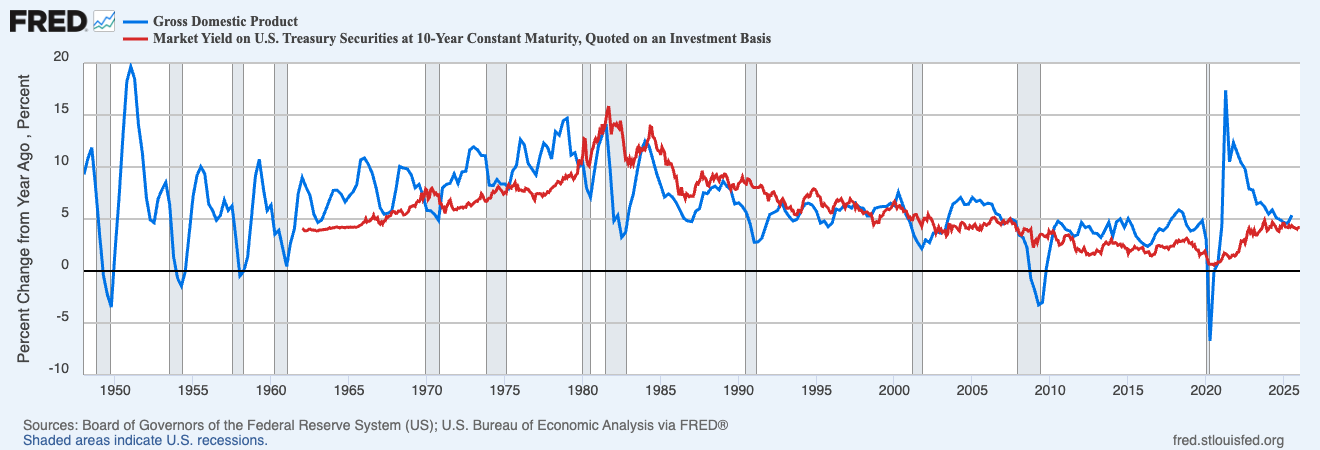

The federal debt might be driving more policy than you’d realize. If the entire federal debt were to mature tomorrow, and the government financed it at prevailing 10 year treasury rates, those interest payments would total 28% of federal tax receipts.

This situation would not be concerning if it didn’t set such a limiting ceiling for growth. Nominal growth is currently only 5.4% y/y and so long-term rates are only at 4.2%. Growing our economy at the same rate as the 1960’s, 70’s, and 80’s might imply a doubling of interest rates (or more) to 8.4%. Our debt, financed at 8.4%, would then total 56% of federal tax receipts. Not enough revenues would be left over to operate the government.

This is obviously a gross oversimplification of the federal debt burden. All I want to illustrate is that any desire for higher growth is at odds with the government’s ability to finance existing debt, especially now.

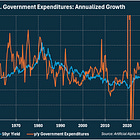

The Government Reaction Function

One approach to burdensome government debts, which has been executed many times before, is to artificially lower interest rates such that the economy (and thus, tax receipts) can grow faster than the debt. Overnight rates at the Federal Reserve are the best (and only?) place to finance the government at artificially low rates.

As far back as 1791, when Revolutionary War debts crippled the government, the First Bank of the United States was ordered by Congress to finance federal debt at a rate no higher than 6%.

And the Federal Reserve has received as little protection as the First Bank. Much like Jerome Powell today, the Federal Reserve Chair has a history of being pressured to lower rates. The Federal Reserve artificially lowered rates to fund WWI. The Fed again coordinated with FDR to suppress interest rates during WWII. LBJ pressured the Fed to lower rates as he ramped up spending on the Great Society and the Vietnam War. Nixon took the same baton from LBJ.

This is not to argue that the government has no other options for dealing with the debt. Instead, this is to identify a government policy that is prone to implementation. We can be more confident in our read of the situation because yield suppression is a well-trodden path during periods of high debt.

Losers and Winners

The losers of this policy and/or power struggle are the bondholders whose yields would fail to keep pace with nominal growth, debasement, and/or inflation. The government does not want to pay bondholders a market yield, in which case their bonds would underperform!

The winners of this policy are all assets that are protected against nominal debasement and/or inflation. Gold, houses, and commodities are obvious winners vs bonds because of their direct competition for diversification allocations and assumed protection against debasement. Stocks likely view these developments through a neutral lens because their earnings generally grow with inflation but their multiples can be damaged by weak bank leadership and inflation volatility.

Takeaways

The core audience of this letter might not own bonds or gold because diversification assets aren’t suitable for their investment strategy. These developments might have very little impact on those investors or their strategies.

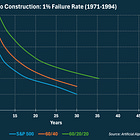

Another audience might be meaningfully diversified because they find diversification more suitable for their retirement needs. Those investors should use this analysis to understand the dominos that cause a 60/40 portfolio to supply insufficient diversification. There is plenty of precedent for yield suppression at the expense of bondholders. This is why portfolios backtested with 20% Treasuries and 20% Gold perform better than a 60/40 portfolio on a risk-adjusted basis.