Debasement Protection

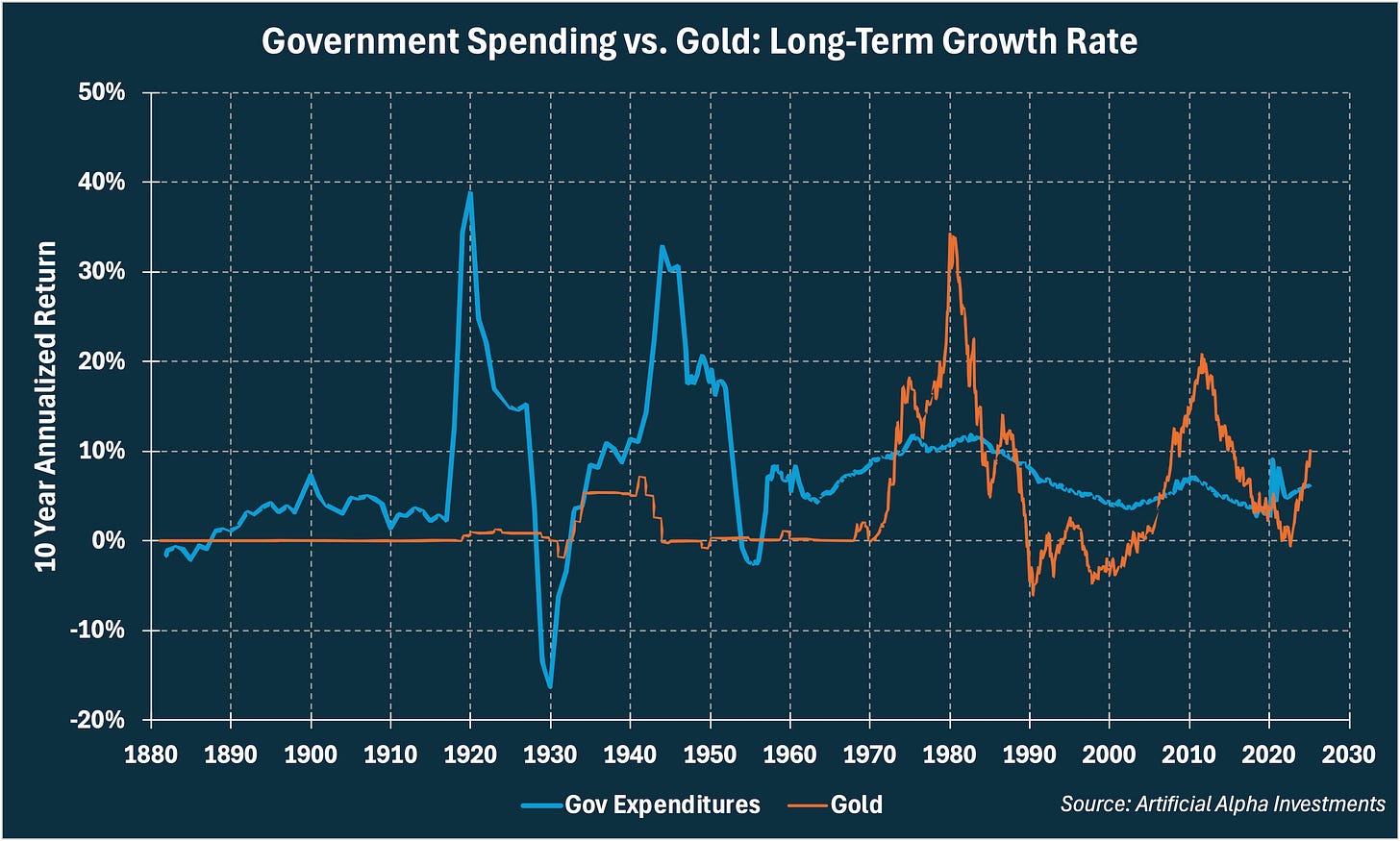

The amount of money in the economy increases by ~7% per year, sometimes by more and sometimes by less. This is known as debasement. The value of Gold (commodities, more broadly) and Treasuries (debt, more broadly) should both be contextualized in comparison to this debasement of the dollar.

Gold’s price is quite correlated with the money supply. The faster the money supply increases, the faster Gold’s price goes up. More money chases the same amount of Gold as the currency gets debased. Gold investors are betting on more debasement.

Treasury investors are similarly hoping to outpace debasement, but the game is very different.

Whereas the future return on Gold is unknown, and likely dependent on the future rate of currency debasement, the yield on a Treasury is promised up front. The yield on a 10 year Treasury will not change over the course of those 10 years, no matter how much the currency gets debased along the way.

Thus, the only way for a Treasury to outpace debasement is for less money to get printed over the life of the Treasury than the investment’s agreed-upon yield. Treasury holders are betting on less debasement.

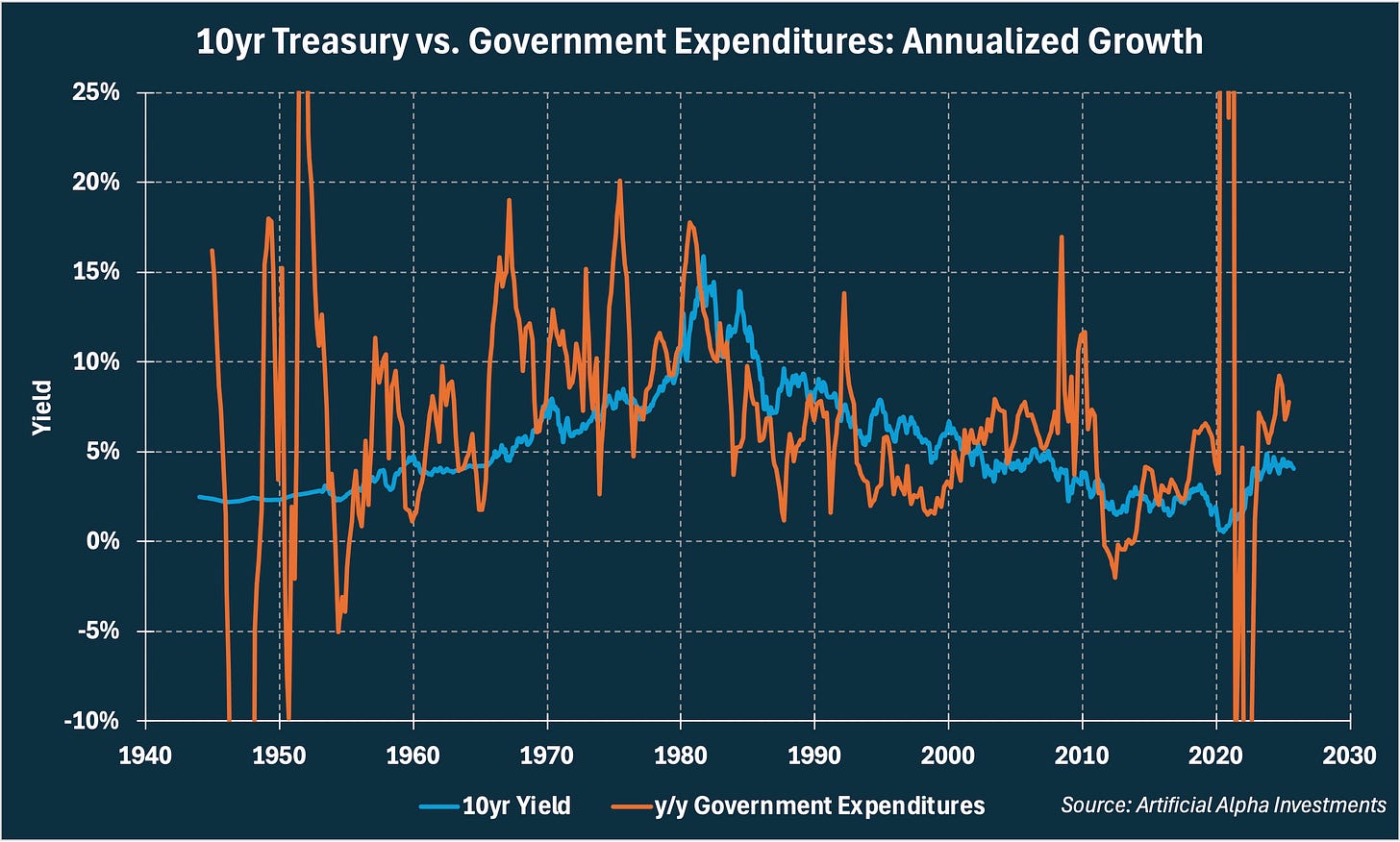

Below are some historical examples of this dynamic using this chart of y/y government expenditures (one measure of debasement) and 10 year Treasury yields for reference.

The government printed money at about the same pace as Treasury yields between 1954 and 1965, such that Treasuries represented a solid investment.

Then, the Vietnam War and rapidly expanding federal social welfare programs ballooned debasement past Treasury yields in the late 1960s. This imbalance led to the end of the Gold standard, drastic outperformance of Gold over Treasuries, and rampant inflation in the 1970s. Markets finally balanced again in 1980 when Paul Volcker raised interest rates to where they could adequately compete with debasement.

The 1980s and 1990s were great decades for investors. Yields on all investments, and in particular Treasuries, outpaced debasement for a long time.

Debasement picked up again in the 2000s as an exorbitant amount of debt was created on household balance sheets in the housing sector. Yields, especially in the mortgage industry, were far too low in comparison to all this debasement. Gold enjoyed a decade of outperformance as most debt underperformed and then some debt defaulted in the 2008 recession.

The 2010s were weird. Debasement was so low that growth suffered. Yields were properly priced, however.

The 2020 pandemic jumpstarted today’s market forces. Government spending went through the roof as we protected families against a partially shuttered economy. Yields went to zero out of fear. We are still experiencing an imbalance between high government spending (debasement has only accelerated since the pandemic) and low yields. Government spending increased by 7.8% y/y in Q2 2025 and 10 year Treasuries only yield 4.1%.

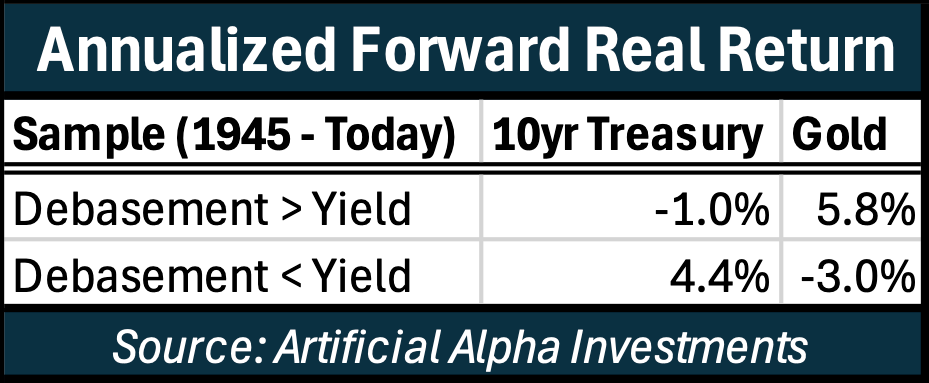

I took the chart above and calculated the annualized real rate of return for 10 year Treasuries and Gold when government expenditures were growing faster or slower than Treasury yields. The ability for each investment to protect purchasing power was highly dependent on whether yields were reasonably priced vs. trailing debasement.

Even for investors who don’t wish to trade this valuation technique, such a simple model should inspire confidence in each asset’s unique diversification benefits.

Today’s 10 year Treasury yield at 4.1% will not protect against 7.8% y/y growth in government spending. This is why active traders and retired/diversified investors are turning to Gold to protect their portfolios against debasement.