Beyond 60/40: The Case for Gold

Part 3 of the Diversification Pillars series

The 60/40 portfolio was born in 1952 during the gold standard, a period when the US Dollar was pegged to gold.

In theory, the gold standard was to incentivize a balanced money supply such that gold prices could be held constant. In practice, the federal government often ran deficits, “printed money”, and put pressure on the peg.

Periods of “money printing” were historically met with bank runs to convert increasingly worthless dollars into trustworthy gold and these money supply imbalances eventually caused strains on the peg. Debt accumulation during WW1 forced many governments to temporarily suspend the gold standard. Debt accumulation during the Great Depression forced Britain to completely abandon the gold standard in 1931 and the US to temporarily suspend the gold standard in 1933.

Despite eventual capitulation, artificial price dampening by governments dedicated to the gold standard made sure that gold was not useful as a financial instrument. It is not surprising to me that Gold was excluded from the 60/40 portfolio in 1952.

In a world without the gold standard, gold is a very unique financial asset.

Gold supply is largely fixed because it is so hard to find or produce.

Gold’s intrinsic value is unaffected by a recession.

Gold does not degrade.

Bonds fail #1 because the government has the power to print more bonds, stocks fail #2 because earnings fall during a recession, and other commodities fail #1 and #3 because of their inferior chemistry. Stagflation, an environment with high money growth and low real growth, would theoretically favor gold’s unique combination of financial qualities.

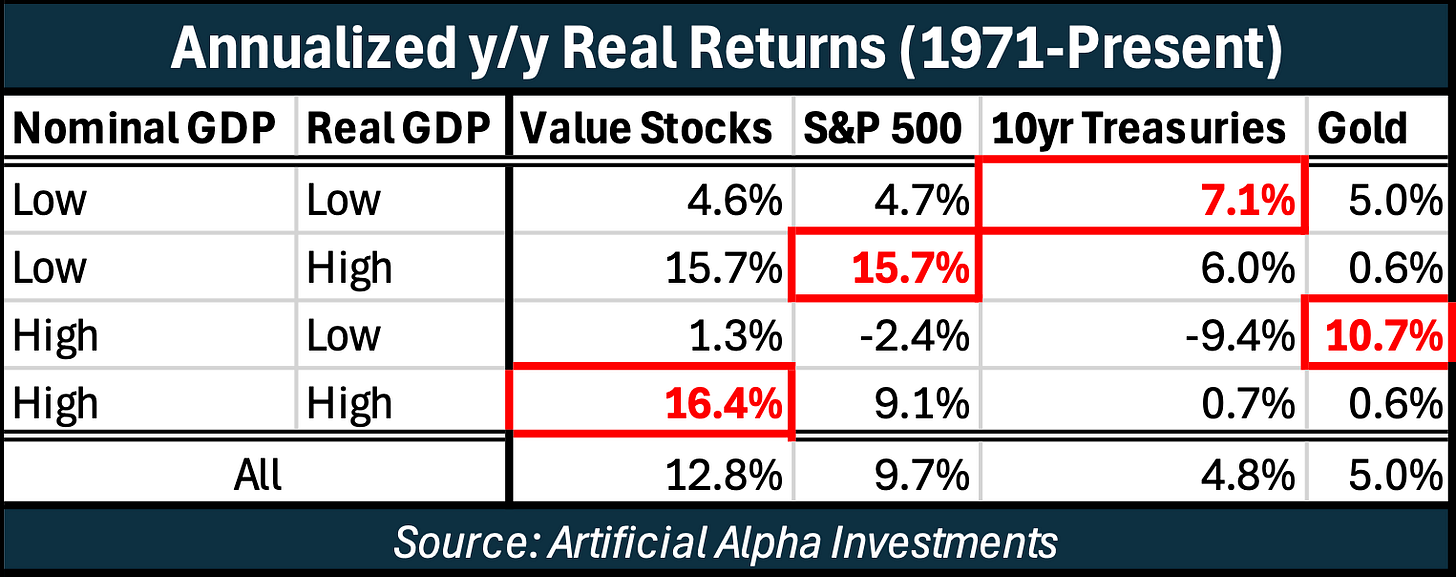

Backtesting confirms this theory. During stagflationary periods since 1971, when Real GDP was low and Nominal GDP remained high, Gold was the best performing asset. This is evidence that Gold’s price follows its fundamentals.

The environment in which Gold excels also happens to be an environment in which the S&P 500 tends to struggle. The S&P 500 returned -2.4% per year during stagflationary periods.

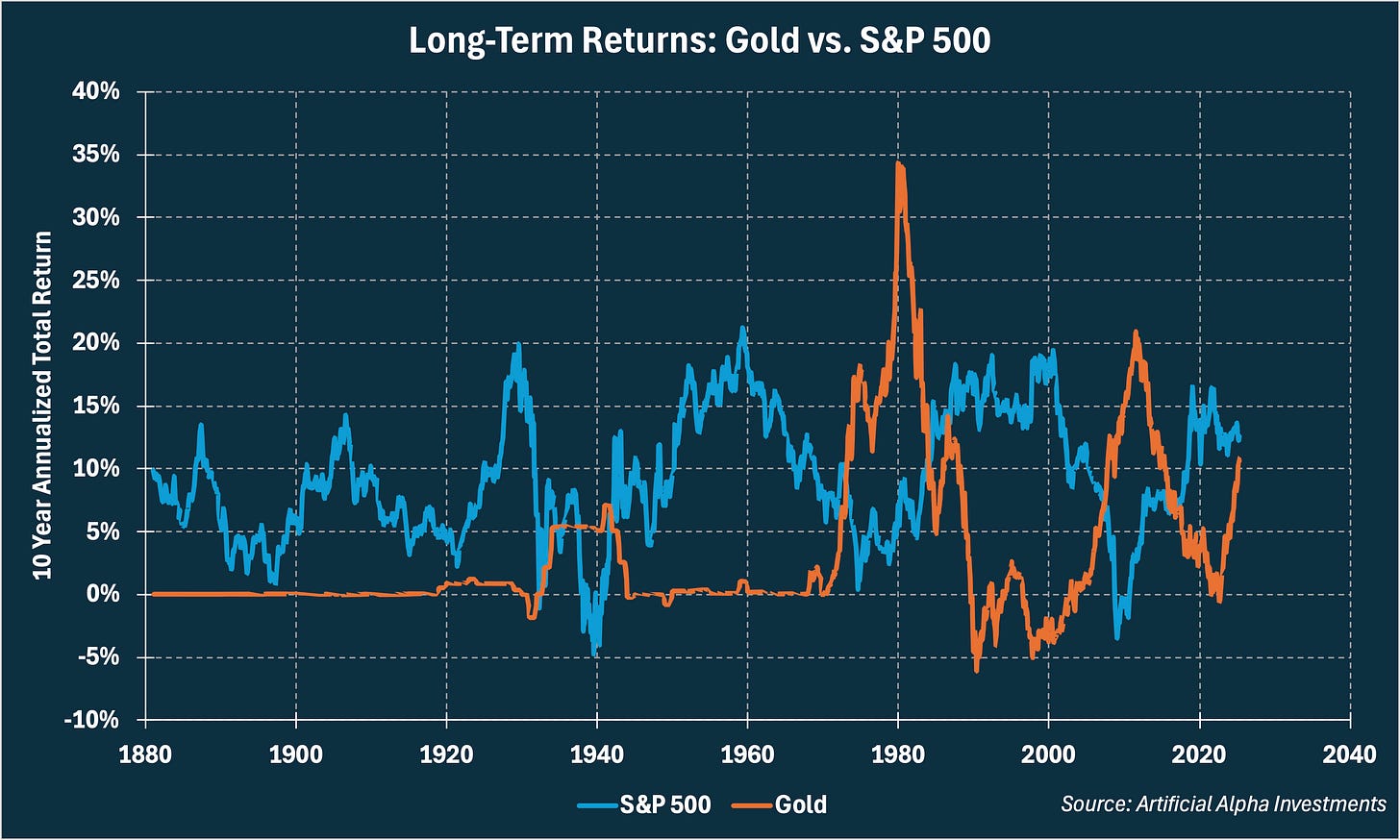

Charting the 10 year annualized return of Gold and Stocks again confirms a clear preference for opposite economic environments, this time on a longer timeframe. You can even see that challenges to the gold standard after WW1 and The Great Depression were accompanied by negative pressure on the stock market. These are illustrations of Gold’s hedging value against the S&P 500.

Bonds are also useful for hedging Stocks, but Gold and Bonds hedge completely different types of recession. Bonds are an attractive hedge when Real GDP and Nominal GDP slow, but struggle when Nominal GDP growth remains high. This is evidence that Gold and Bonds provide different types of S&P 500 insurance.

By balancing hedges across Bonds and Gold, investors are hedging against a wider range of economic outcomes. I will substantiate this added diversification by revisiting the same applications from The 60/40 Portfolio.

Reducing Volatility

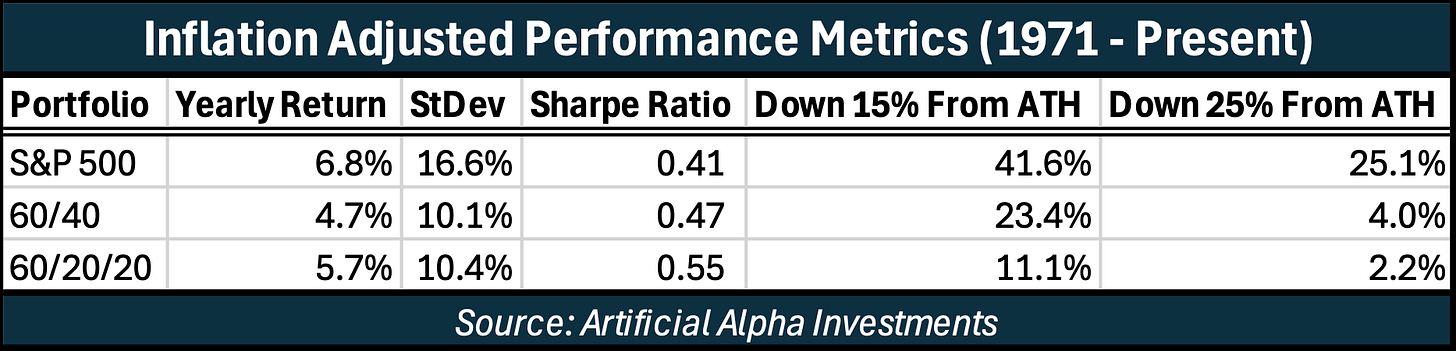

The following statistics suggest that investors with less risk appetite can use diversification to lower their portfolio’s volatility without severely handicapping returns.

The 60/20/20 portfolio includes 20% Treasuries and 20% Gold and volatility-adjusted returns were further improved over the 60/40 portfolio.

Stretching Savings

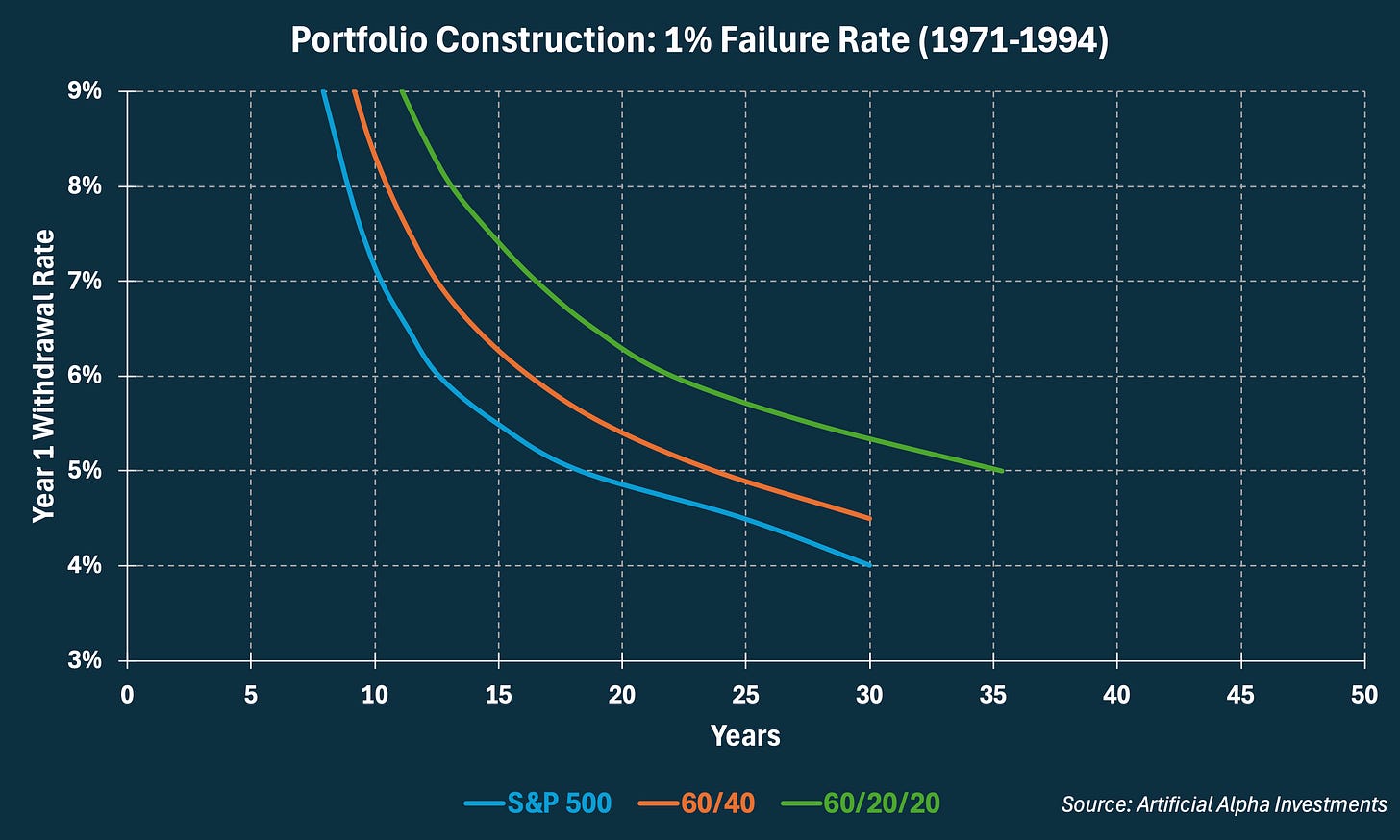

One side effect of lower volatility is to support higher withdrawal rates and extended retirements. I previously introduced The 4% Rule because it provides a framework for testing these goals.

The chart below allows readers to observe combinations of withdrawal rates and retirement lengths that similarly resulted in a 1% failure rate. Three different portfolios are represented by the three curves.

Investors could have increased withdrawal rates or extended retirements using 60/40 diversification, but this was doubly true using 60/20/20 diversification.

Hedging Recession

Active investors will find that challenging environments favor diversifying assets to risk assets. Since 1971, Gold has returned 13.0% per year during recessions whereas the S&P 500 has returned 1.2% per year during recessions.

In Summary

Again: Diversification is most relevant to active investors with short/moderate time-frames, less risk appetite, and moderate/high withdrawal rates. Diversification is least relevant to passive investors with long time-frames, more risk appetite, and low withdrawal rates.

Not all are convinced of Gold’s role in a diversified portfolio. I am comforted by gold’s independence from a gold standard, consistent supply and demand across millennia, connection between price and fundamentals, proven history of hedging Stocks when Bonds cannot, and performance improvements in a diversified portfolio.