The 60/40 Portfolio

Part 2 of the Diversification Pillars series

Diversification is meant to reduce the risk of investing in risky assets while maintaining most of the reward. Sometimes, diversification is prudent. Other times, diversification is simply preferential.

A 60/40 portfolio, one which holds 60% stocks and 40% bonds, is the most simple and common rule of thumb for asset class diversification. The idea was born from wonky, Nobel Prize winning work by Harry Markowitz and William Sharpe (Markowitz, 1952).

Although Modern Portfolio Theory is complicated, its prescription is quite simple; the portfolio with the optimal risk/reward profile is one that mirrors the total market universe. The market consisted of $60 of stocks for every $40 of bonds when “Portfolio Selection” was published in 1952, and thus the 60/40 rule of thumb was born.

I will substantiate this 60/40 portfolio by illustrating common applications of diversification.

Reducing Volatility

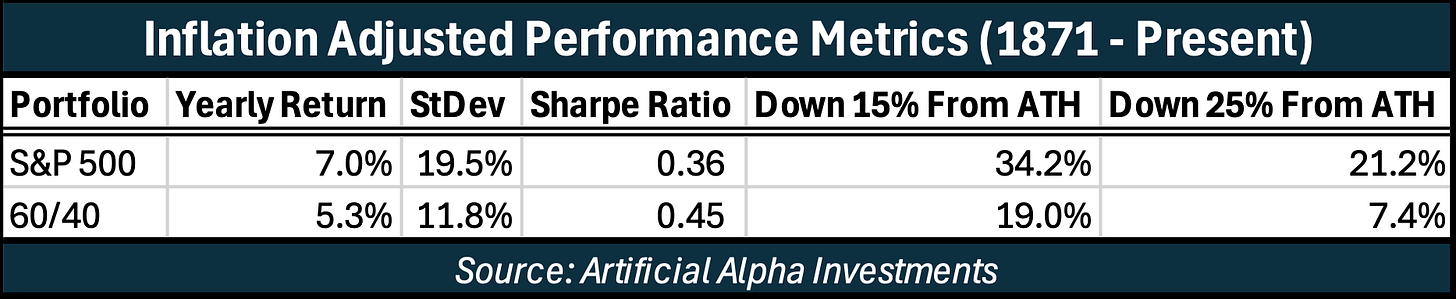

The following statistics suggest that investors with less risk appetite can use diversification to lower their portfolio’s volatility without severely handicapping returns.

Historically, diversified investors only had to sacrifice 24% of their real returns for 39% less volatility. A 60/40 portfolio spent 44% less time in a 15% inflation-adjusted drawdown and 65% less time in a 25% inflation-adjusted drawdown.

Stretching Savings

One side effect of lower volatility is to support higher withdrawal rates and extended retirements. I previously introduced The 4% Rule because it provides a framework for testing these goals.

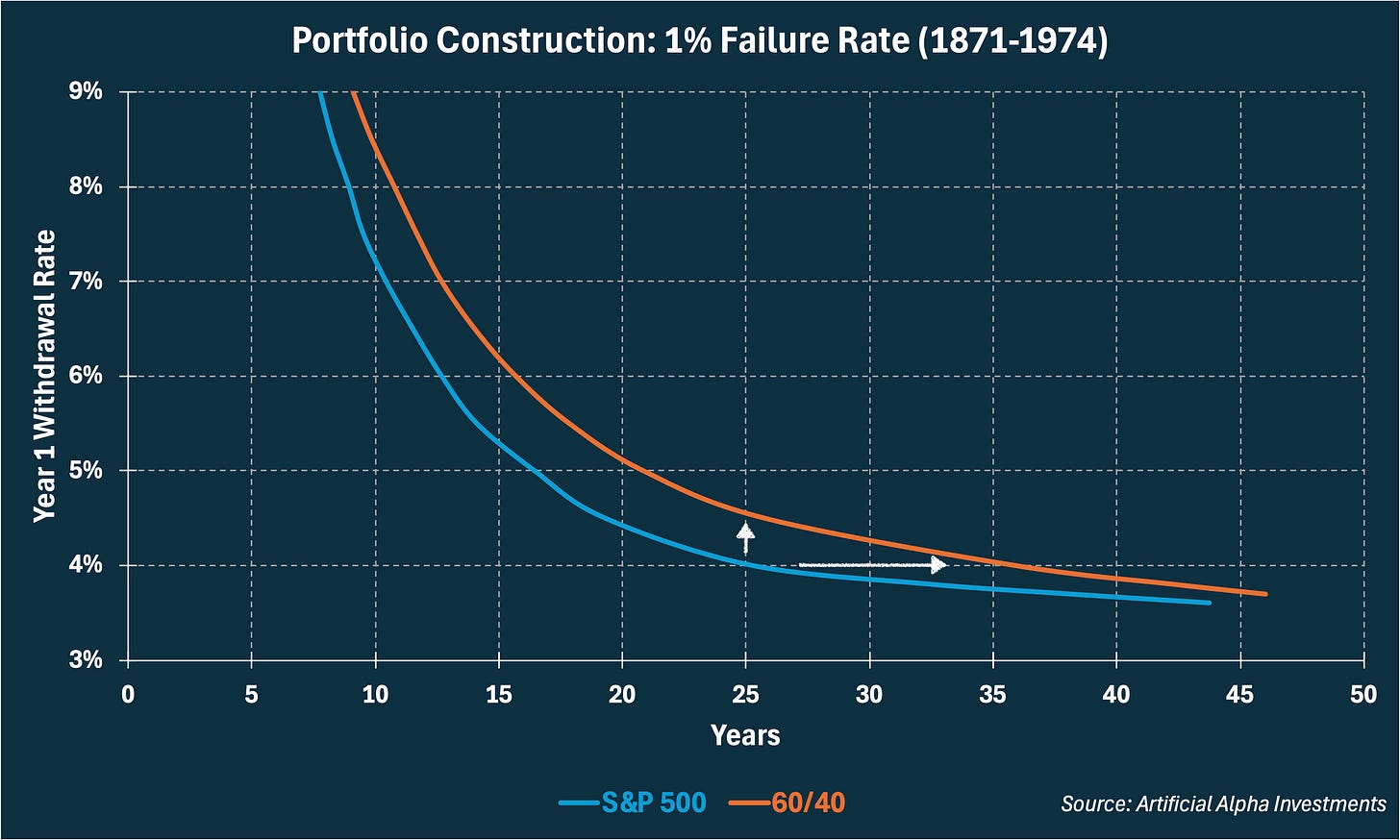

We found in that letter that retirees who only held stocks had a 1% chance of running out of money within 25 years of retirement if they followed the 4% rule. Do these statistics improve if those retirees diversified instead?

The chart below puts different variables on the two axes, allowing readers to observe combinations of withdrawal rates and retirement lengths that similarly resulted in a 1% failure rate. Two different portfolios are represented by the two curves.

Investors following the 4% rule could have used 60/40 diversification to increase their withdrawal rate to 4.6% or lengthen their retirement from 25 years to 35 years without increasing their risk. Moderate withdrawal rates and time-frames could have been extended using diversification.

Hidden in this chart are the investors who did not necessarily benefit from diversification. Young investors have a timeframe longer than 45 years, where diversification hindered success just as much as it helped. Wealthy investors have a withdrawal rate less than 3.5%, where risks did not necessarily require diversification.

Hedging Recession

Active investors will find that challenging environments favor diversifying assets to risk assets. Since 1945, a 60/40 portfolio has returned 7.3% per year during recessions whereas the S&P 500 has returned 1.2% per year during recessions.

In Summary

Diversification is most relevant to active investors with short/moderate time-frames, less risk appetite, and moderate/high withdrawal rates. Diversification is least relevant to passive investors with long time-frames, more risk appetite, and low withdrawal rates.

For whatever reason someone seeks diversification, I think the 60/40 portfolio is attractive in its simplicity. My work extends beyond that solution however. The next letter in this series will introduce gold and/or commodities as complementary diversification assets.