Large-Cap Value Portfolio

Landscape

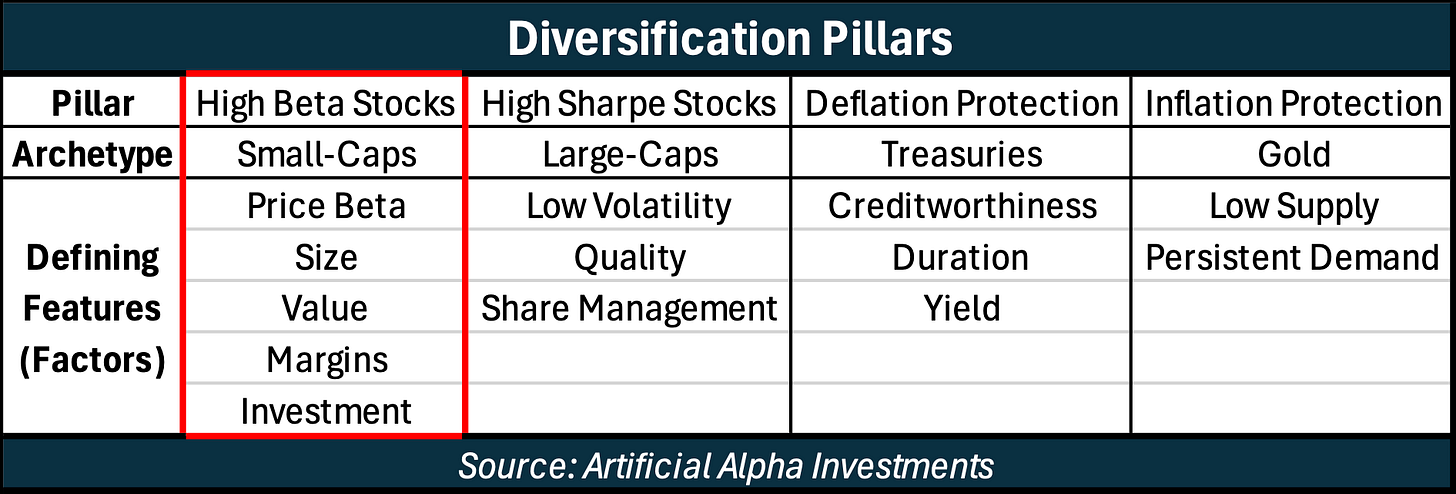

Artificial Alpha’s Large-Cap Value Portfolio lives within the High Beta Stocks diversification pillar.

Core Benefits

The High Beta Stocks pillar, beyond its diversification benefits, is an investor’s most aggressive bucket and tends to provide the most growth over long periods of time. This Large-Cap Value Portfolio enhances those characteristics for clients by actively trading stocks from the S&P 500.

Suitability

Depending on the outcome of a suitability interview, I might suggest anything from a small allocation for diversification sake to a large allocation for full commitment to portfolio growth. This product is meant to reach an audience that shares a growth mindset and has access to sufficient tax-advantaged assets (IRAs and some 401(k)s).

Performance History

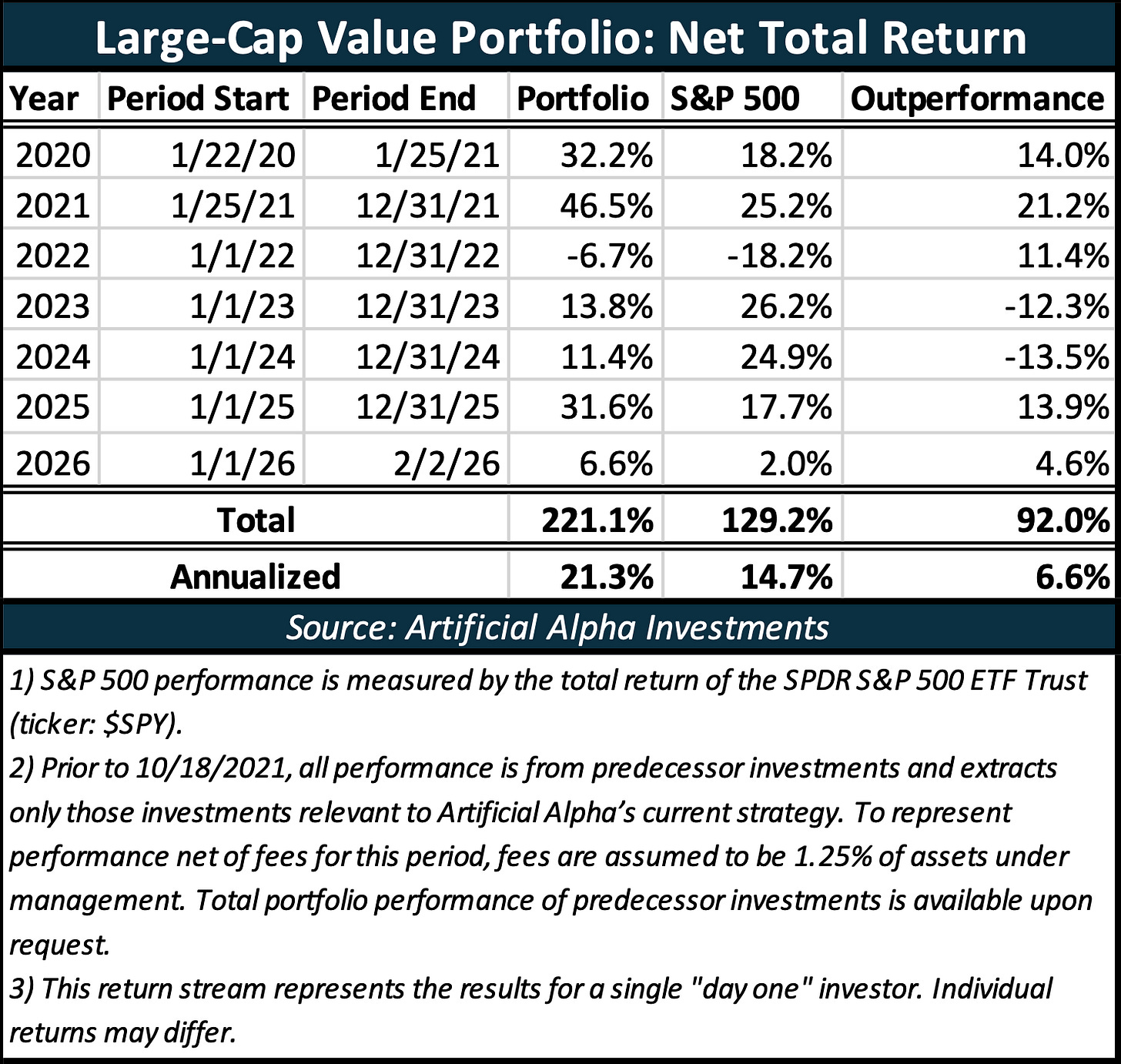

This portfolio has been traded for clients since January, 2020. Artificial Alpha’s Large-Cap Value Portfolio is primarily built to outperform the S&P 500 (after fees).

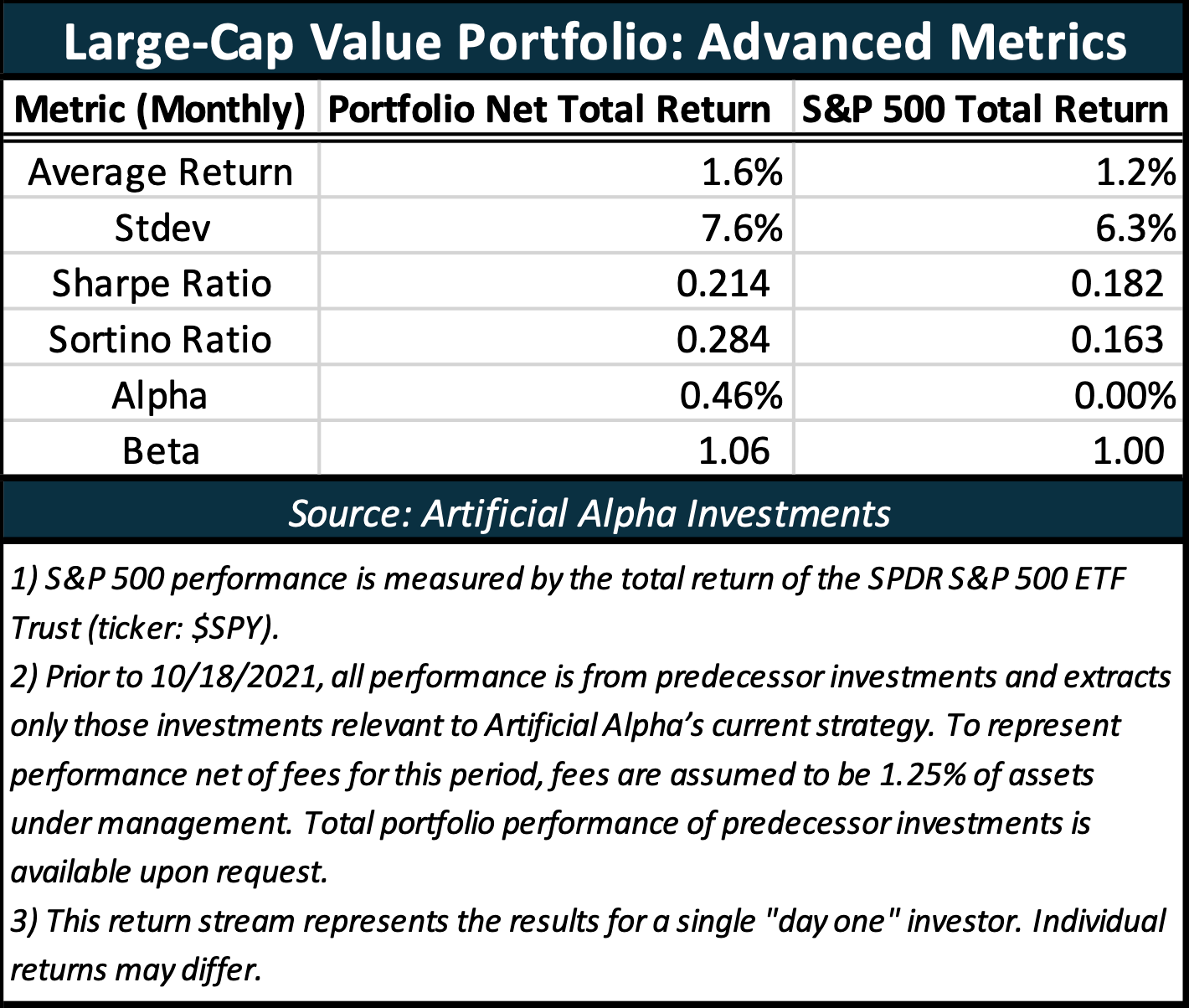

Artificial Alpha’s Large-Cap Value Portfolio is not built to lower volatility, but it is still designed for better risk-adjusted performance than the S&P 500 (after fees).