How ETFs Fall Short

While available Exchange Traded Funds (ETFs) are adequate for most investors, there is still a glaring scarcity of niche solutions that meaningfully differentiate from boilerplate indices like the S&P 500.

For example, I previously wrote about diversification concepts for risk-averse investors. This is when I reveal that those index-based strategies are very blunt and inefficient solutions to achieving a low volatility portfolio, even though they are technically sound. The S&P 500 is only somewhat appropriate for those investors.

Consider, for contrast, an aggressive investor who is willing to look past short-term volatility and focus on maximizing long-term returns. This investor very likely owns the same S&P 500 index fund as the diversified, risk-averse investor. Are those same 500 investments actually suitable for both portfolios?

Truthfully, the risk-averse investor would benefit from carving out a small subset of stocks from the S&P 500 and holding only those stocks. I would estimate that ~80% of the stocks in the S&P 500 are, to some degree, working against that investor’s low volatility preferences! And the same goes for the aggressive investor, who might carve out a completely different subset of the index for maximizing growth.

Unfortunately, ETFs that satisfy diverging risk/reward preferences are not widely available and that is why there is so little incentive for investors to stray from the boilerplate S&P 500 crowd.

Below are some specific shortcomings of available ETF products. I will emphasize these shortcomings from the perspective of an aggressive investor, but the risk-averse investor is presented with the same challenges.

Issue #1: Unavailable Products

If you want to lever your exposure to your favorite meme stock then you might be able to find an ETF for that (this is unadvisable for most investors, and very lucrative for the ETF provider). But if you want to passively invest in some of the factors outlined in Nobel Prize winning research by Eugene Fama and Kenneth French, you’re out of luck!

Most of the “factors” that Fama-French identified are fundamental measurements used to identify stocks with a higher risk/reward profile. These are the type of stocks that the aggressive investor might find more interesting.

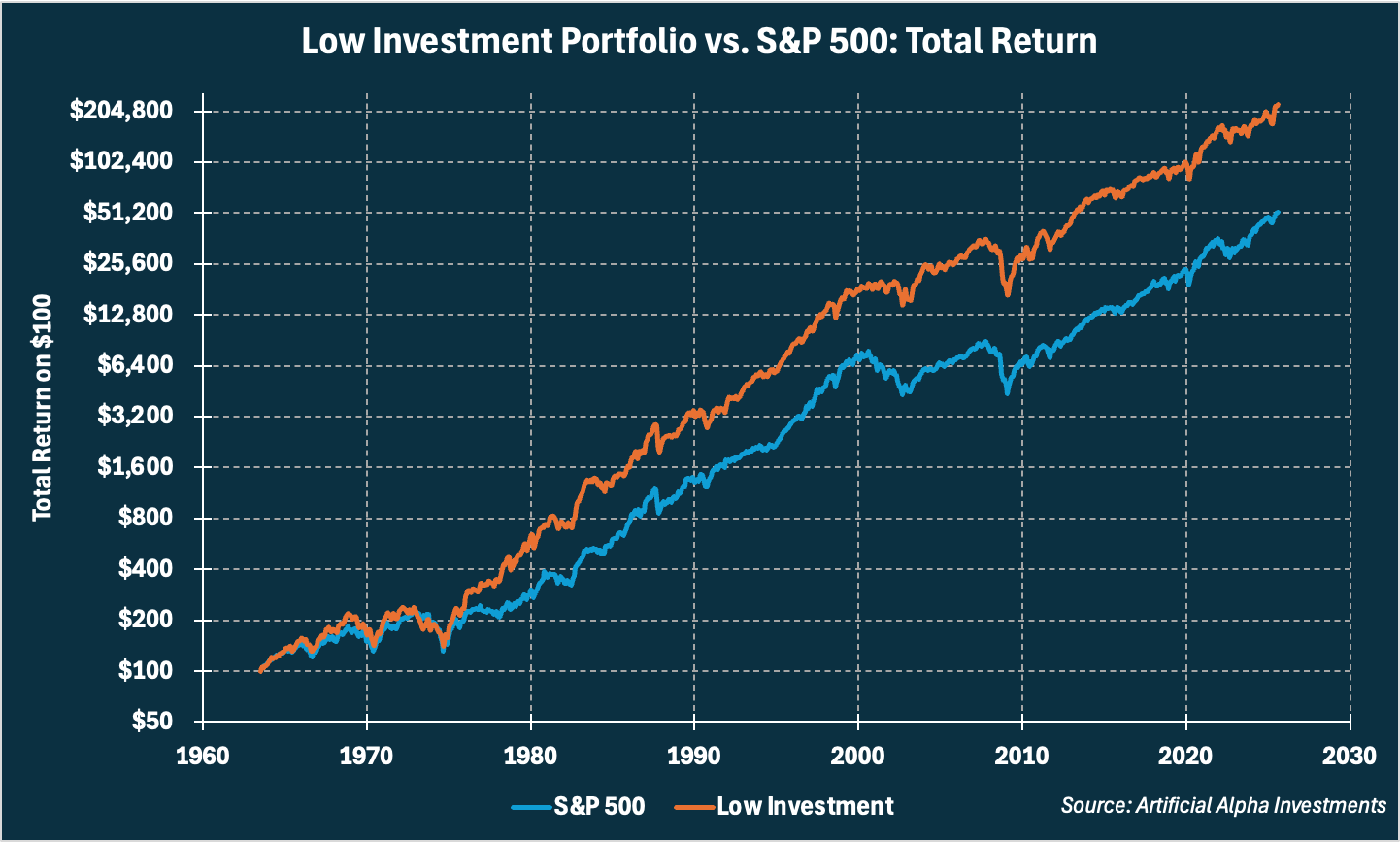

One factor identified by Fama-French is asset growth, or what Fama-French refer to as the Investment factor. The lowest 20% of companies by asset growth have had a 13.2% total return per year since 1963, vs. 10.6% for the S&P 500.

Despite having access to over 4,000 listed ETFs, 61 of which are levered single-stock ETFs, there is no way to passively invest in this basic subset of equities. Investors must invest in individual stocks to incorporate this investment style.

Issue #2: Excessively Broad Products

Some investment styles do exist via available products but their precision leaves much to be desired.

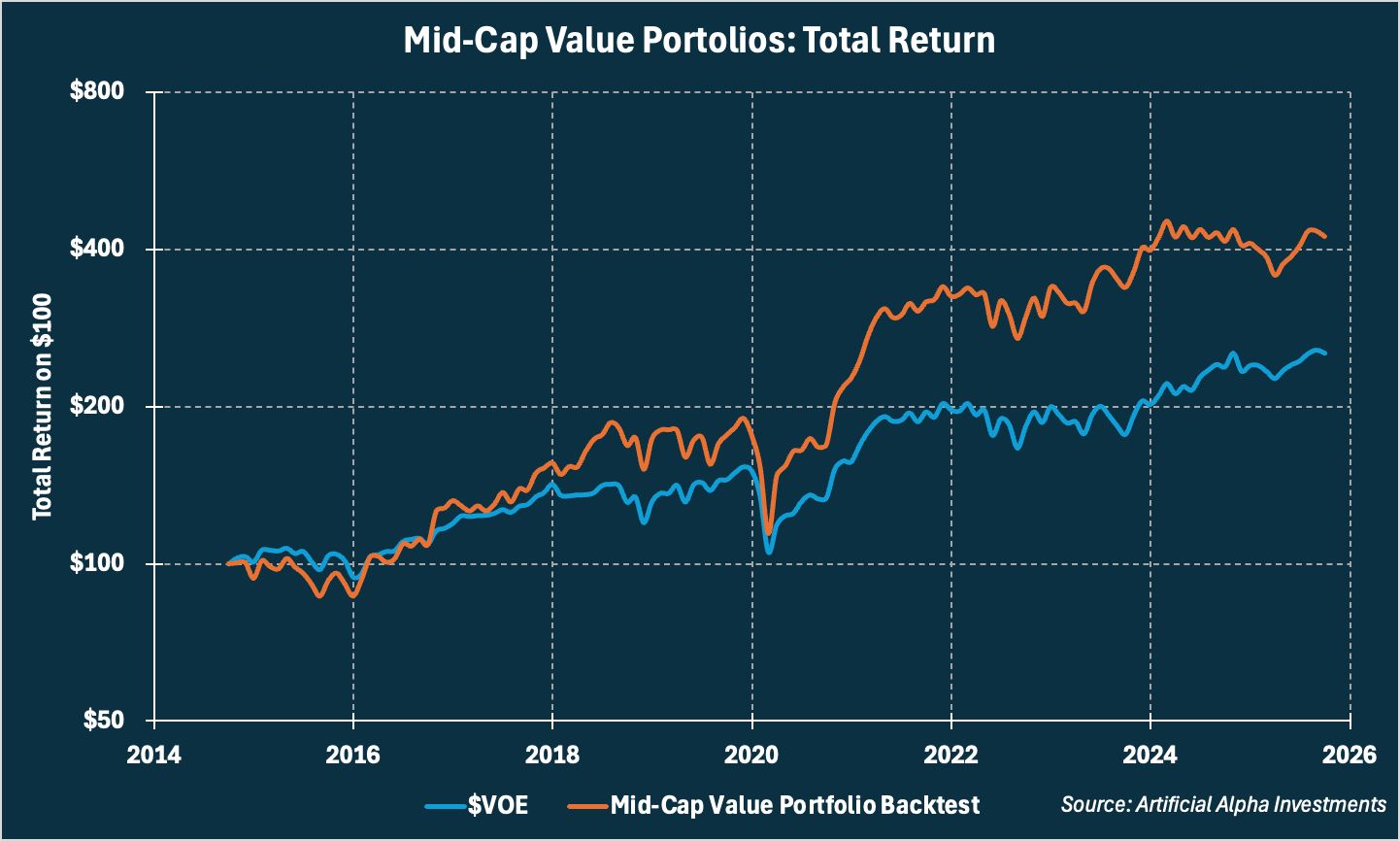

Take, for example, the Vanguard Mid-Cap Value ETF ($VOE). This ETF implements aspects of the Size and Value factors from Fama-French research, all with a low fee. Investors theoretically have access to higher risk/reward investments via this ETF.

There are a few problems with this implementation, however, primary of which is how broad they’ve left the filter on this portfolio. There are 180 stocks left in this portfolio and I suspect the 180th stock is barely contributing extra risk/reward exposure.

To illustrate this point, I built a Mid-Cap Value portfolio that invests in the top 25 Value stocks from the S&P Mid-Cap 400 index based on a single measurement of Value. This should concentrate risk/reward by reducing the size of the portfolio from 180 to 25.

Sure enough, the backtested portfolio would have had a 14.0% total return per year since 2015, vs. 8.8% for the $VOE ETF.

Almost all ETFs are quite broad and carry 100 or more stocks. Investors should invest in individual stocks if they want to sufficiently concentrate their investment preferences.

Issue #3: One-Dimensional Products

The last shortcoming of available products is that they are painfully one-dimensional, meaning that most filter on a single metric.

There is no be-all and end-all measurement of risk, safety, etc. Multiple filters are needed to intensify whatever characteristics are desired from an equity portfolio. Fama-French, for example, identified four factors in their aforementioned research.

In much the same way that available ETFs are diluted by their size, they are also diluted by their extreme simplicity.

The Artificial Alpha Edge

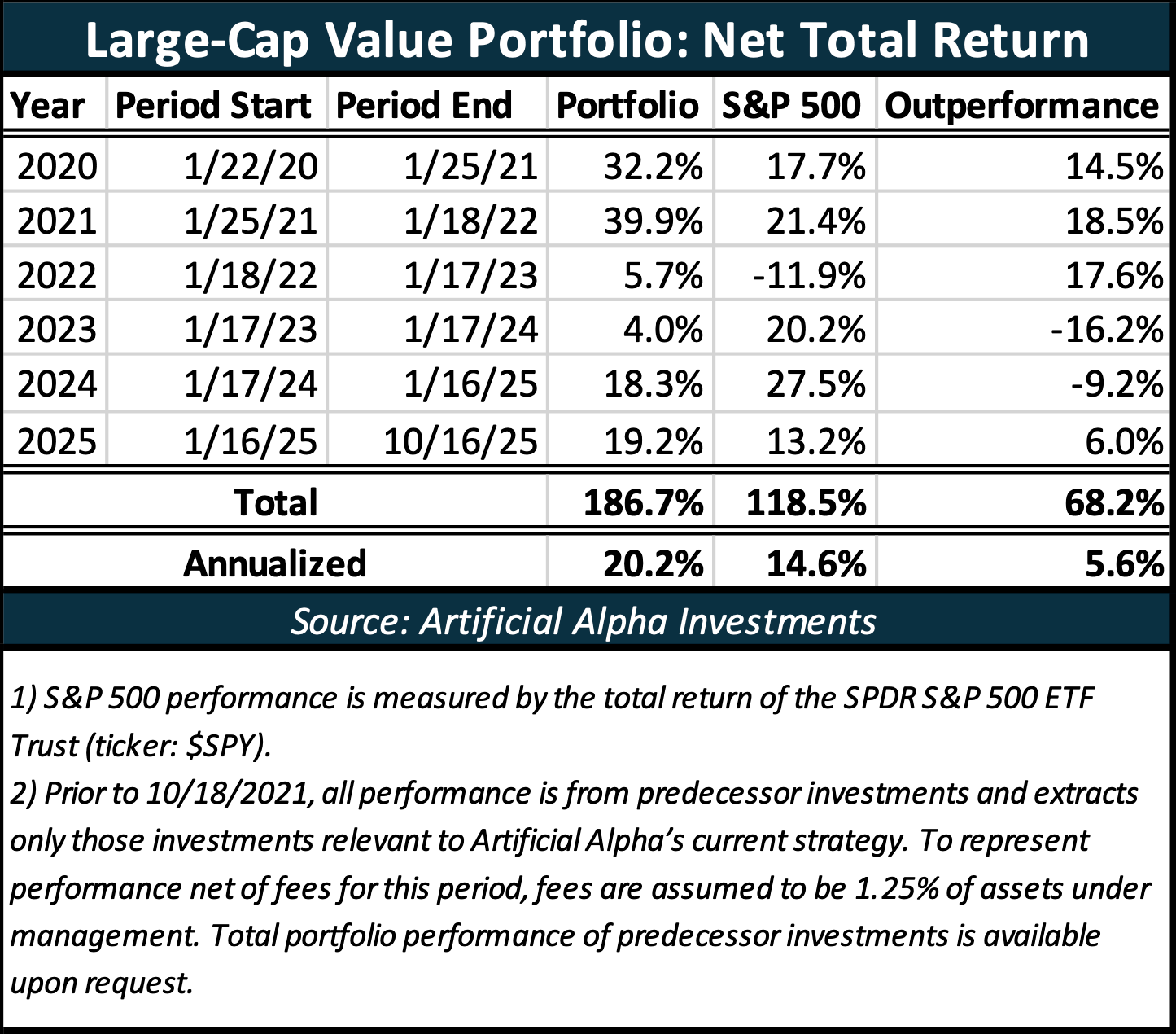

Artificial Alpha Investments has provided clients with active portfolio management to address these ETF shortcomings since October 18, 2021. Its flagship portfolio, designed for outperformance, has been continuously traded since January 22, 2020.

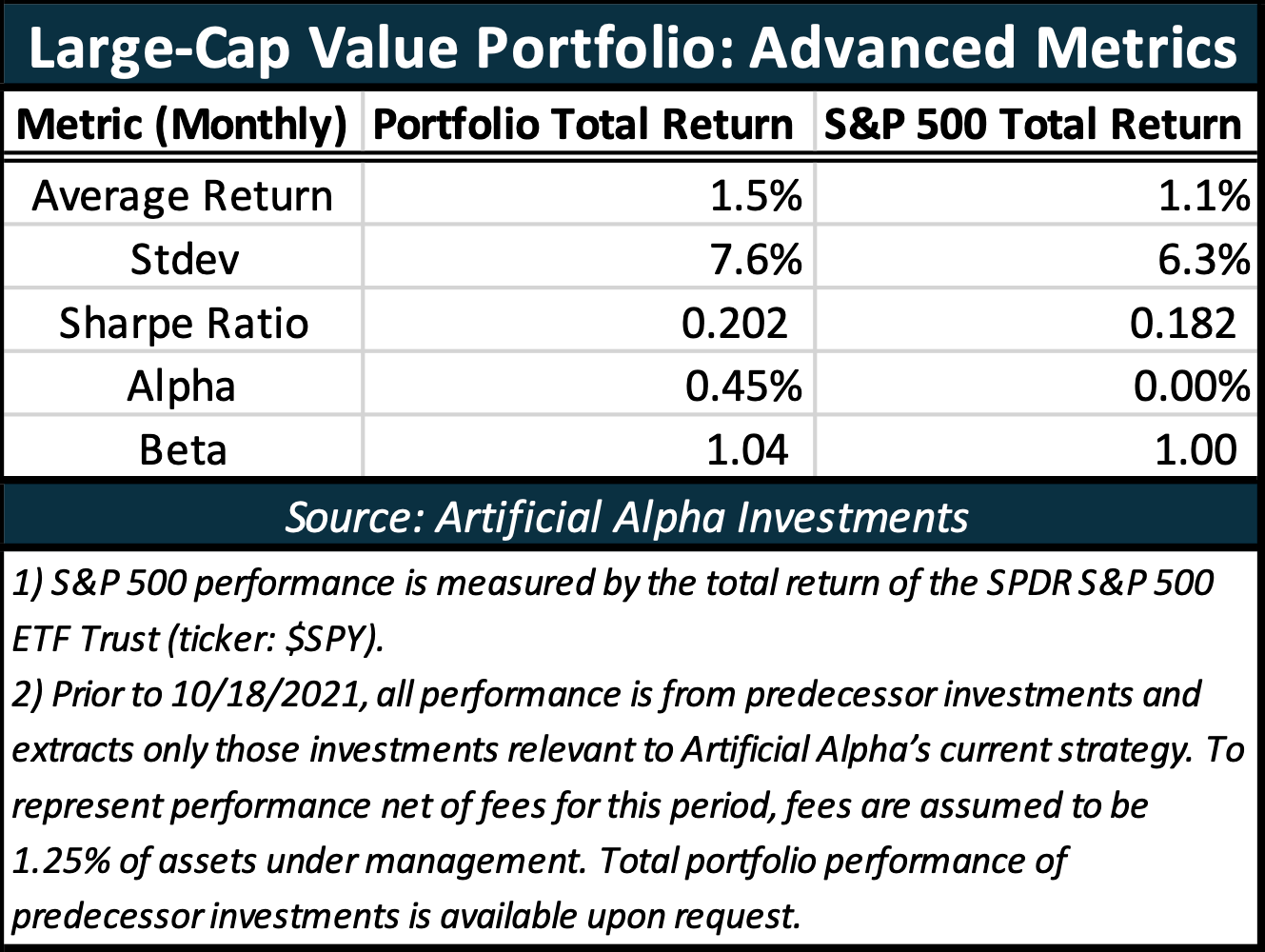

A wonderful side-effect of buying individual stocks with purpose is that undesirable investments tend to fall away. In theory and in practice, this selective work yields additional outperformance even beyond risk related effects. The portfolio’s risk-adjusted outperformance is expressed through its Sharpe Ratio and Alpha measurements.

Working With Me

I’ve been building this Large Cap Value portfolio since 2017 and trading it since 2020. I incorporated in 2021 because I sensed I was on to something. Today, after years of tweaking its logic and studying every aspect of its landscape, I believe in the portfolio’s unique value more than ever.

I hope to justify the fees I charge by delivering unique products and superior outcomes, on top of great advice and services. The number of products I offer and preferences I can service will be expanding in 2026. Please reach out with interest!