Election Market Reaction

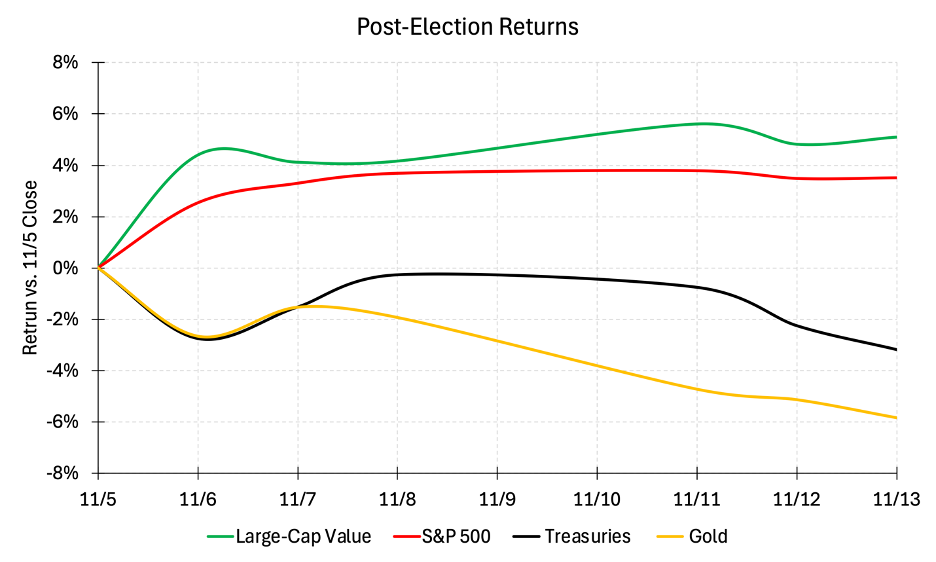

The market reaction to Trump’s victory was one of the largest and most decisive in recent elections. Value stocks ($RPV) are up 5.1%, the S&P 500 ($SPY) is up 3.5%, Treasuries ($TLT) are down -3.2%, and Gold ($GLD) is down -5.8% since the election.

The framework I established in my June ’24 letter for picking short-term asset class winners is very helpful for decoding what the market thinks about a Trump victory. I would recommend that letter if you haven’t read it and want some more background on the data below.

https://www.artificialalphainvestments.com/p/short-term-drivers

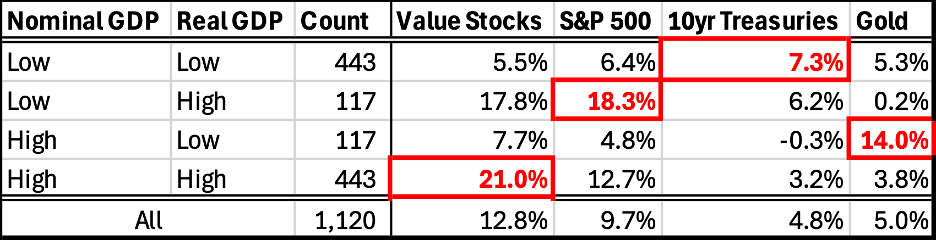

The following chart summarizes the average annual return for different asset classes during different economic regimes. Each economic environment favors a different asset class, and each asset class prefers a different economic environment.

Casting the market reaction on top of this table (Value Stocks won, Treasuries and Gold lost) has the market expecting higher nominal growth and higher real growth under Trump.

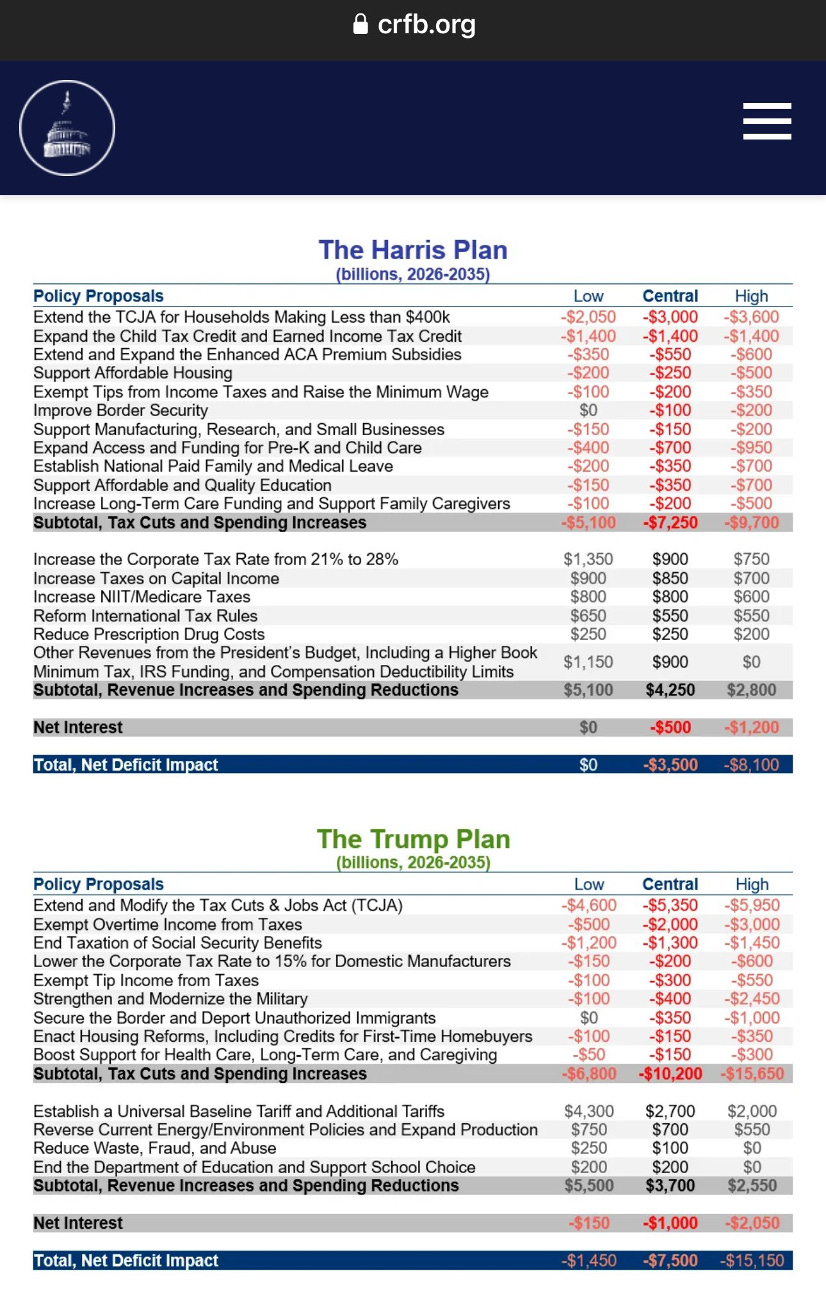

I wasn’t surprised by the market’s expectation for higher nominal growth under Trump. Trump’s agenda is expected to lead to a higher net deficit than that of Harris’s agenda. All of this net spending should spur investment.

The first thing that caught my attention, however, is that the market expects higher nominal growth to largely translate into higher real growth, as opposed to inflation. This is the harder read. Are Trump’s proposals good or bad investments? The market says good.

Doubly interesting is how poorly Gold reacted to a Trump presidency. It is fair for Gold to have a tepid reaction to higher real growth, but I think there is an additional factor at play here. We’re already hearing chatter from the Trump team about Bitcoin’s role as a reserve asset, which would mean Gold suddenly has a direct competitor for demand from the central bank. I’ll again refrain from offering any predictions on Bitcoin adoption, but I do think Bitcoin is engineered as a commodity and reserve asset (as opposed to a currency).

We will see if the market is right! This is certainly one of the more optimistic reactions to a presidential election in some time.