Short-Term Drivers

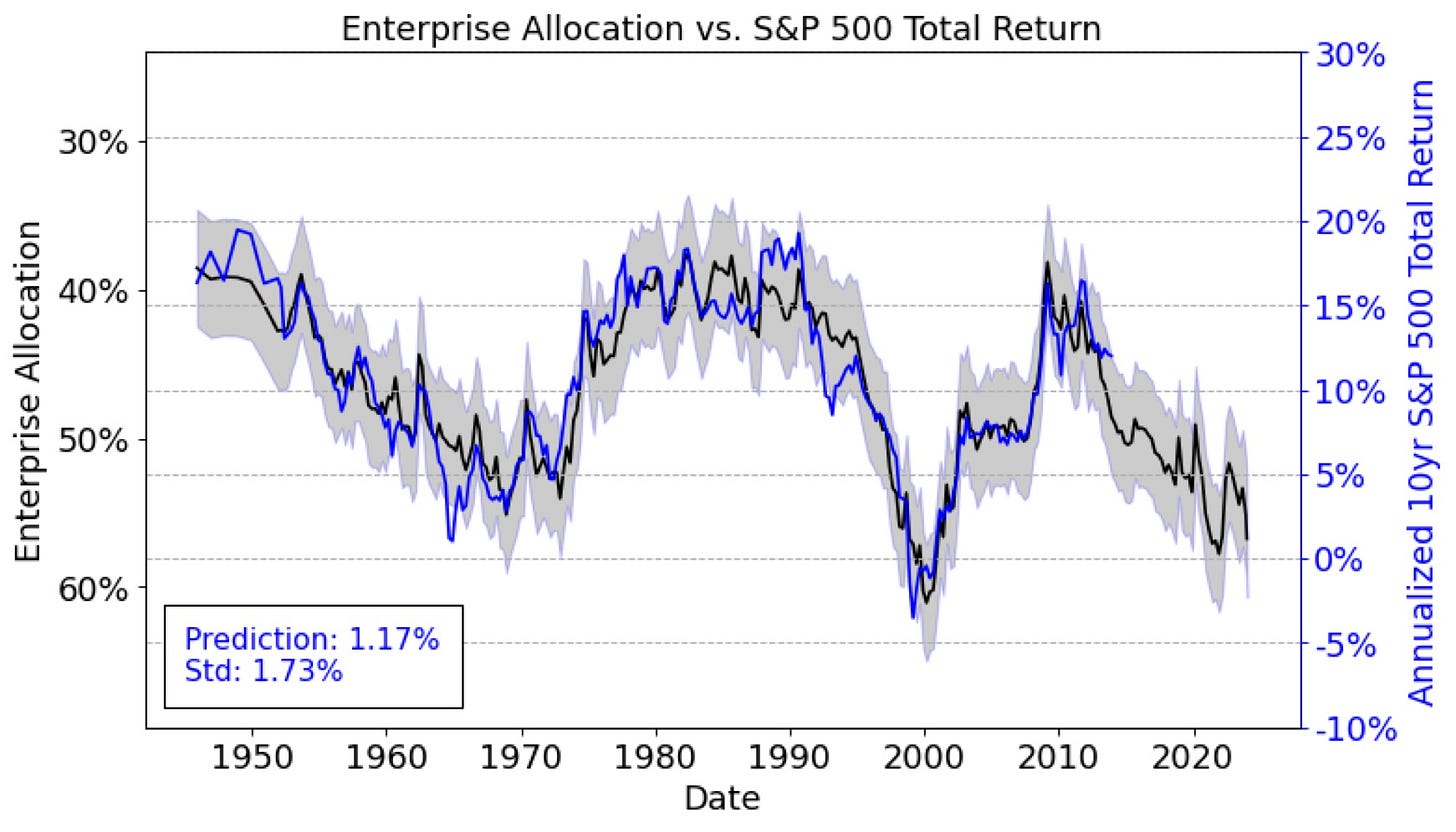

I mention stock market valuations a lot and their impact on long-term return expectations. It is important to stress the long-term implications of valuations, however. I estimate that valuations take up to 10 years to manifest via performance. Knowing when stocks are cheap or expensive is useful, but it often takes a long time for those valuations to matter.

Even the most extreme valuations succumb to more powerful forces in the short-term. In my estimation, the economy is potentially the most powerful driver on a yearly basis.

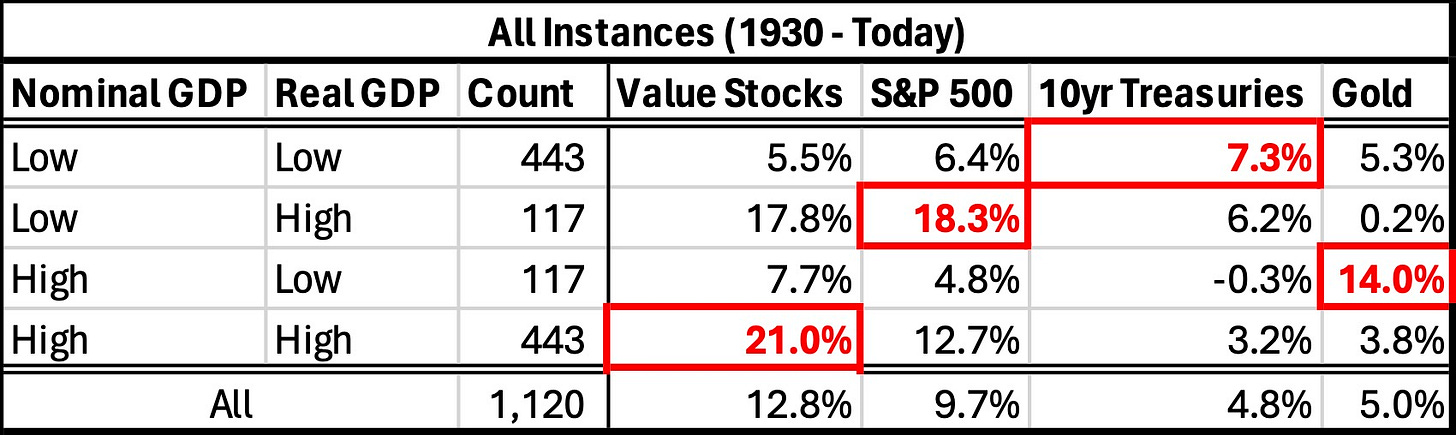

We can begin to understand the driving power of the economy by calculating the average annual return of different financial assets during different economic regimes. I chose to compare value stocks, large capitalization stocks (the S&P 500), the 10yr treasury bond, and gold. I defined four basic economic environments of high or low nominal GDP and high or low real GDP on a year over year basis.

I highlighted the strongest performing asset in each row above. Each economic environment favored a different asset, and each asset preferred a different economic environment. The economy is strongly correlated with investment performance.

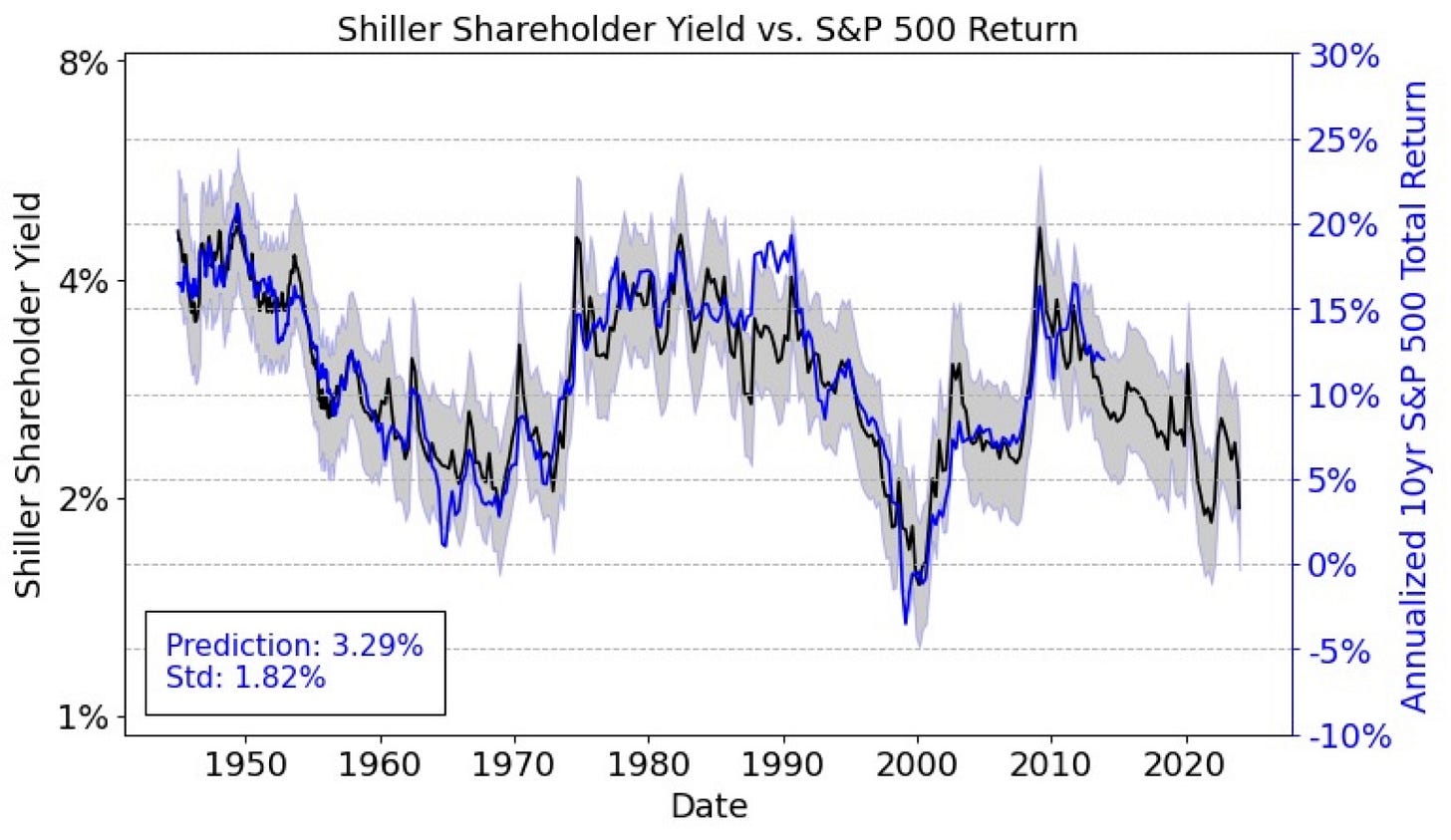

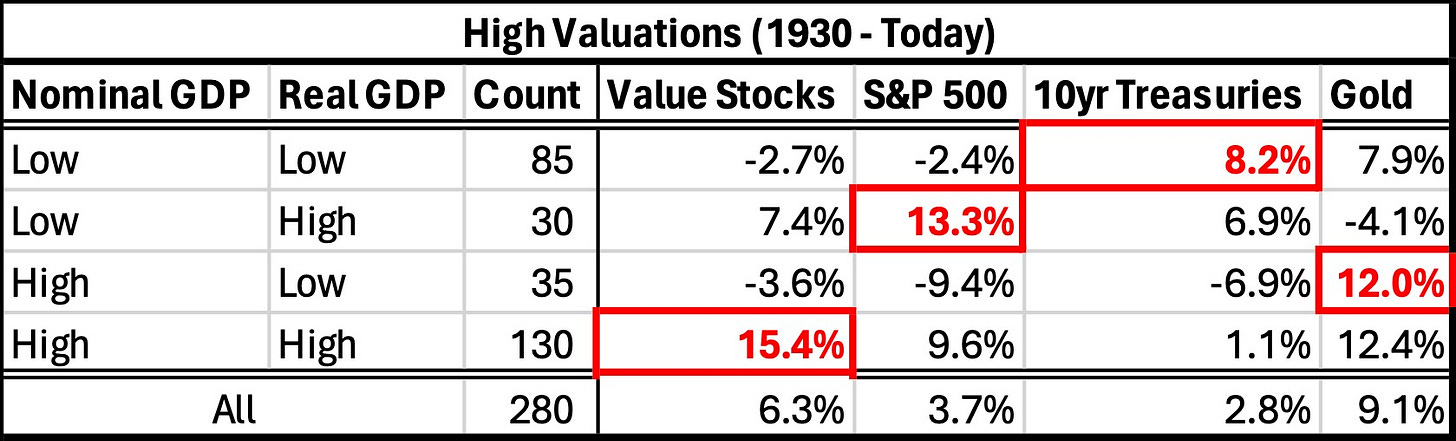

Next, I filtered the sample from above to only include the periods where stocks had high starting valuations. We are left with 25% of the sample during which stocks were most expensive based on the Shareholder Yield valuation metric from Chart #2.

Even though stocks faced significant valuation headwinds in this sample, each economic environment still favored the same assets. The best investment on a yearly timeframe was still determined by economic outcomes, not by high stock valuations.

Notably, stocks do have lower expected returns during these periods of high valuations. Those low returns aren’t realized until the economy experiences a period of low growth, however. Observe above how poorly the S&P 500 and values stocks performed during periods of high valuations and low real GDP.

There is likely no trading lesson here because predicting how the economy will perform over the next year is very difficult. Some investors can make money this way, but they are few and far between.

Instead, I want to emphasize how emotionally taxing it might be to change your investment mix based on valuations. We had high valuations last year, but the economy did great and so stocks performed great as well. Who knows what kind of economic outcomes we will have this year.

Go right ahead and factor valuations into your investment decisions, there is an advantage to doing so. But realize that the timeframe over which you should expect results is dependent on a relatively unpredictable economic downturn. Economic forecasts are most relevant to short-term investment performance.