Characterizing Gold

Gold ($GLD) is up 37.5% year to date and 98.0% since the start of 2023, compared to 12.2% and 72.9% for the S&P 500 ($SPY). I’ve already written some about the recent history of gold as a financial asset, as well as its diversification benefits in a balanced portfolio:

But why are gold’s returns so high recently? Let me use this moment to illustrate gold’s character as a financial asset.

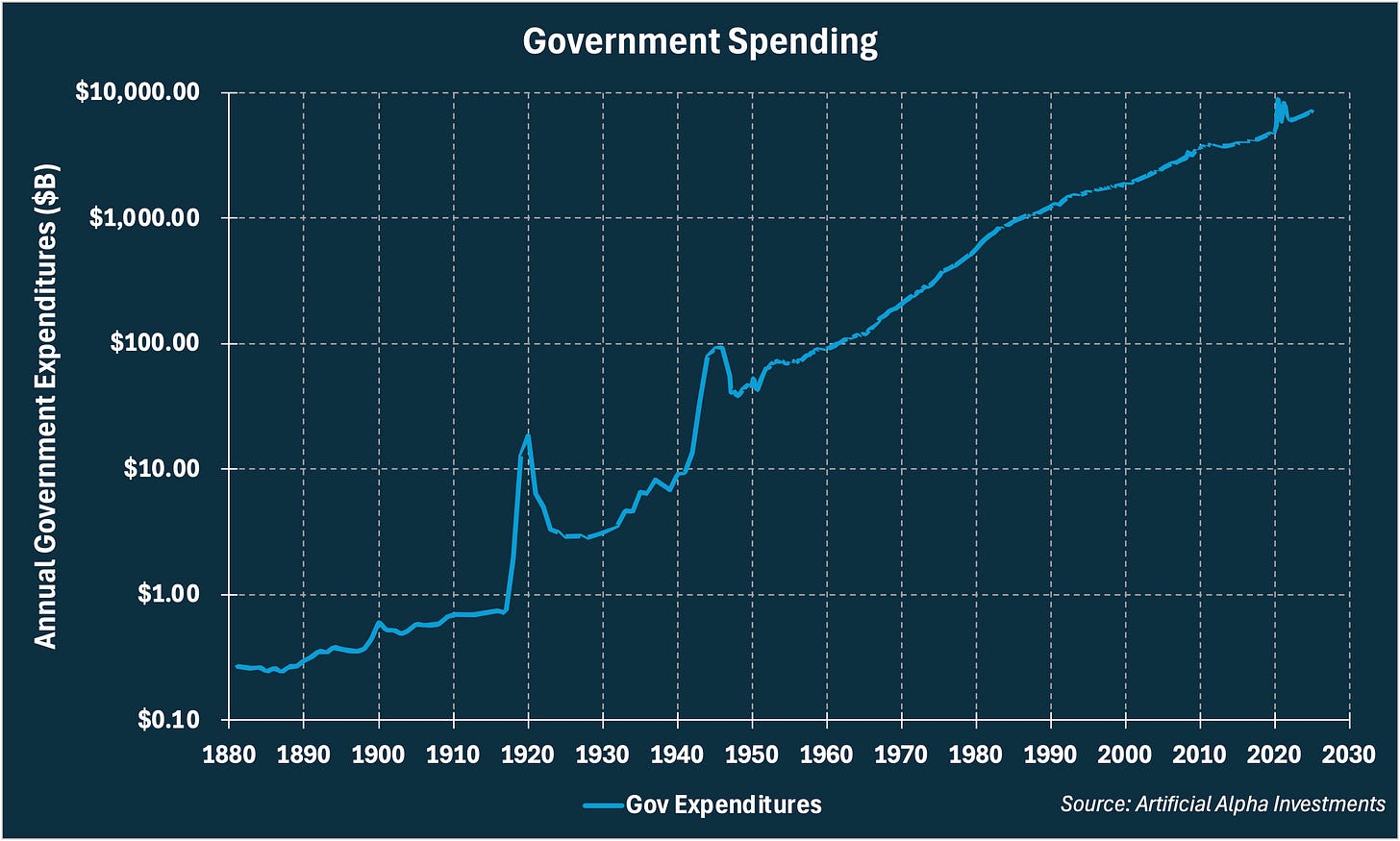

One major source of “money printing” is the federal government, which over time has expanded the money supply with higher and higher spending. This isn’t the only form of “money printing” but it is the largest and most relevant to the 2020s.

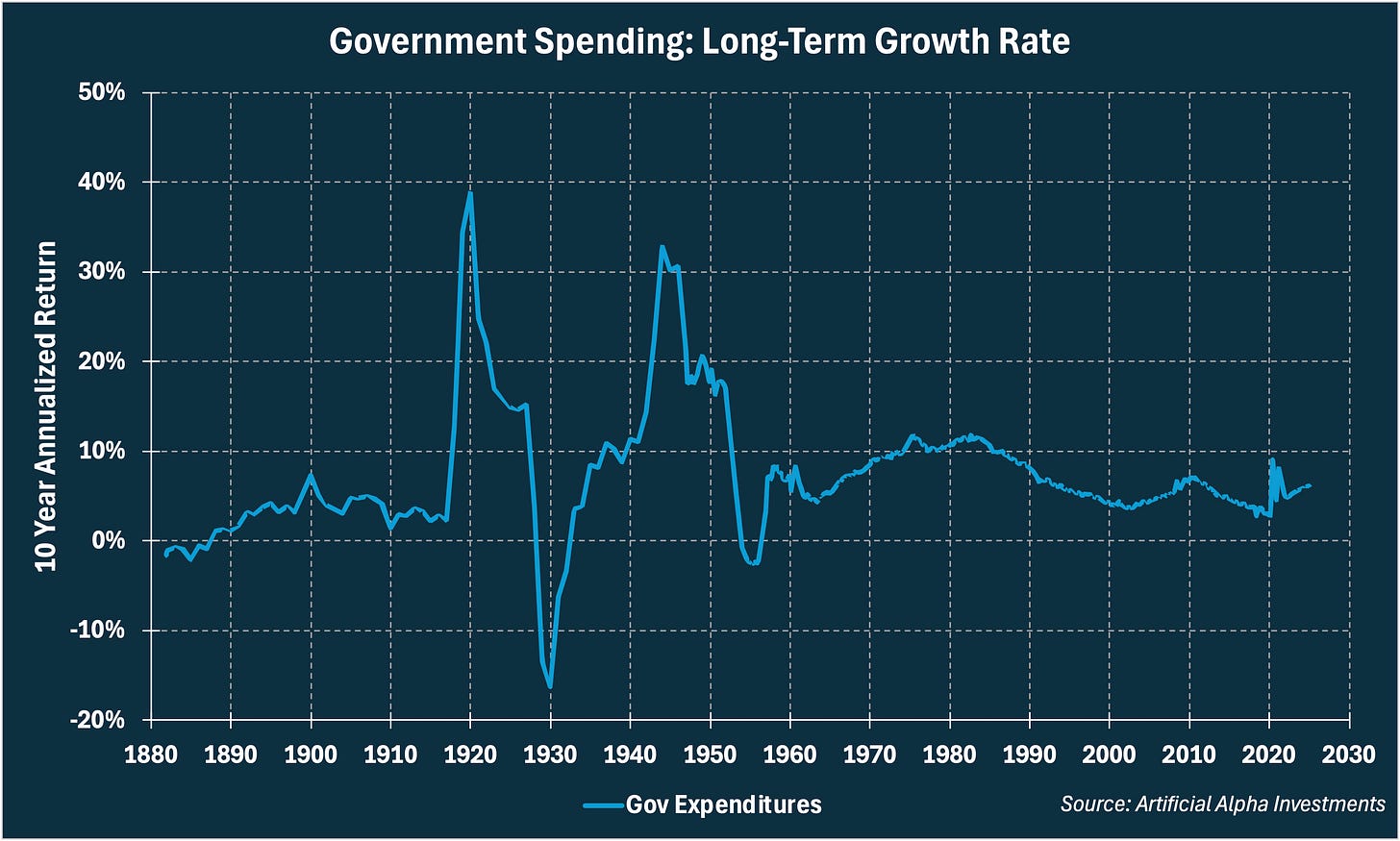

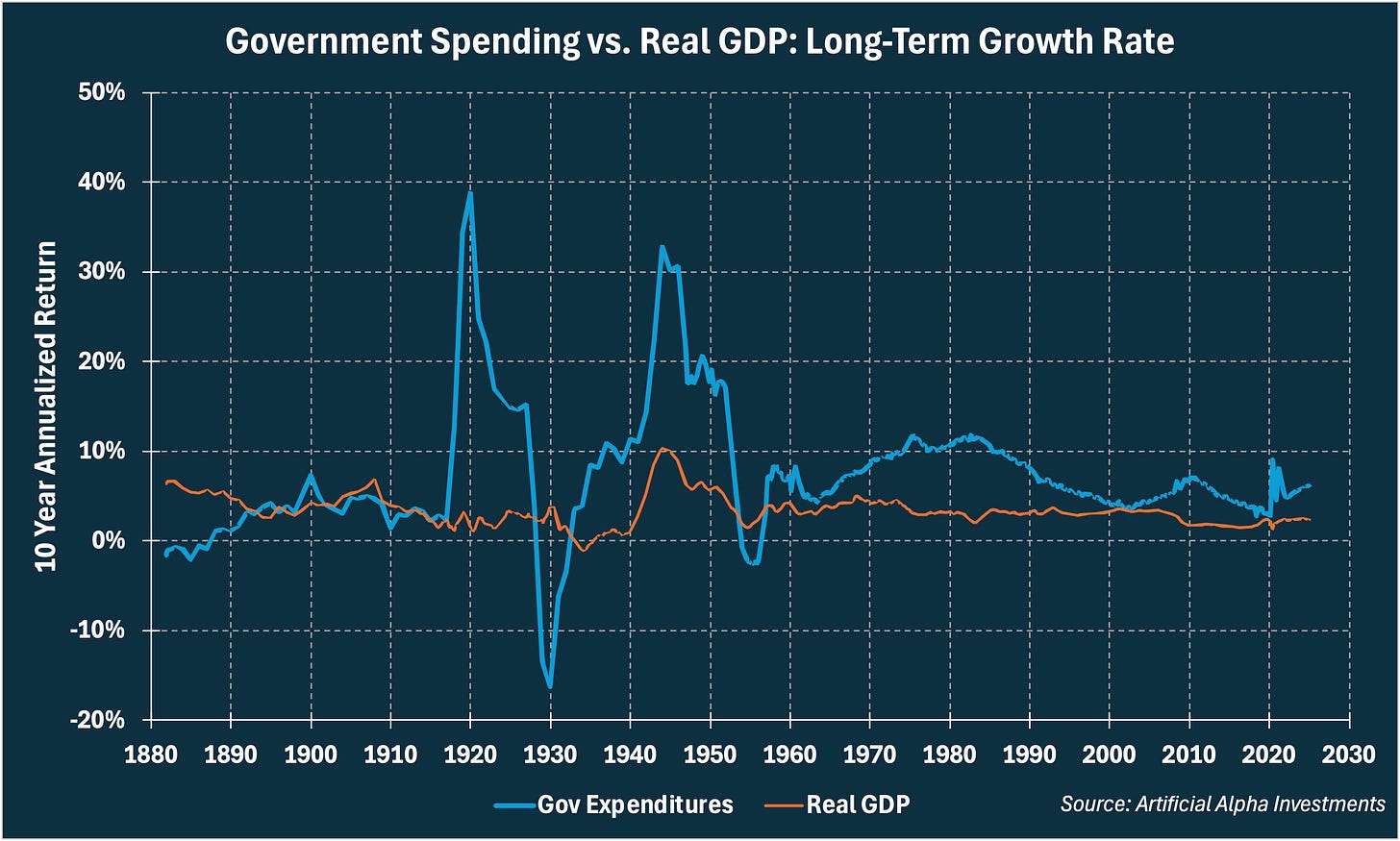

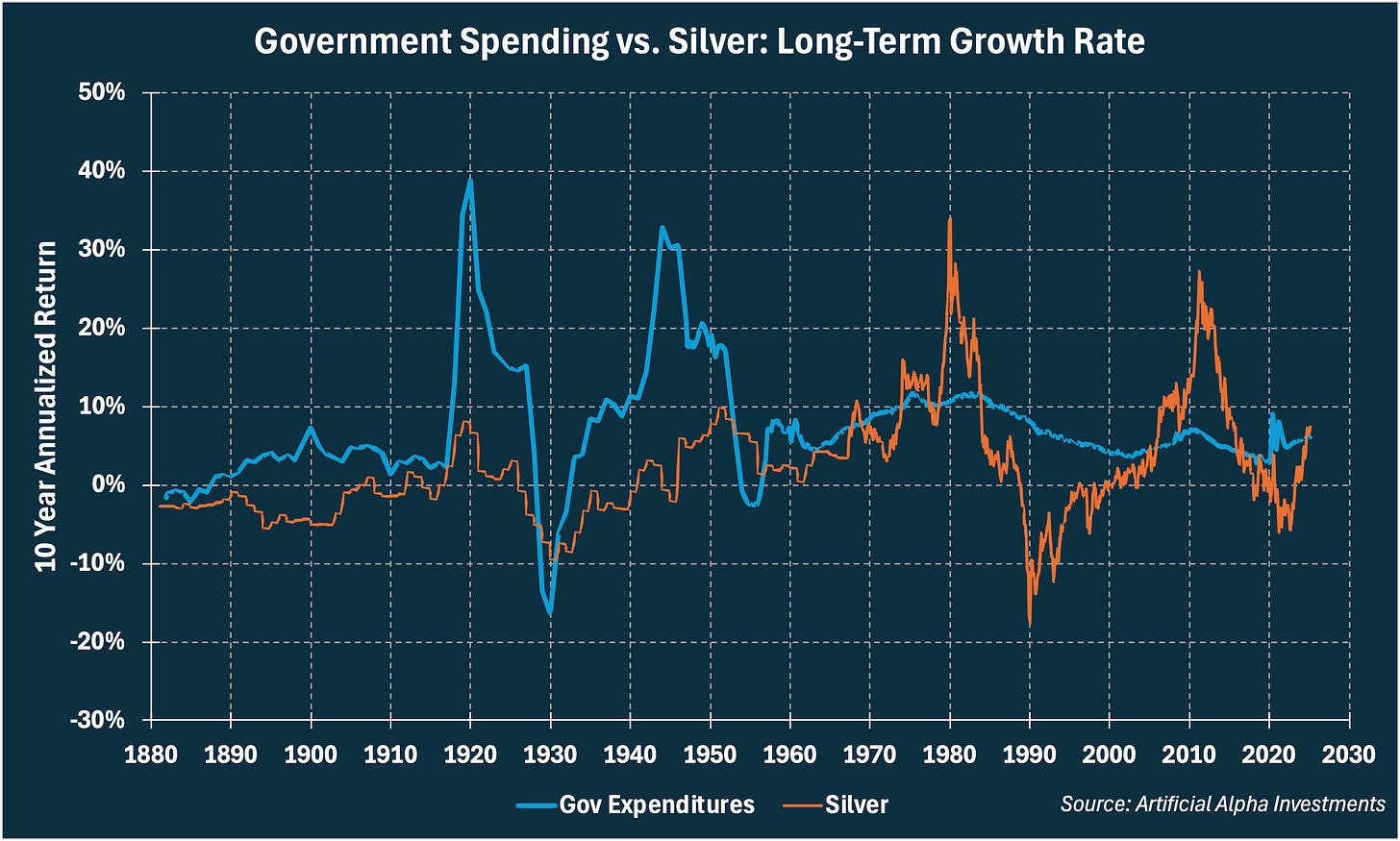

I prefer to look at the long-term growth rate of the government’s spending, with this chart showing the annual growth rate over the previous 10 years.

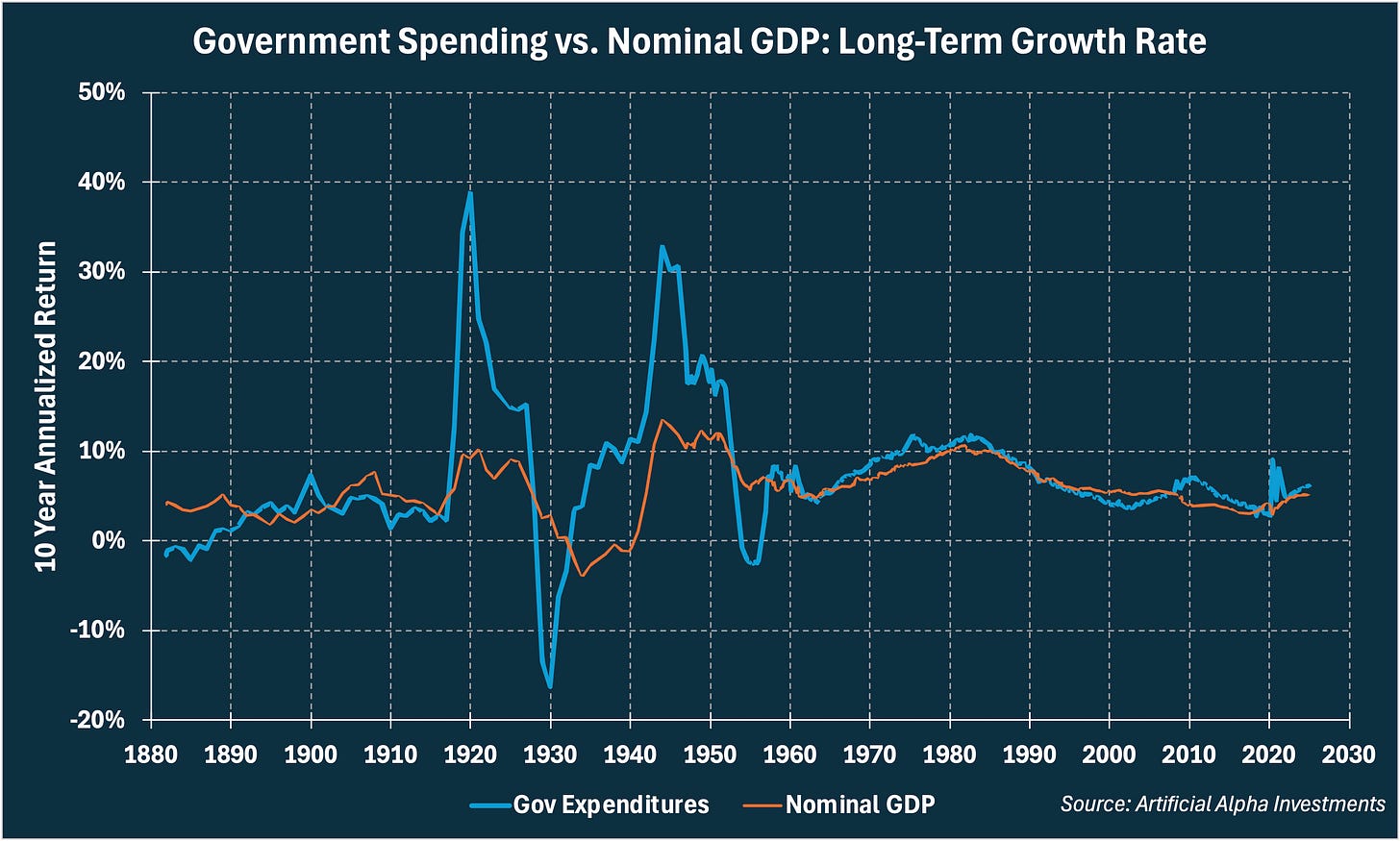

Government spending results in higher nominal GDP, with which there is a strong correlation.

But government spending is largely uncorrelated with real economic growth.

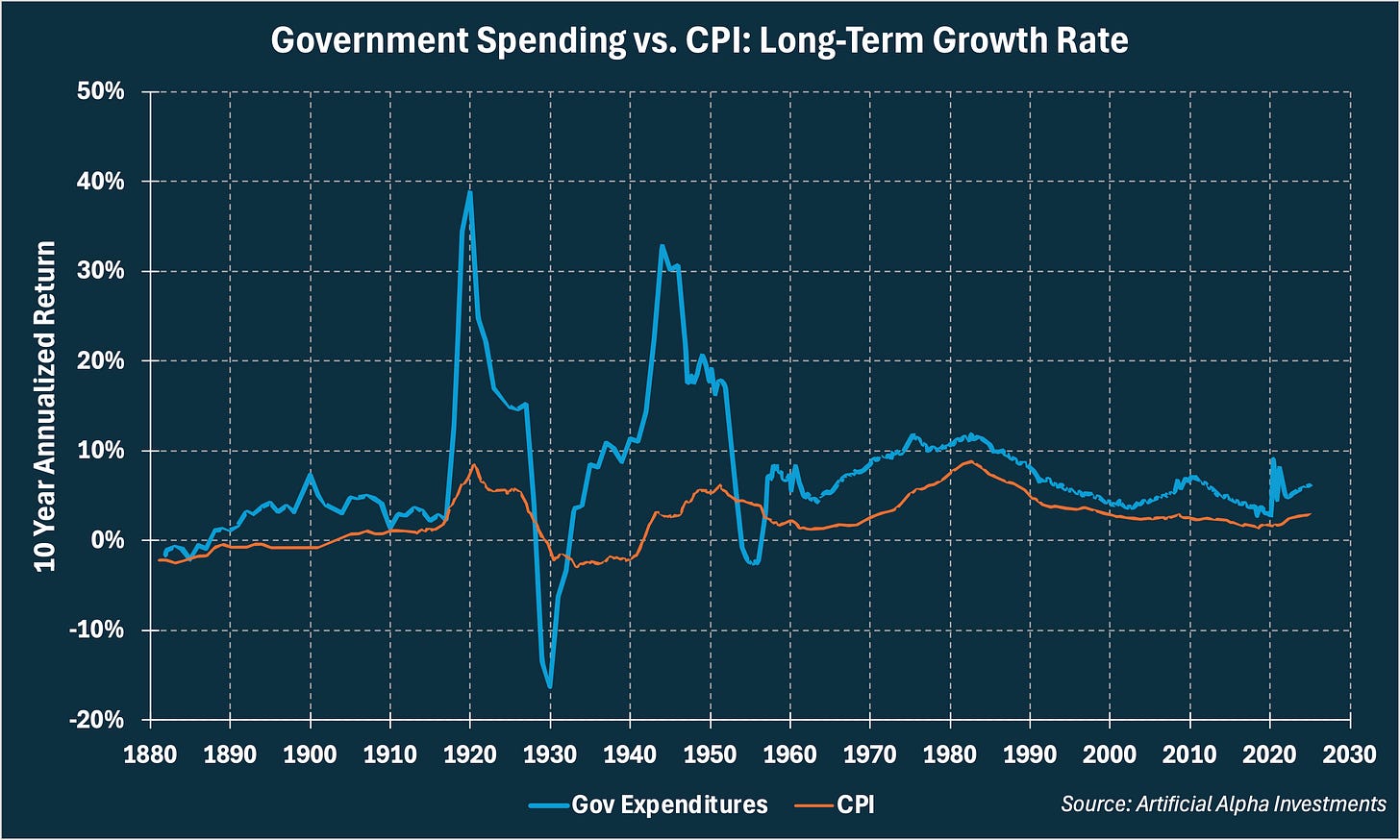

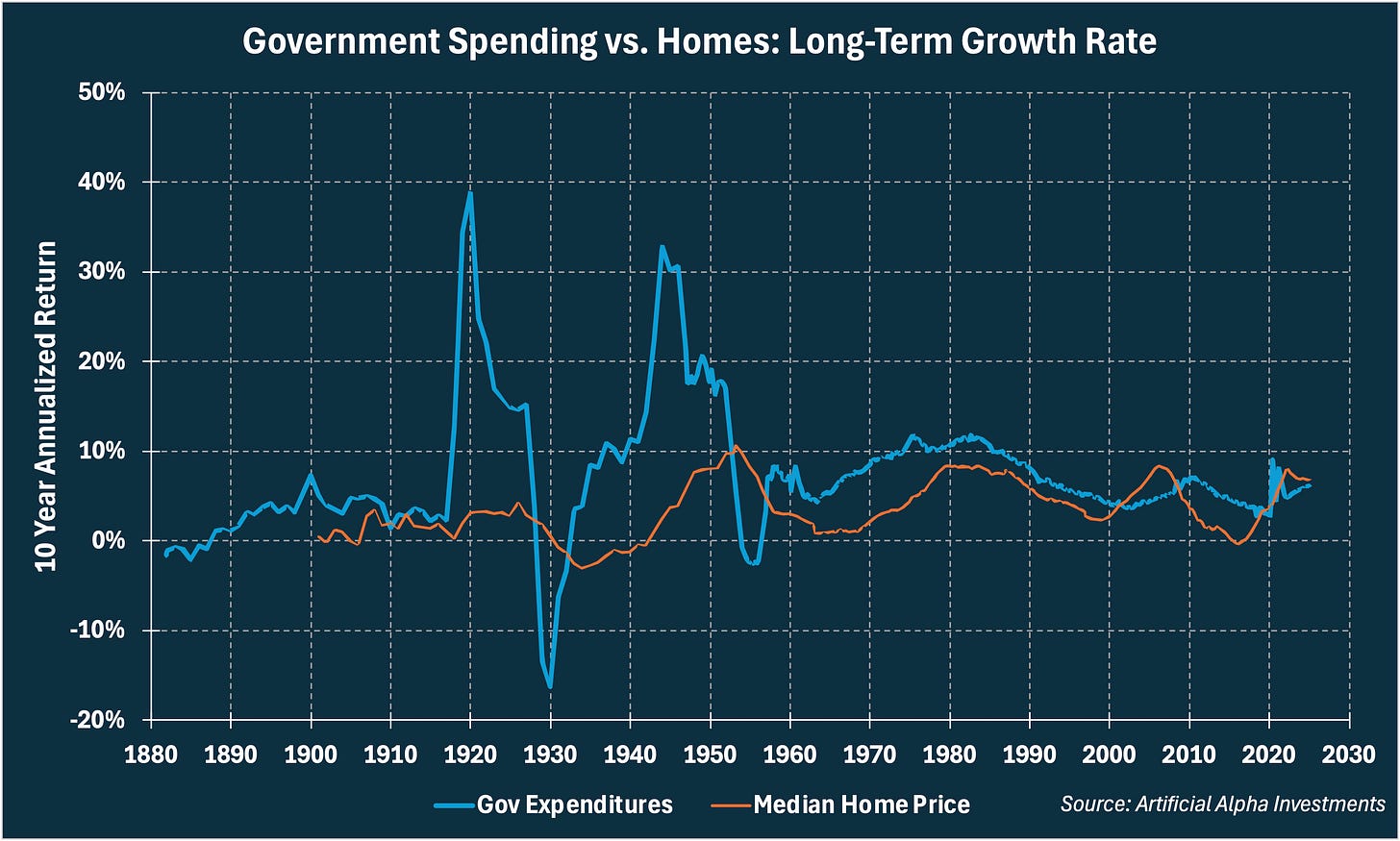

This lack of any real economic stimulus means that most government spending results in higher prices instead of economic benefits. Inflation is much more correlated with government spending than is real growth.

Prices rise on general consumer goods, like those represented in CPI, but they also rise for more traditional assets like homes.

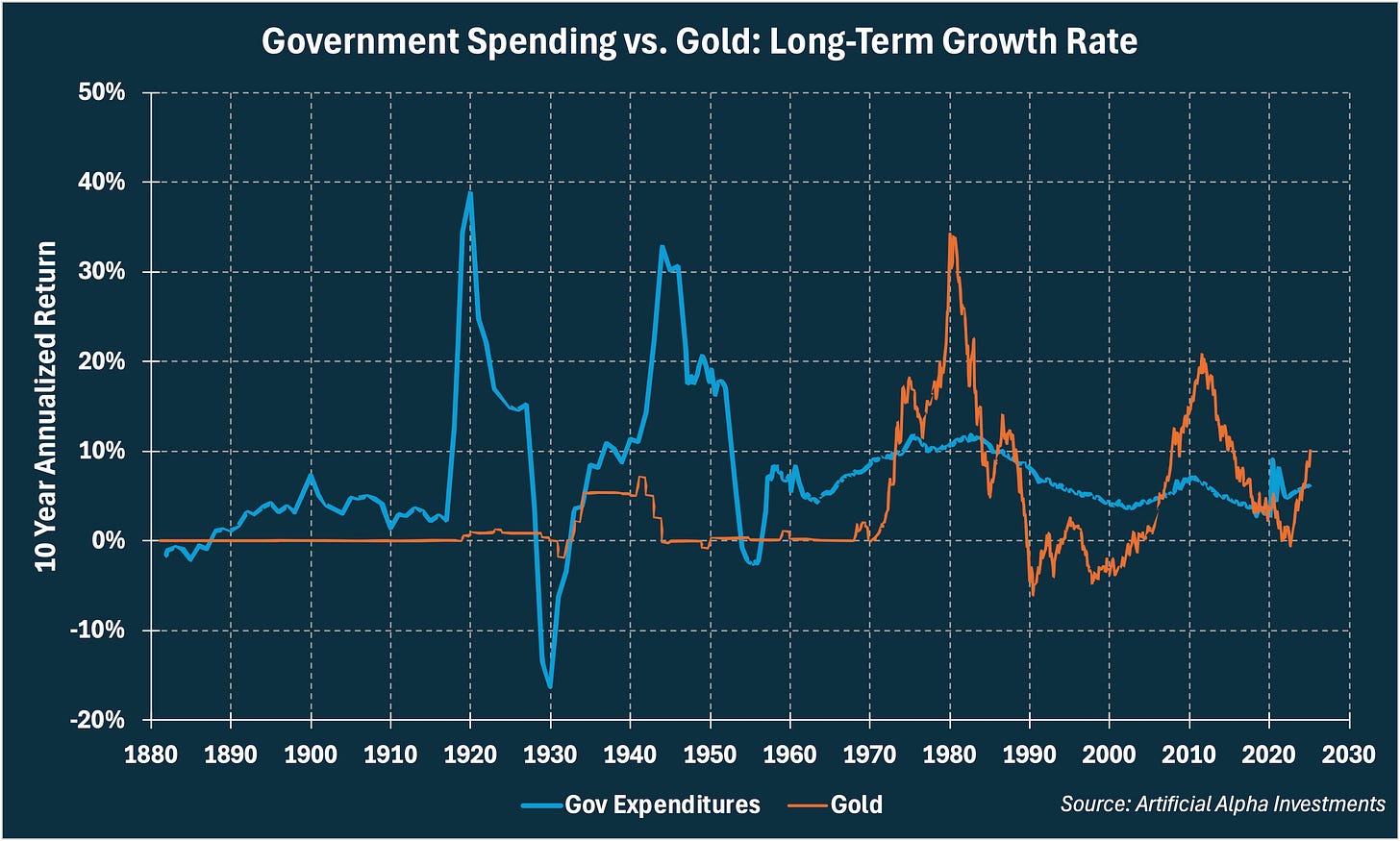

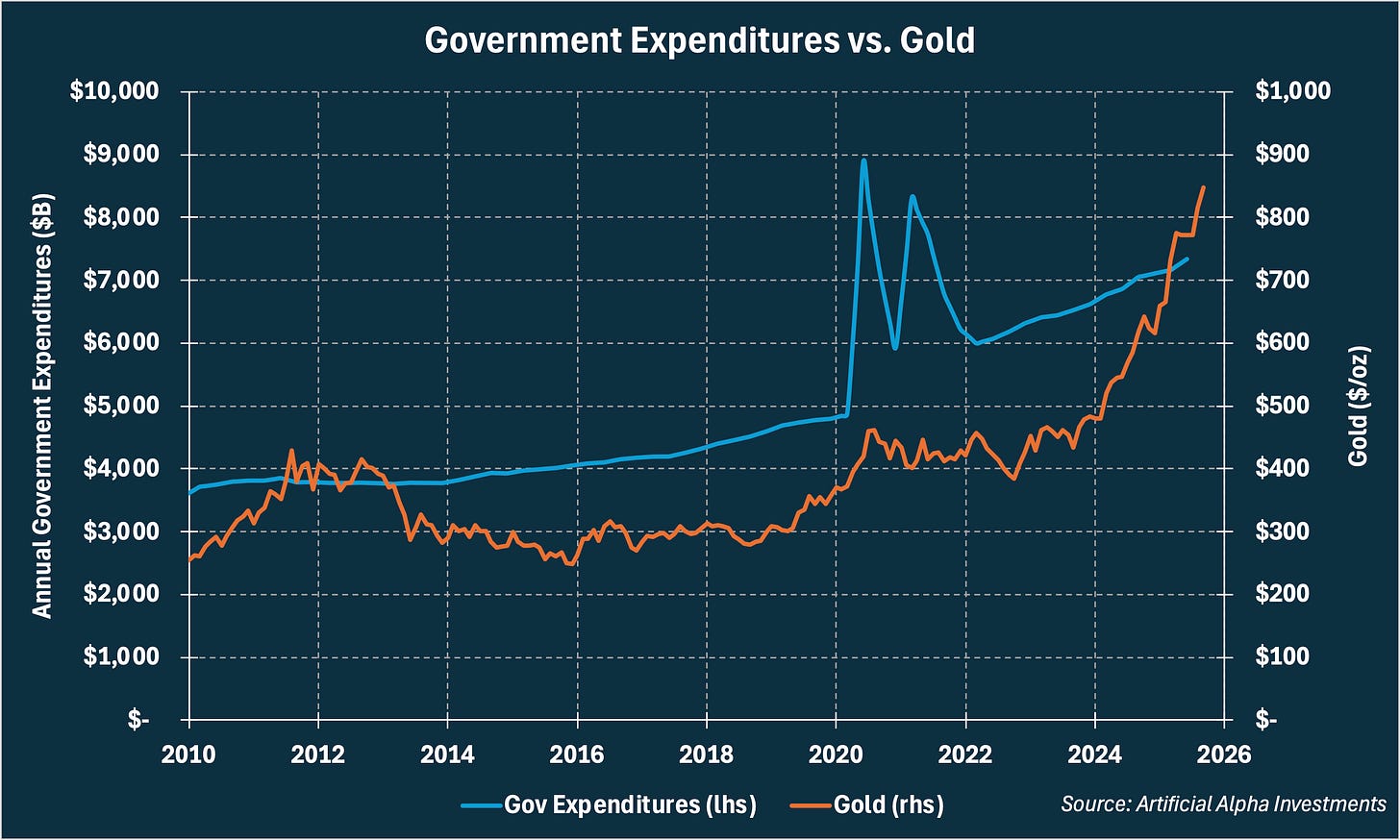

Gold prices also correlate with government spending, although with much more volatility due to gold’s financial nature. Remember that gold was pegged to the dollar prior to 1971, so prices were flat for much of this history.

Silver prices were not pegged to the dollar and we can see a longer history of correlation.

Accelerating Government Expenditures are the simplest explanation for accelerating gold prices. Covid caused an acceleration of government spending that we are having trouble stopping and, as expected, precious metals are protecting against this currency debasement.

You will notice that gold even reacts in this way to deficit related headlines. When the Federal Circuit struck down President Trump's tariffs imposed under the International Emergency Economic Powers Act on August 29, gold rose 2.4% on the next trading day in anticipation of higher government deficits.

Hopefully this adds some color to gold’s role in a diversified portfolio. As an added bonus, I touched on some economics with interesting political implications. Gold is a very politicized asset after all!