When You Hear “Recession”

Originally published on 5/5/2023

In my last letter I constructed an aggregate of economic indicators that suggests we recently entered a recession, and at the very least we have entered a serious bout of slow growth. This may seem like a good time to sell stocks, but the story isn’t as straightforward as it might seem. I still think most investors would benefit from managing expectations as opposed to making investment or contribution adjustments.

Against my better judgement, this is a rare moment where short-term stock market returns are worth investigating since they have a strong and consistent correlation with recessions.

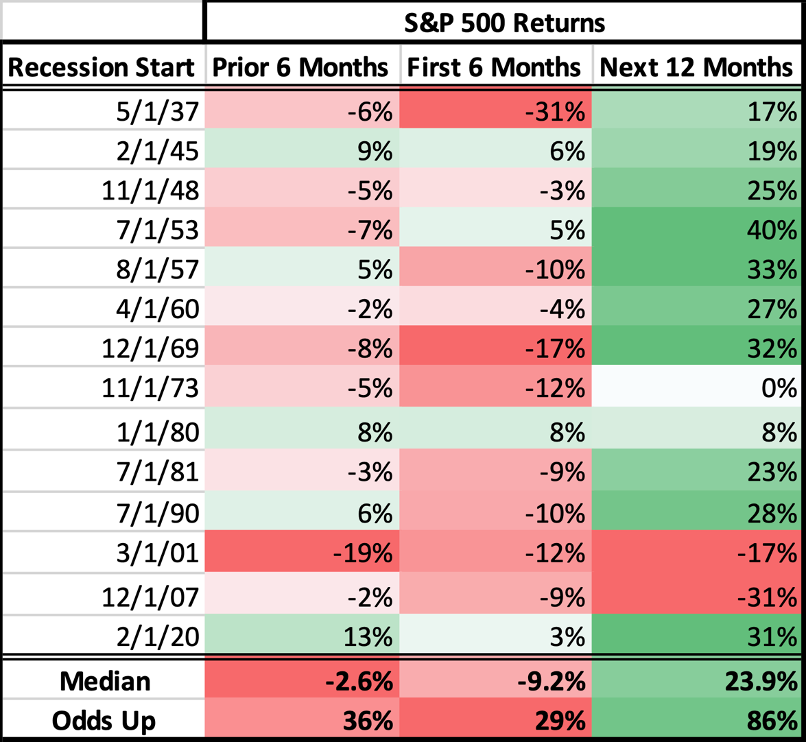

I collected stock market returns for the 24 months surrounding every recession since 1937. I split those data into three periods below.

Stock market data seem to tell a similar leading, coincident, and lagging story to the economic data. Leading economic data make investors uneasy. Coincident data make investors downright worried. By the time lagging data confirm the recession and sentiment is lowest, stocks are ready to rebound. Stocks rebound when recession pessimism peaks!

Investors would ideally sell with the leading economic indicators and buy when the lagging economic indicators follow through, but this isn’t so easy in practice.

Selling or diversifying with the leading economic indicators would involve selling when markets are still booming and a recession feels improbable. Only the most talented and involved investors, of which I am not one yet, could consider taking meaningful action here.

Selling with the coincident economic indicators is likely too late. Sure, the first 6 months of a recession are awful for stocks, but the 12 months after that are equally amazing for stocks. If an investor just sat through 18 months of volatility every time, or even continued buying through the pain, the median 18-month return was 12.5%. Why risk a reasonable 12.5% return just to avoid some of the dips along the way?

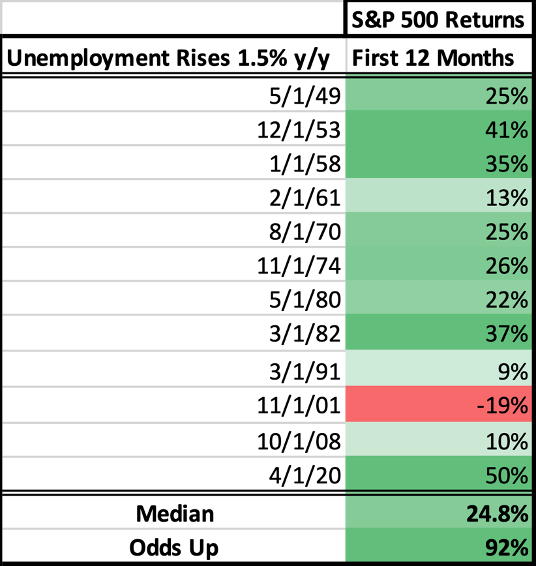

Buying with the lagging economic indicators is intriguing to me though. Let’s take a closer look at one lagging economic indicator, the Unemployment Rate. Unemployment data tend to confirm a recessionary cycle. Let’s look at stock market returns after the Unemployment Rate rose 1.5% from the year prior.

Finally, those are some data I will concede are reasonable to act on. Rising unemployment is a clear signal and it carries a strong history of outsized forward returns. These data are as good as they get.

I believe that taking advantage of the post-recession rebound is the most important priority during a recessionary cycle. Trying to avoid modest early-recession losses is not worth the risk of missing large post-recession rebounds on average. Investors should figure out how to be fully invested by the time optimism bottoms out and the stock market reverses higher.

On top of being a viable strategy, buying the rebound is the most tax-efficient option and most likely corresponds with your overall investment strategy and philosophy. Be warned, though, that pressing your bets at the height of pessimism will be hard. That is why we are managing expectations and building a gameplan now!

I don’t think it matters whether I am right about the recession call in my previous letter, since I wouldn’t recommend any immediate selling anyways. I’m more interested in pressing my bets into these troubling economic data, unemployment data being the most troubling, and making sure I take full advantage of the post-recession rebound if/when the recessionary cycle completes.