Volatility Returns

Originally published on 3/10/2023

The pandemic era provides good context for the stomach required to be a stock market investor. Living through volatility is difficult and the past three years have provided plenty of volatility. But even though the past three years have been volatile, they haven’t exactly been painful. The risk/reward tradeoff we’ve experienced recently isn’t all that uncharacteristic of the stock market.

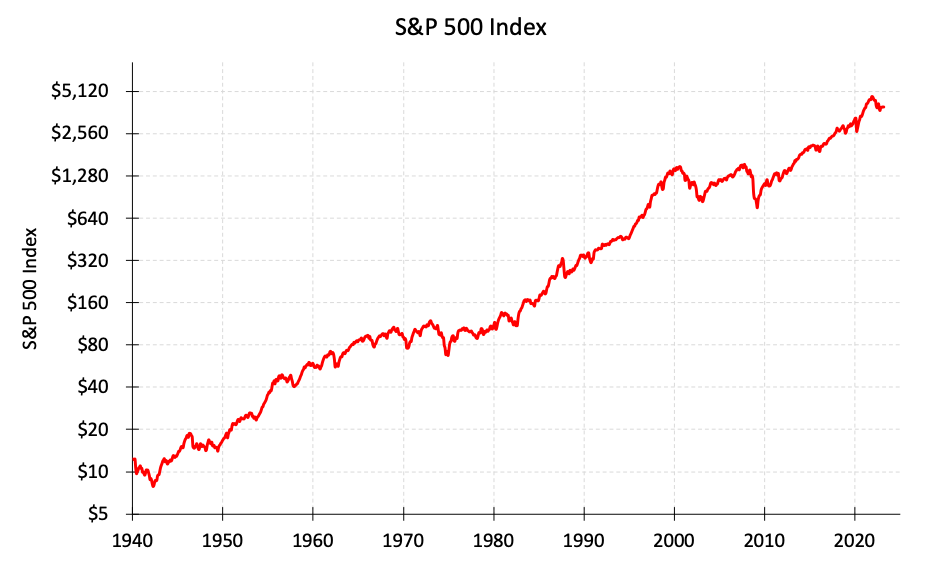

The past 3 years of volatility have been high but are no outlier in comparison to the past 80 years of stock market activity. The S&P 500 had a maximum drawdown of -33.9% in 2020 and a maximum drawdown of -25.4% in 2022. These both felt dramatic at the time, but 20% drawdowns are commonplace and occur every 5 years on average.

These brutal drawdowns are balanced with class-leading long-term returns. The S&P 500 index has grown at a 7.2% pace annually since 1940 despite all these 20% drawdowns. Investors are rewarded with higher returns for putting up with so much risk and volatility.

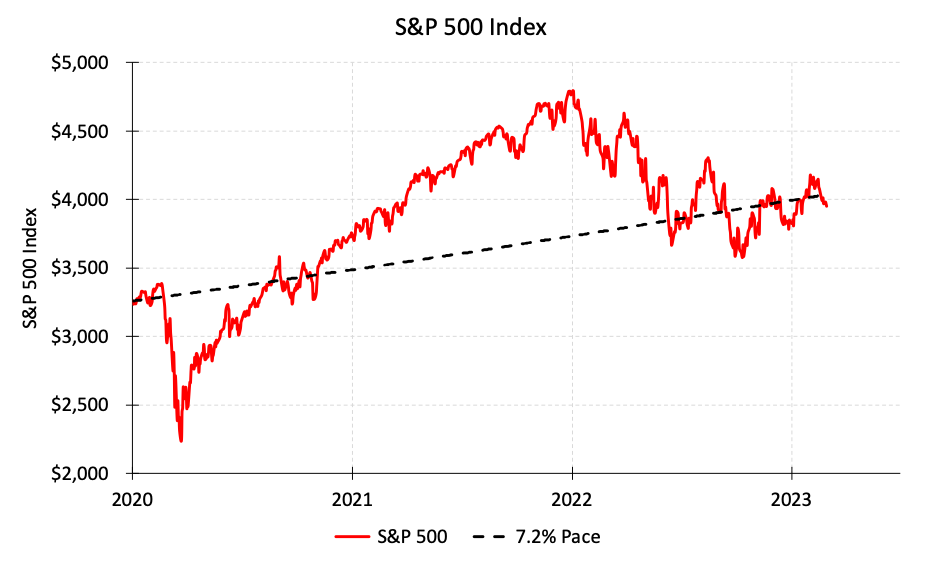

It is easy to be an investor during periods of low volatility and high returns. It is hard to be an investor during periods of high volatility and low returns. Stock market activity since 2020 falls somewhere in the middle.

S&P 500 volatility has been high since 2020 but returns have kept up with the 7.2% historical pace. This makes the past 3 years a nice representation of average stock market activity after a long period of low volatility and high returns in the 2010’s.

Consider how much worse the early 1970’s or the 2000’s were when volatility was high AND prices went down for 10 years.

It is important for investors to choose an investment strategy that they can manage behaviorally during downturns. Panic selling into a downturn is worse than sticking to a lower risk, lower return investment strategy. Hopefully the past 3 years help illustrate the trade between volatility and returns that stock investors generally make. The stomach required to be a stock investor will be greater when times are even more challenging than these.