The Recessionary Cycle

Originally published on 5/3/2023

I love economics, so forgive me as I write an update on where we are in this “slow-growth” cycle again. The spoiler is in the title though, so I might as well confirm that I think we’re more likely in the midst of a recessionary cycle. Here’s my pitch for recession in Q1 2023.

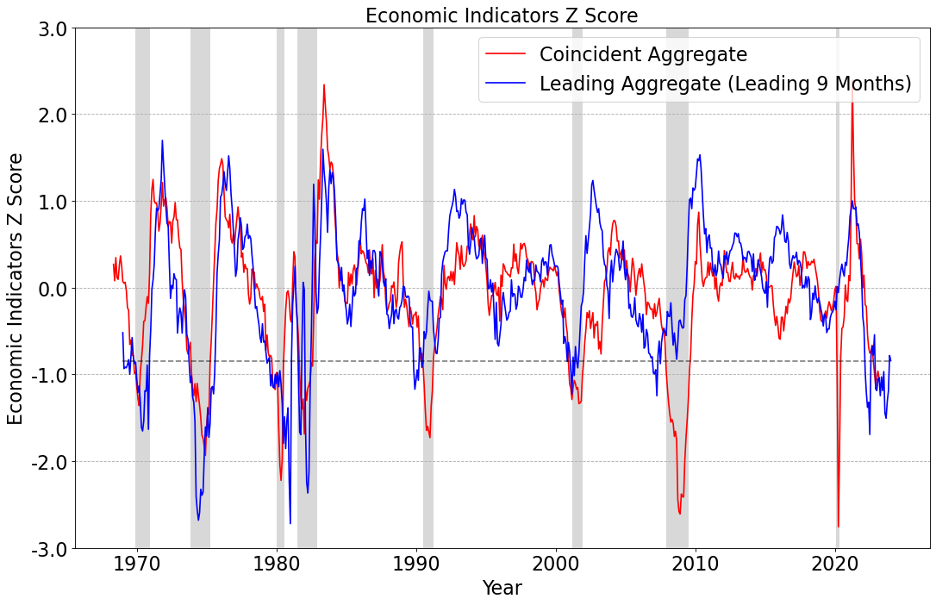

I wrote in December about how tight monetary policy in 2022 was going to take some time to seep into the economy, but that the level of rate tightening seen in 2022 has caused a recession 9/10 times since 1950. A recessionary cycle is usually preceded by rising short-term interest rates, which are immediately recognized in the economy by the housing sector and other rate-sensitive businesses. These data are our best leading indicators.

About 9 months later is when we tend to see an impact on economic activity. Lending standards, retail sales, manufacturing activity, asset prices, building permits, consumer sentiment, and working hours are all affected. These coincident data usually mark the official recession start date.

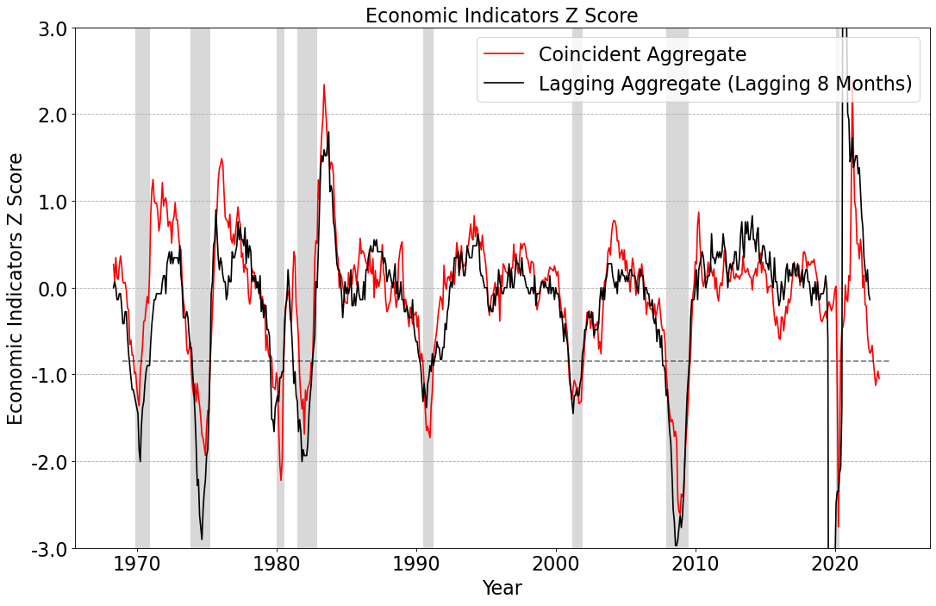

Unemployment is the last and most definitive shoe to drop, usually turning about 8 months after the coincident data show weakness. Unemployment are the lagging data. This makes for a long, 17-month wait between leading data and unemployment data on average!

(Random note/rant: Most market watchers talk about a valuable leading indicator called the “yield curve inversion” and then get antsy when nothing is borne out a year later. These things take time and there is no rule on the exact number of months it will take!)

In a quest to measure these economic phenomena, I located 18 leading, coincident, or lagging indicators. I’ve averaged these 18 indicators into leading, coincident, and lagging indices because economic data are noisy, unmeaningful, and hard to digest as individual series. Please reach out if you’d like to learn more about how I calculated my three economic indices.

(Another note/rant: GDP data stink like monkey butt! The data are quarterly, noisy, and subject to big revisions.)

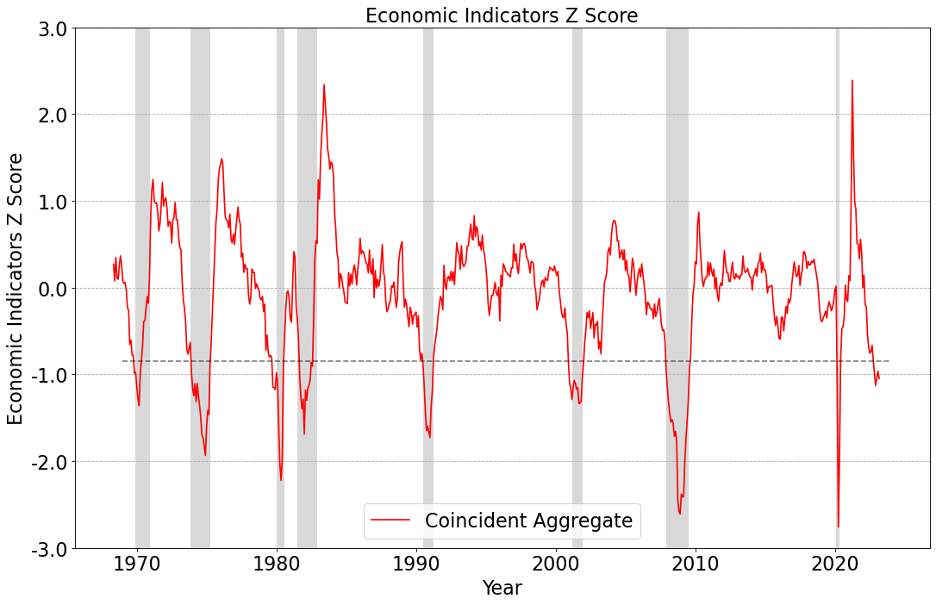

What does coincident economic data tell us about where we are now? We are undeniably experiencing low growth.

We (NBER, actually) tend to date the start of a recession when coincident economic data experience a -0.85 standard deviation move lower. This time around, my coincident index crossed below -0.85 in November 2022 and coincident data continued to get worse in Q1 2023.

Can a recession be confirmed? We don’t really call it a recession until the lagging, unemployment data confirm the other coincident economic data, and we haven’t seen unemployment tick up yet.

Remember, though, that we don’t expect unemployment to go up until 8 months after the coincident data showed weakness in November 2022. We might expect to see changes in unemployment this summer if lagging data follow the usual script, although this cycle seems to be playing out even slower than usual so far.

So, what lies ahead? There is some value in looking at leading economic data to see what comes next, although recessions take on a life of their own sometimes (see 2008).

These leading data make up a mixed bag. Housing is starting to pick back up and commodity prices are coming down. That said, high interest rates still represent a meaningful problem for the economy over the next 9 months.

Altogether, these data mean that business is getting tighter, tight enough that I think we entered a recession in Q1 2023 (my opinion only). I take this conclusion from the coincident economic data displayed above as well as some industry-specific data I’m starting to see at my day job.

These findings also suggest that the scariest economic data, those being unemployment data, haven’t nearly hit the press yet. We can’t be sure we’re in a technical “recession” right now, only that we’ve reached the beginnings of a low-growth cycle. I tend to believe we will see the full recessionary cycle through.

And these data suggest we don’t have many tailwinds from the leading data yet. Interest rates are still high. The Federal Reserve seems intent on putting us through a recession to squash inflation and it doesn’t seem like they will let up until the lagging data confirm a recession.

I’ll spell out what recession means for stock prices in my next letter. The answer isn’t necessarily bearish, and dare I say it’s bullish?