The Market is Forward Looking

Originally published on 2/7/2023

I’ve been writing through a negative lens about the economy lately and I really don’t want to make the impression that I’m necessarily pessimistic about stocks or other risky investments by consequence. Not exactly because stocks and economies are uncorrelated, but because stocks lead the economy by so many months that when the world starts arguing about whether we’re in a recession is nearly the best time to buy risky assets like stocks.

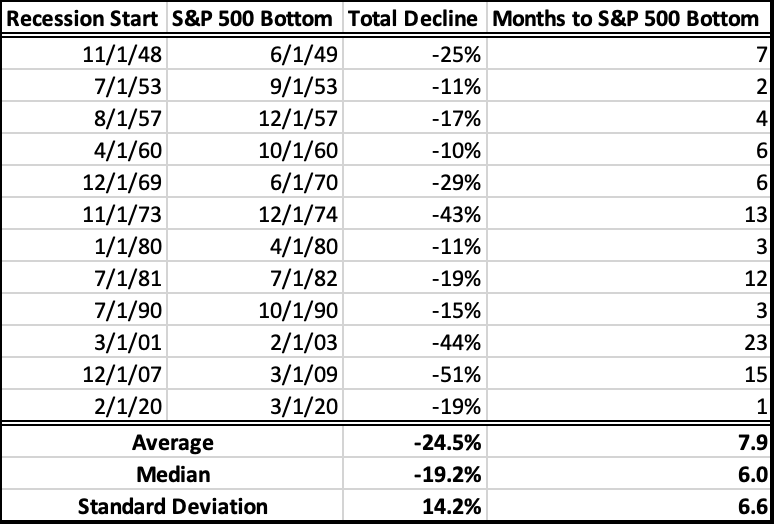

Let’s consider the month of every recession since WW2 and the month that the S&P 500 bottomed. The median recession in our sample sent the S&P 500 19.2% lower within 6 months of the recession’s beginning.

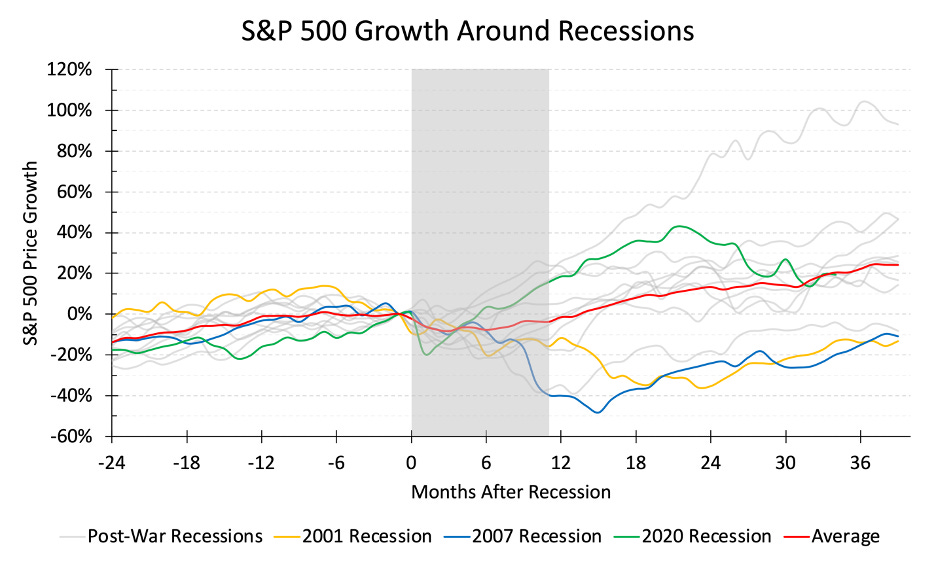

Visualizing the path of the S&P 500 around each of these recessions also illustrates how early stocks tend to peak in anticipation of a recession. The stock market usually peaks about 7 months before a recession, wiggles around for a bit, goes lower while we’re arguing about a recession, and then reverses 3 to 6 months after the recession began and our economic future looks most dire.

How did 2022 compare to those averages? The S&P 500 peaked in January 2022, about 11 months before some recessionary data started showing up in December 2022. The S&P 500 bottomed (assuming no further declines) in October 2022, after a 25.3% decline. The magnitude of this decline is in line with an average recession, and I’m not surprised that the markets reacted 3 to 6 months earlier than average to this very-telegraphed economic slowdown.

I’ve highlighted the 2001 and 2007 recessions in the chart above because they represent the biases we’ve picked up during recent recessions. These S&P 500 declines were elongated and brutal but do not nearly represent the average. Aggressive, young, long-term investors should avoid overweighting these probabilities in their investment decisions.

There is a counterintuitive possibility that stock prices already bottomed despite all this chatter about a recession. I have no idea if a recession is upon us or not and any opportunity to sell will have already passed by the time I finally find out. The stock market is a leading economic indicator and trying to predict the market’s next move based on coincident economic data is largely unfruitful.