The First Cut

The Federal Reserve decided to lower the federal funds rate by 0.5% last week, marking an end to rising and then “higher for longer” interest rates. They justified this policy shift by pointing to a better balance of inflation vs. unemployment risks in comparison to prior years.

The federal funds rate is the yield on overnight loans between banks and is set by the Federal Reserve. Along with government spending, the federal funds rate is a key policy input into the U.S. economy because it tips the scale between spending vs. saving and between inflation vs. unemployment. A lower policy rate tips the scale towards higher economic activity, spending, and inflation.

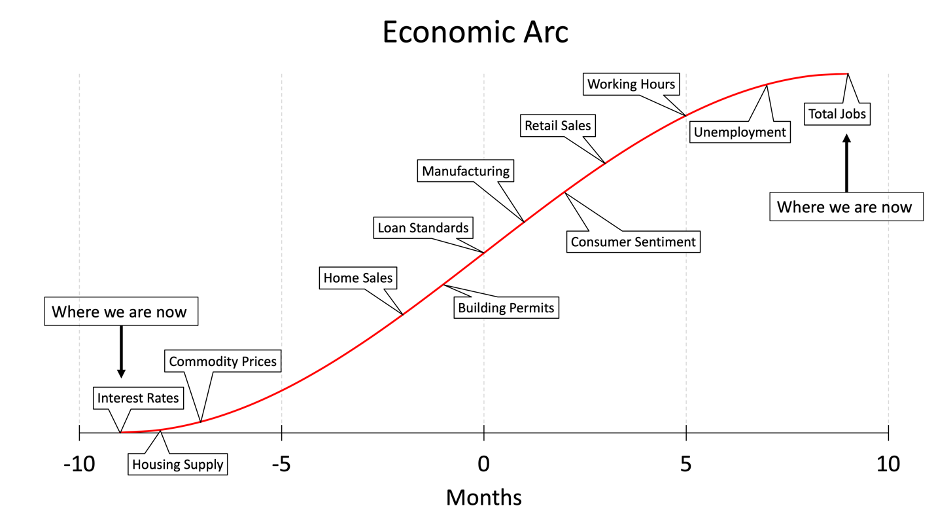

As an input into the economy, the federal funds rate is among the most leading economic indicators. Interest rate policy generally leads to housing activity and market pricing, then manufacturing activity, then retail activity, and finally employment. On average, this economic cycle lasts 18 months (although no cycle is the same).

Using the following logical chain, we can hypothesize that cutting interest rates will lead to higher stock prices:

1) Interest rates are an economic input that lead economic activity

2) Lower rates tip the scale towards higher economic activity

3) Stocks primarily benefit from higher economic activity (see “Short Term Drivers” from June 2024)

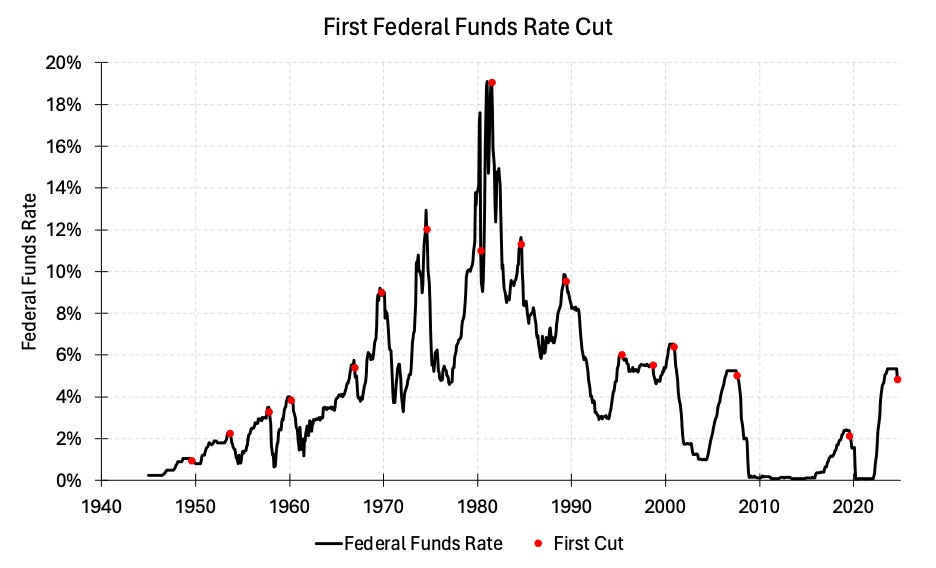

We can test this hypothesis by taking a sample of each time the Federal Reserve changed course and cut the federal funds rate. This chart of the federal funds rate shows the sample of rate cut decisions we will use.

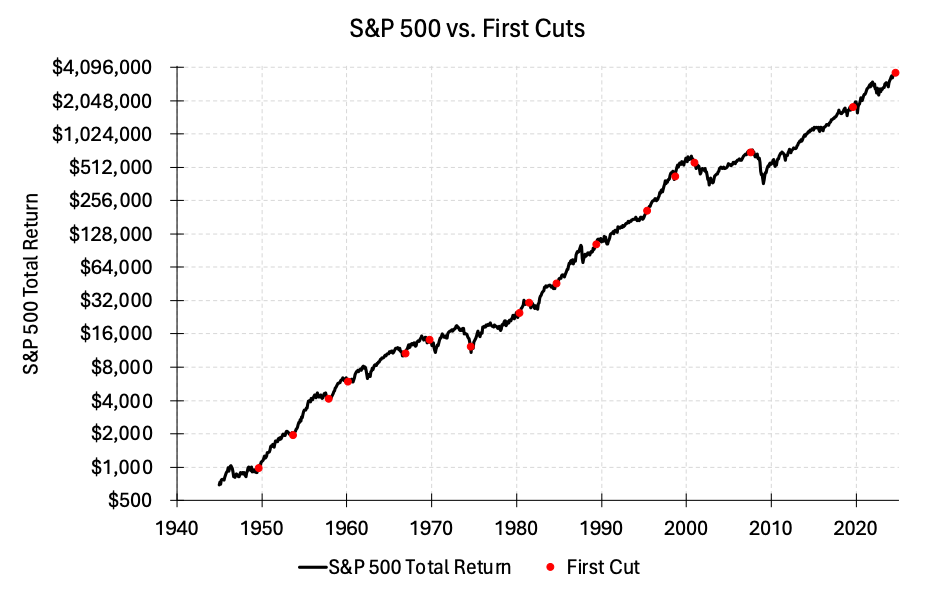

And this chart of the S&P 500 total return overlays our sample of rate cuts on top. Most of these interest rate cuts were great moments to buy stocks.

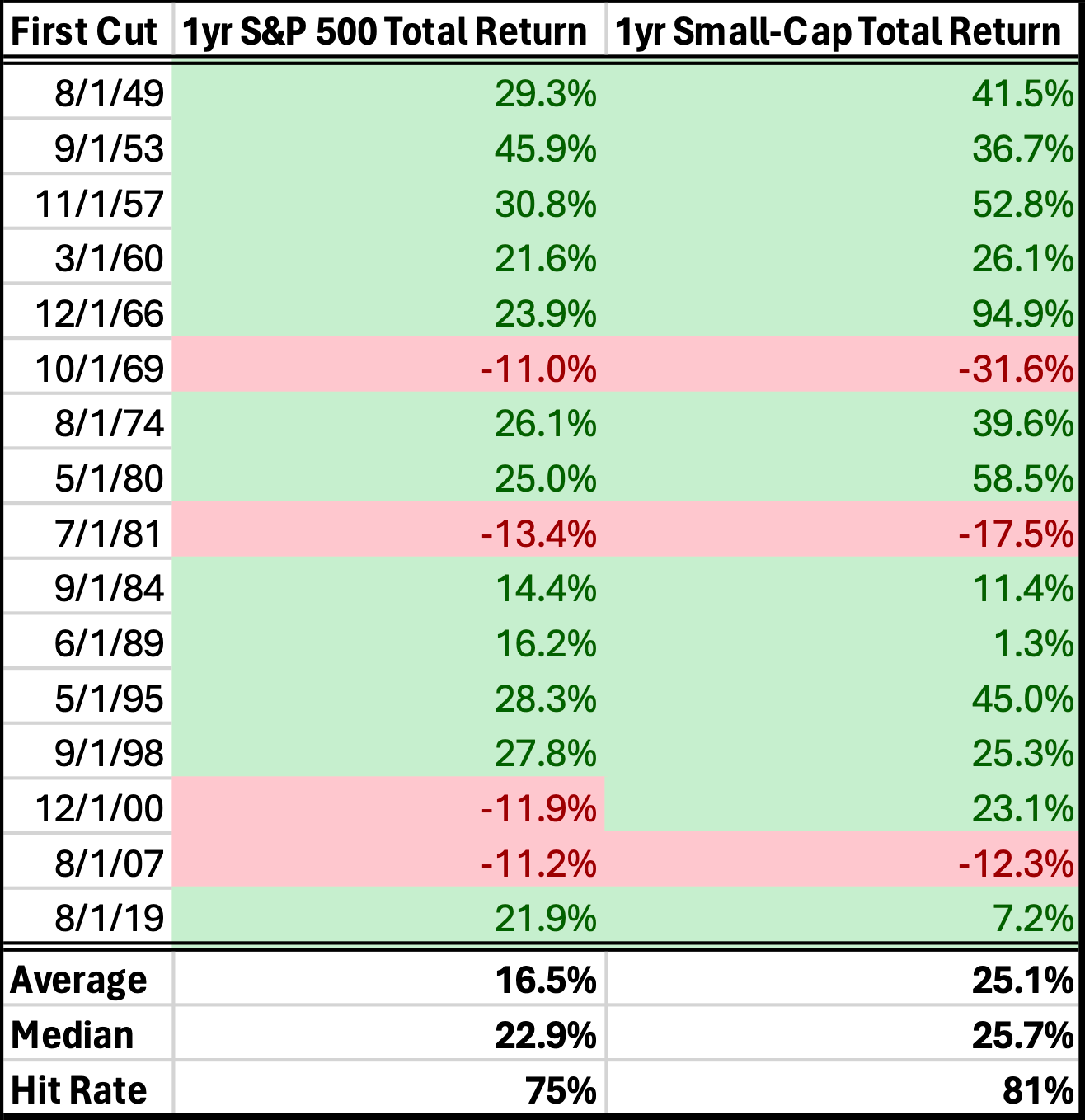

Finally, this table summarizes the investing results from our sample by taking the 1 year forward return of the S&P 500 and small-cap stocks. The average returns for both large-cap and small-cap stocks were terrific after the commencement of these interest rate cutting cycles.

One peculiarity about the range of outcomes during a cutting cycle is its exceptionally binary nature. The S&P 500 was down 10% or more in 25% of our sample but only 10% of all years. The S&P 500 was up 20% or more in 63% of our sample but only 39% of all years. On one hand, catastrophic risks are higher during a weak economy. On the other hand, prospects are great if nothing breaks as policy gets more accommodative.

This binary dynamic is probably why I see so many negative reactions to this news. Anyone who spends too much time measuring the odds of negative outcomes is seeing those odds surging. I’d like to remind us about the rising odds of positive outcomes too!

Even though I don’t advocate for allocation adjustments based on this type of analysis, I’m nonetheless comforted by these cuts and other optimistic economic developments. As always, and especially after the federal reserve cuts rates, there are risks to investing in stocks but the odds are in your favor!