Stock Market Concentration (pt. 1)

Originally published on 3/13/2024

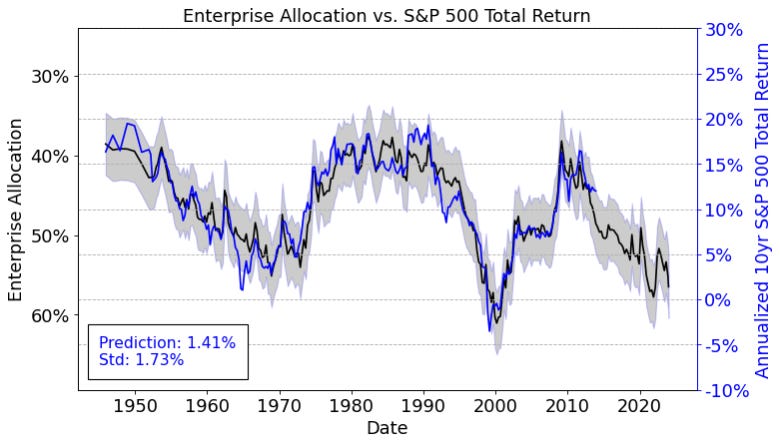

I wrote last year about tempering expectations for stocks in the decade ahead due to high valuations. I believe most working-aged people should practice this long-term perspective.

I’m finding it is very hard to invest right now. Until recently, S&P 500 return expectations were comparable to or better than 10-year treasury yields and money market yields. Now I must reconcile my 30+ year time horizon and high risk tolerance with the potential for a lackluster decade.

Nonetheless, the economic cycle is in full swing, and the cycle tends to matter more than valuations in the short-term. How could we possibly invest to satisfy long-term return goals while taking advantage of this short-term economic thrust?

One unique aspect of this stock market is that the largest 5 stocks make up a large percentage of the overall market. S&P 500 investors now have 25% of their investments allocated to just 5 businesses.

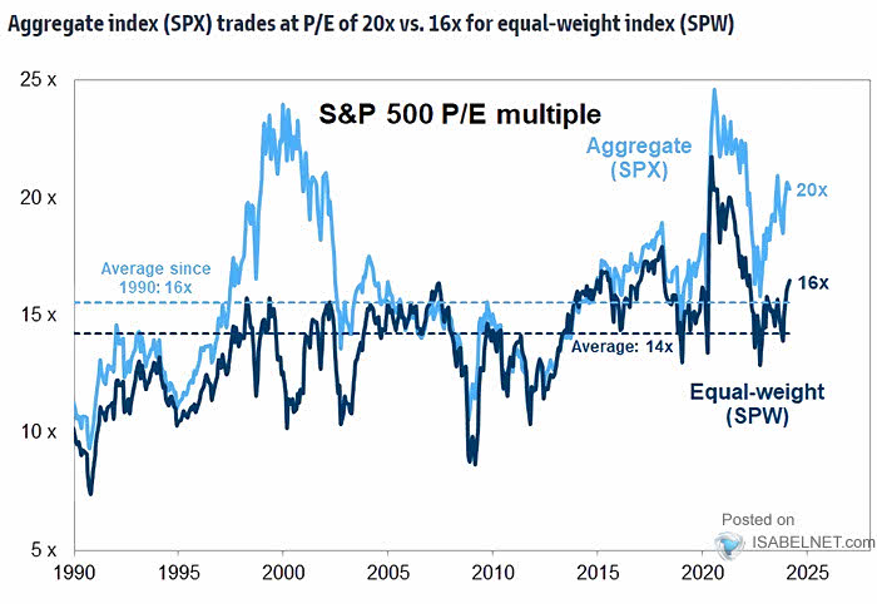

Additionally, the largest businesses are more expensive than their peers. The S&P 500 has a Price/Earnings ratio of 20x. When all businesses are weighted equally and only 1% of investments are allocated to the largest 5 stocks, the Equal-Weight S&P 500 has a Price/Earnings Ratio of 16x.

That might seem like a small difference, but a similar difference was present in 2001. And from January 2001 to January 2011, large capitalization stocks returned 1.5% per year while equally weighted large capitalization stocks returned 4.5%.

Transforming that 3% outperformance onto today’s expectations could mean the difference between a 2.5% annual return for the S&P 500 and a 5.5% annual return for the equal weighted S&P 500. It would be difficult for 2.5% to outperform other assets but 5.5% has a fighting chance.