Stock Market Competition

Originally published on 8/3/2023

Everyone has been focused on short-term market expectations recently, but I think it is time to shift back to a long-term focus now that the economy and stock market are rebounding.

Stock market returns are very unpredictable over the next year, but stock market returns become more predictable once we take a 10-year view. Unlike short-term insights that all point towards buying almost any dip in price (for example, see my last letter for why you should buy into a recession), long-term analyses give varying advice on long-term investment decisions.

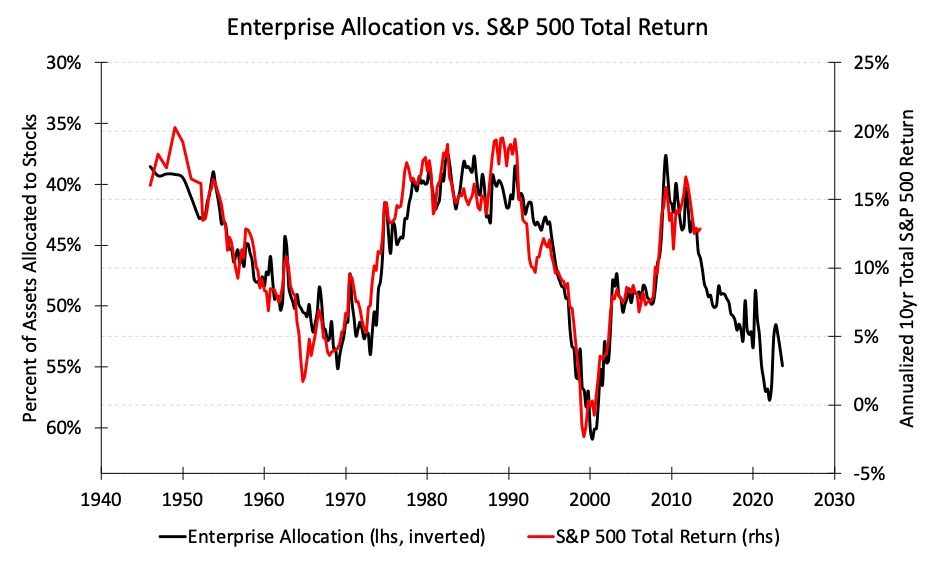

My favorite indicator, Enterprise Allocation, measures the percentage of all financial assets in the US that are allocated to stocks as opposed to cash and bonds. Since this percentage has been mean reverting over long periods of time and the current Enterprise Allocation is near record highs (the left axis is inverted), we can assume that stocks will face headwinds over the next 10 years as investors slowly reallocate.

The chart above takes a linear regression to predict the total return of the S&P 500 over the next 10 years (red line) by using the current Enterprise Allocation as its only input (black line). This model predicts that investors should expect a 2.7% return per year over the next 10 years. Other models with different approaches also predict a return between 2-3% per year.

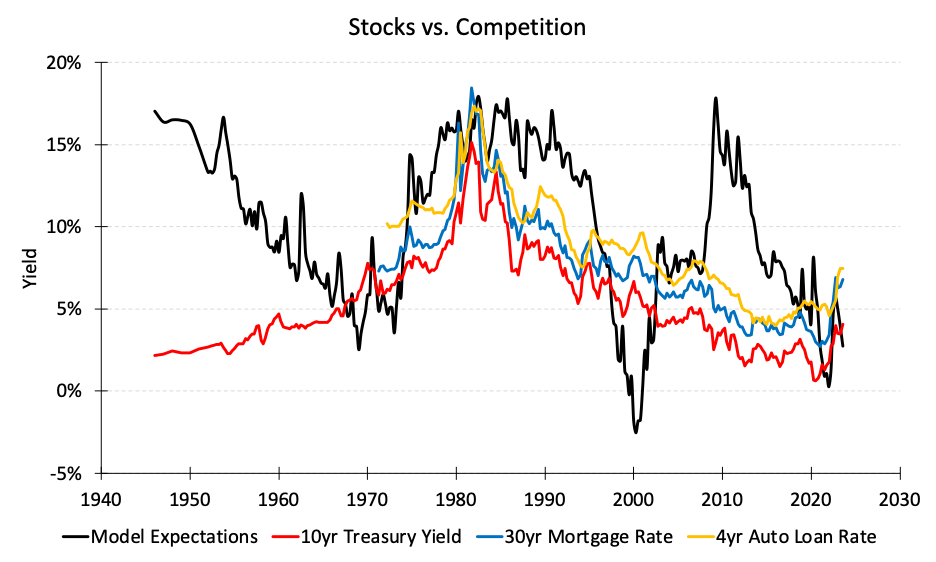

Below-average expectations have not been a huge problem for the stock market over the past 5 years, but now stocks are faced with much better competition. The chart below compares the black stock market model from above in comparison to other bond rates.

Treasury bond rates, mortgage rates, and car loan rates have all soared above the model’s 2.7% long-term stock market projection.

Consider an investor who recently took out a mortgage at 7.0% and an auto loan at 7.5%. Paying back either loan represents a guaranteed rate of return that far exceeds today’s stock market expectations.

Consider a family that is trying to balance retirement contributions with short-term savings contributions. They might be saving for large upcoming expenses like a home or college tuition. A 10-year treasury currently yields 4.2% and a 2-year treasury currently yields 4.9%. Saving for that home using some combination of short-term bonds will likely go further than investing for retirement using long-term bonds or stocks.

This attractive competition for stocks emerged because the Federal Reserve raised bond yields to fight inflation. And we’re slowing realizing that they might not be done!

Keep in mind that these stock market projections should not be taken as gospel because they make certain assumptions about government and economic consistencies as well as investor allocations. But they should give good context to the recent rise in bond rates, and some credence to evolving investor priorities. If you’ve been dead set on investing for retirement, now is a good time to take inventory of your debts and consider convenient ways to take advantage of short-term bonds yields.