Nvidia’s Valuation Matters

Originally published on 8/29/2023

Nvidia has been getting all the airtime in 2023, and for good reason. Due in no small part to a giant surge in Chat GPT related capital investment, Nvidia’s revenue has rocketed from $6.70B in Q2 2022 to $13.51B in Q2 of 2023. At Nvidia’s size, that growth rate is unprecedented.

Nvidia’s growth is so otherworldly that investors have begun to assume it will go on forever. Nvidia’s investors are currently paying $35.71 for every $1.00 of trailing 12-month revenue. In comparison, S&P 500 investors are paying $2.50 for every $1.00 of trailing 12-month revenue. Nvidia’s investors are expecting the company to continue growing at breathtaking speed.

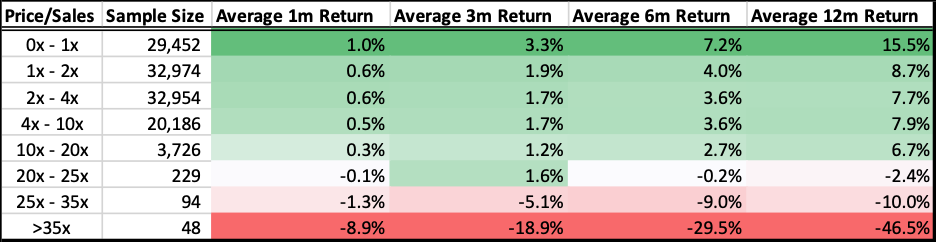

The problem with this level of hype is that investors almost always get too far over their skis. Paying more than 35x revenue is a threshold with a disappointing history. I collected the month-end Price/Revenue ratio of every S&P 500 stock since 2002 along with their forward 1-month, 3-month, 6-month, and 12-month returns.

The sample size of businesses with a Price/Revenue above 35x is tiny, and the outcomes of those investments have been dismal. Almost every single stock lost money over the proceeding 12 months and the average 12-month forward return was -46.5%.

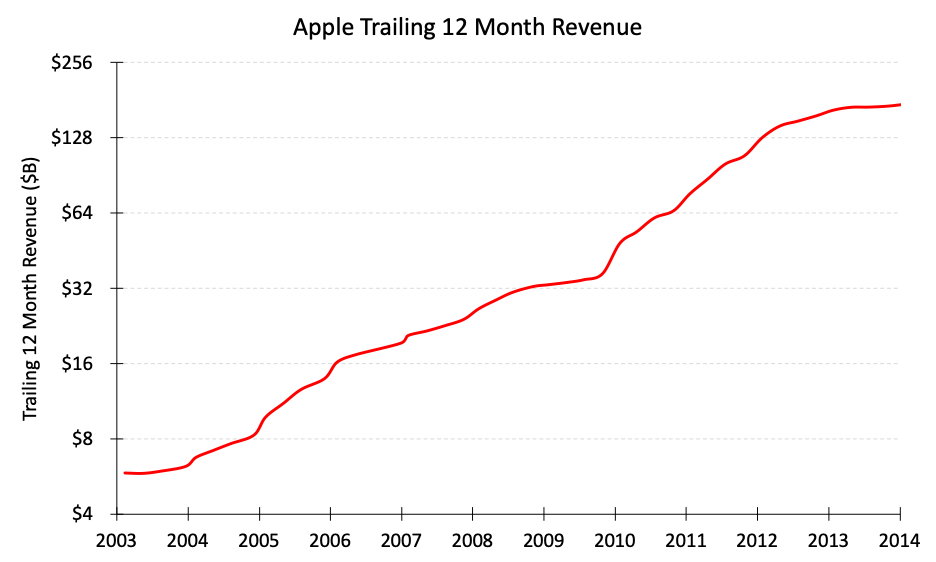

I’d like to emphasize the troubling price that Nvidia investors are paying. Let’s recalculate the investment returns of one of the greatest businesses and stocks of all time, Apple between Q1 2003 and Q1 2014, but with Nvidia’s starting price. Does Apple’s historic run even make the history books?

Apple’s investors only paid $0.89 for $1.00 of revenue at the start of 2003. Apple’s revenue grew by an unbelievable 36.1% per year between 2003 and 2014, and those shareholders were entitled to $24.08 of Apple revenue by early 2014. Additionally, investors were now paying a more reasonable $2.60 per $1.00 of Apple revenue. That initial $0.89 investment was worth $62.54 in early 2014, equal to a 47.3% yearly return!

But what if Apple’s investors had paid $35.71 for $1.00 of revenue at the start of 2003? Those investors would have made only 5.2% per year, lower than the 7.3% yearly return of the S&P 500 over the same period.

Plain and simple, making a concentrated investment in Nvidia today is a moonshot. Trading at a Price/Revenue above 35x has been the death knell for most stocks over the past 20 years. Nvidia’s business would likely have to go on one of the greatest runs of all time during the 2020s to outperform the S&P 500, even greater than Apple’s run between 2003 and 2014.