My Take on Bitcoin

Originally published on 12/20/2023

A lot has been spilled on Bitcoin, but I’ve been purposefully slow to write about it. I think I’m finally ready after the resiliency of Bitcoin during the COVID crash, FTX collapse, and banking failures. I’m going to have to start from the basics of how I view investments however, so get ready for a winding explanation.

1) Currency Debasement

Every year, more and more “money” is printed into our economy. I put money in quotations because most money in our economy is not represented by physical dollar bills but instead by debt and IOUs. I group cash and debt together as “money” because they have broadly similar effects on economic activity.

(Side note: If this is something you’re interested in, imagine that dollar bills are debts on a government’s/society’s balance sheet in the same way that mortgages are debts on a homeowner’s balance sheet. On the other side of every debt there is an asset that most likely contributes to economic activity.)

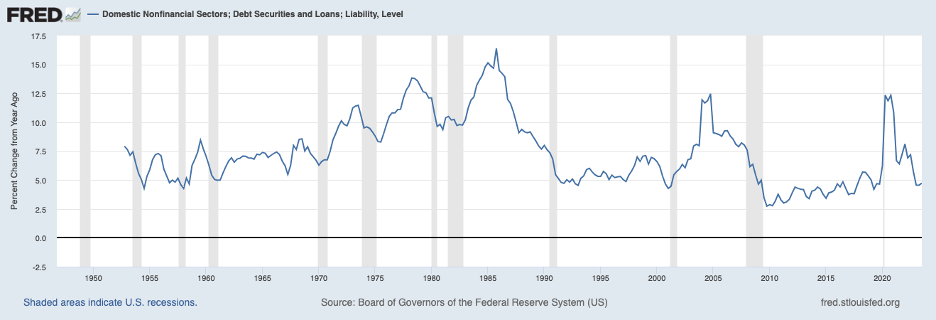

The supply of money has increased by about 7% per year since our modern monetary system was created in the mid 1900s. There are many ways of measuring money supply, but my preferred accounting method takes all nonfinancial debts in our economy.

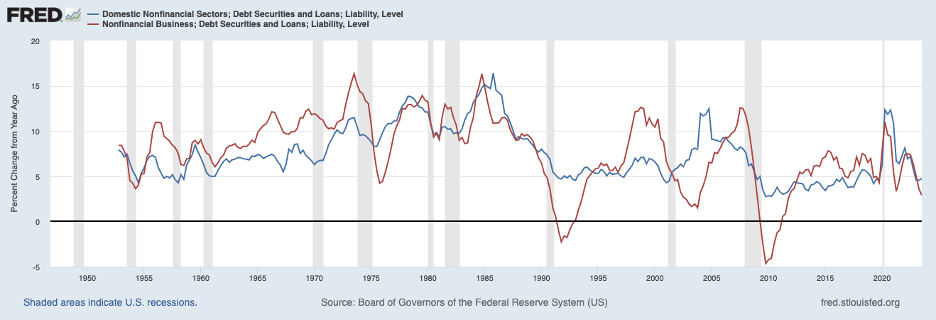

Money supply goes up for a variety of reasons. Businesses cause the money supply to go up when they take out a loan. Out of nowhere, the bank has created an asset on their balance sheet and a debt on the Business’s balance sheet.

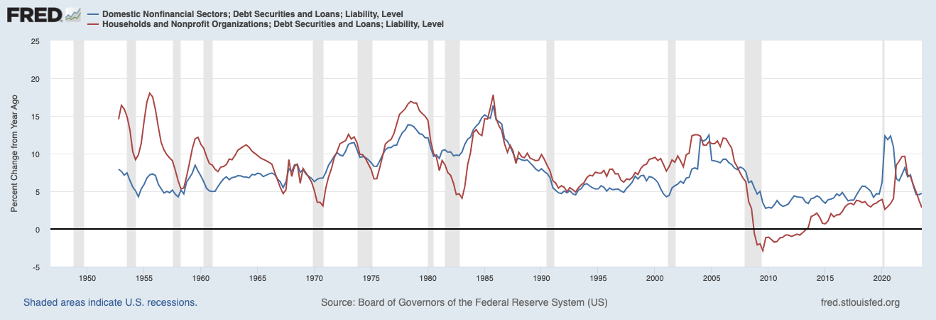

Households and Nonprofits also cause the money supply to go up when they take out loans, most commonly via mortgages.

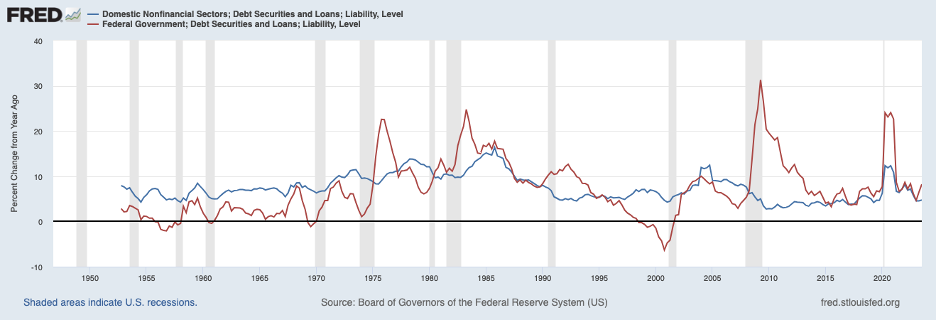

The Federal Government causes the money supply to go up when they conduct money losing social programs that result in a deficit. The Federal Government essentially takes out a loan from the public when they sell treasuries or “print” dollars to cover their spending.

State and Local Governments also contribute to money supply growth, but not nearly to the same degree as Businesses, Households, and the Federal Government.

2) Estimating Demand

Let us group all this money supply under the umbrella of “demand.” Demand for goods went up when the Government printed money for us during the pandemic. Demand for raw goods goes up when a Business gets created. Demand for housing goes up when a Household takes out a mortgage.

By my measurement, demand broadly increases by about 7% per year.

3) Estimating Supply

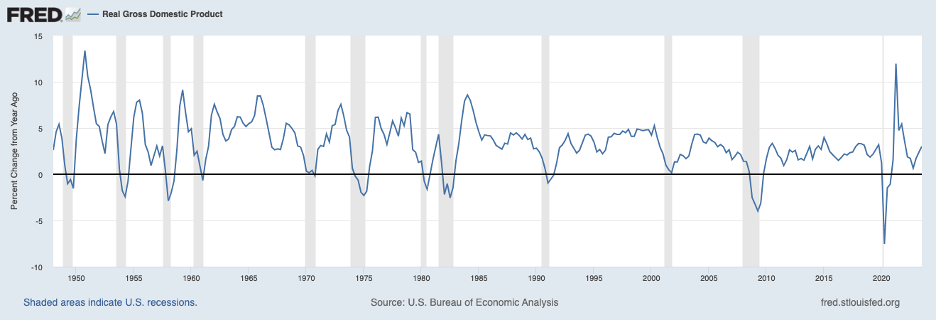

The other side of the pricing equation is supply. Economists attempt to estimate how much volume our economy produces via Real GDP.

Businesses continually get more efficient at producing goods over time; thus, Real GDP and supply broadly increase by about 3% per year.

4) Estimating Commodity Prices

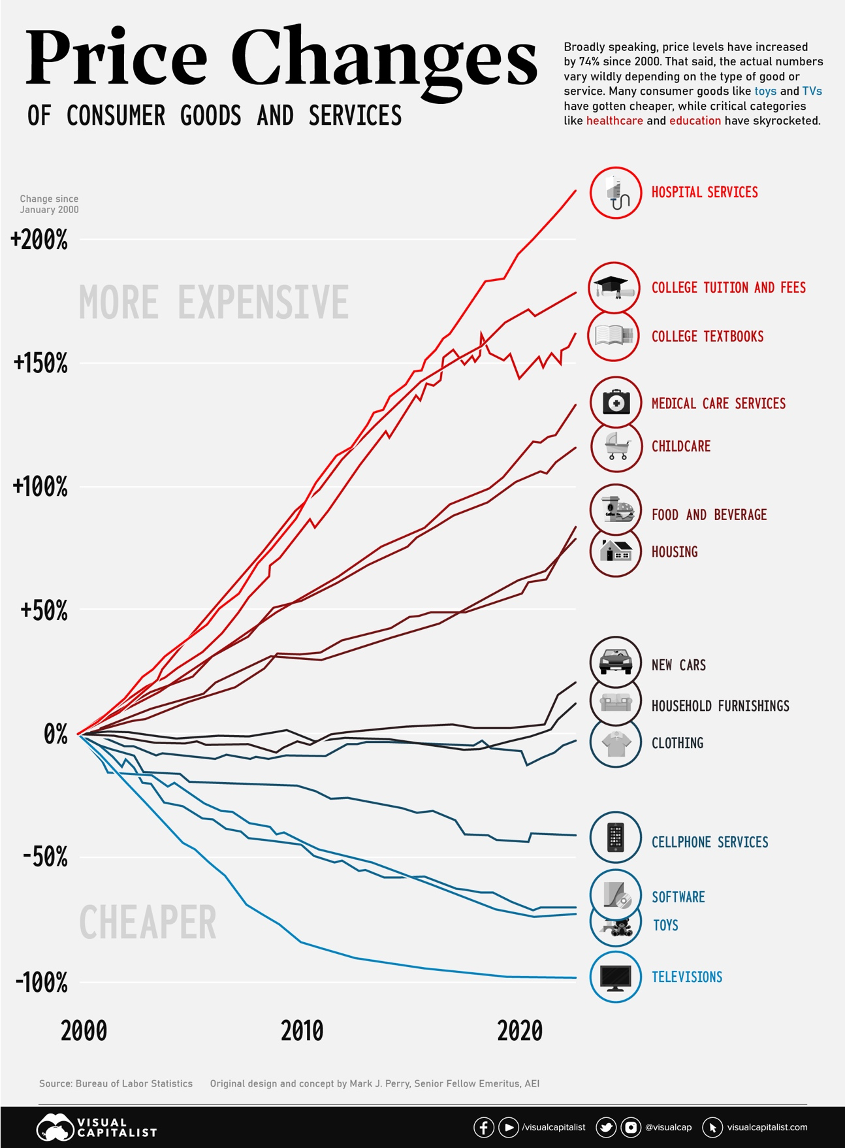

Demand for goods normally rises faster than the supply of goods, which causes prices to go up. Demand for goods goes up by 7% per year. Supply goes up by 3% per year. Simply subtracting 3% supply from 7% demand would predict 4% inflation, which is precisely the average inflation rate since the mid 1900s.

Not all goods are created equal, however. Some have gotten easy to produce and some have made no efficiency gains. This is a bit of a simplification, but one doctor still treats one patient and so supply has barely budged. You guessed it, hospital services have increased by about 7% per year since the mid 1900s! On the other hand, televisions have become insanely easy to produce and prices have dropped!

5) Bitcoin’s Equation

Bitcoin’s supply is famously capped and demand via money supply is increasing by 7% per year. From this simplified view, Bitcoin is a great store of value that should increase in price by 7% per year. Compare Bitcoin’s store of value proposition to that of Gold, which still only musters a 5% annual return due to small supply increases.

(Side note: This supply and demand equation can be used for stock prices too. Demand for business ownership increases by 7% per year and businesses are responsible for that 3% Real GDP growth, which added together predicts a 10% annual return. After dividends, this is precisely the average stock market return since the mid 1900s.)

6) Challenges to Bitcoin’s Equation

Bitcoin has a few problems.

First, supply may or may not be fixed. Not because Bitcoin technology is flawed (it seems to be nearly perfect), but because other cryptocurrencies can be created out of thin air. Bitcoin goes to zero if buyers start to desire other cryptocurrencies too. Supply is virtually unlimited in that universe of indiscrimination. Supply is currently kept artificially low via cultural values and orthodoxy.

Second, demand is not fundamental. There is no practical reason that Households and Businesses will continue to allocate some percentage of the economy’s money supply to Bitcoin. Bitcoin doesn’t help you pay taxes, it doesn’t look good on a necklace, it doesn’t quell your hunger, and it doesn’t fix a broken bone.

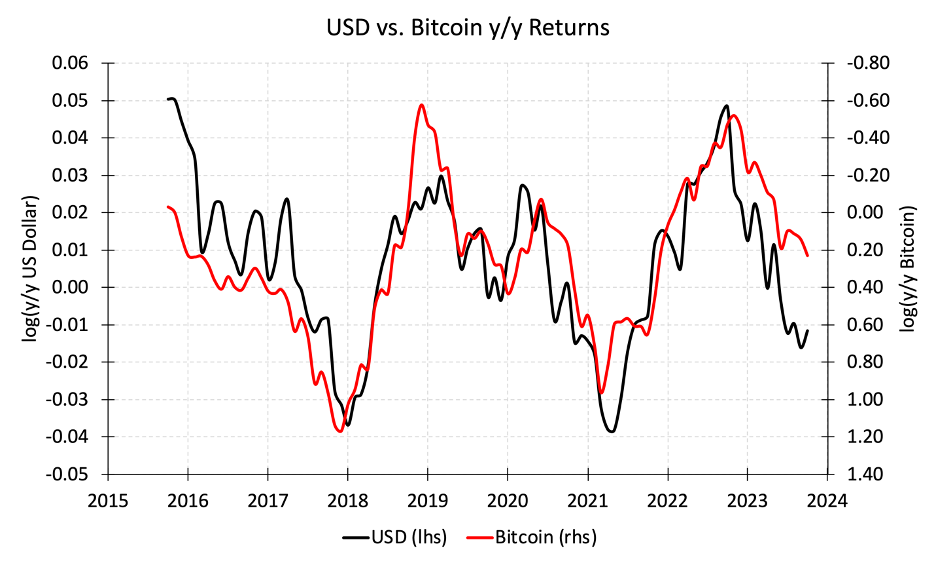

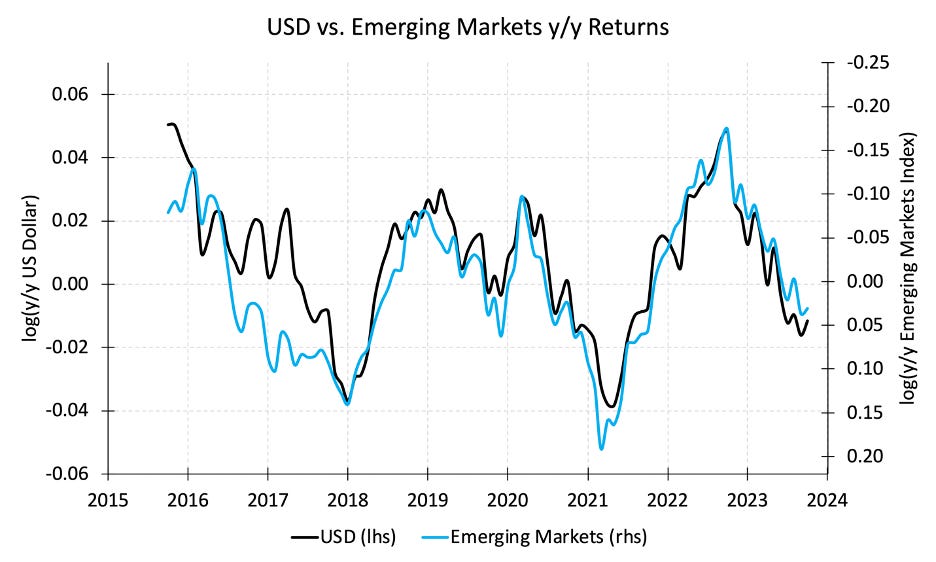

I am sympathetic to the idea that Bitcoin fulfills some financial purpose that justifies demand. After all, there aren’t many assets in the world with a theoretically fixed supply. That said, the best fundamental relationship I can find is an inverse relationship to the US Dollar.

This is great! Except, foreign stocks are also a hedge to the US Dollar, and they have the added bonus of paying dividends. I’d much rather consider foreign stocks to hedge against the US Dollar than an unproductive commodity.

7) Bottom Line

Bitcoin has a fixed supply and represents a valuable hedge against the US Dollar, making it an intriguing financial asset that could outpace inflation long-term. Bitcoin has become even more intriguing to me after it displayed great resiliency in the face of COVID, FTX’s collapse, and a banking crisis.

The bull case for Bitcoin is that it very likely hasn’t captured its full share of the money supply yet. There is great use for a financial asset that theoretically outpaces inflation and I’m not surprised that Bitcoin is budging its way into the commodity portion of portfolios.

But that doesn’t take away from my disinterest in a US Dollar hedge, my concerns that other financial assets hedge against the Dollar better, and my worry about Bitcoin’s artificial supply constraints.

I remain Bitcoin-less. Bitcoin’s upside is huge, and its downside is at zero. Like other commodities and ultra-high-risk investments, it just doesn’t find a place in my portfolio yet.