Misleading Data (Dividend Yield)

Originally published on 9/30/2022

Most successful investment strategies rely more on a consistent commitment to action than they do agile decisions. Misleading data are pitfalls that often threaten these investment strategies, however.

The best financial data are descriptive of a prevalent investment concept and predictive of a key performance indicator. Misleading data tend to fall well short of one or both requirements, which leads to a distorted understanding of the present and/or an inaccurate portrayal of the future.

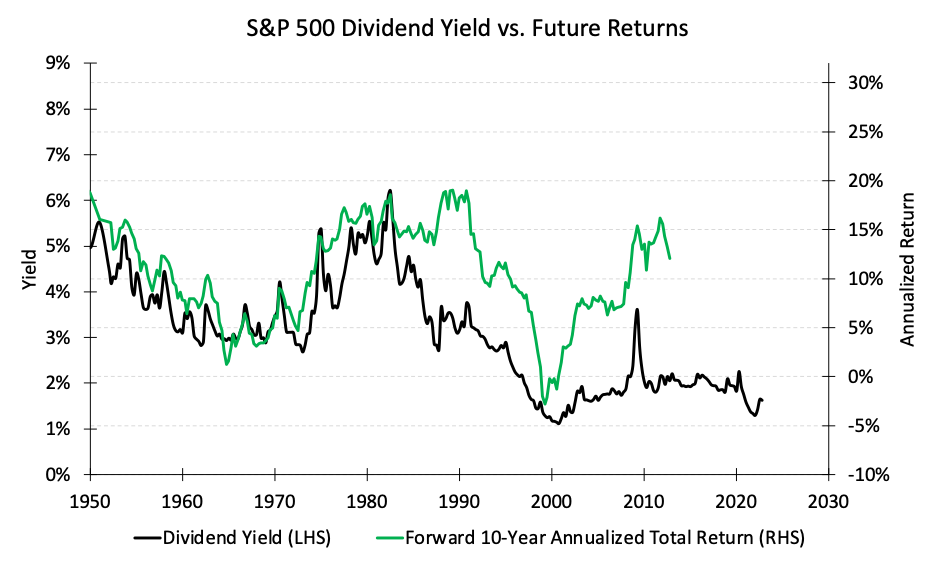

The S&P 500 dividend yield is one such dataset that is likely to mislead investors. A long-term chart of the S&P 500 dividend yield might convince investors that the S&P 500 has never been more expensive relative to its shareholder compensation.

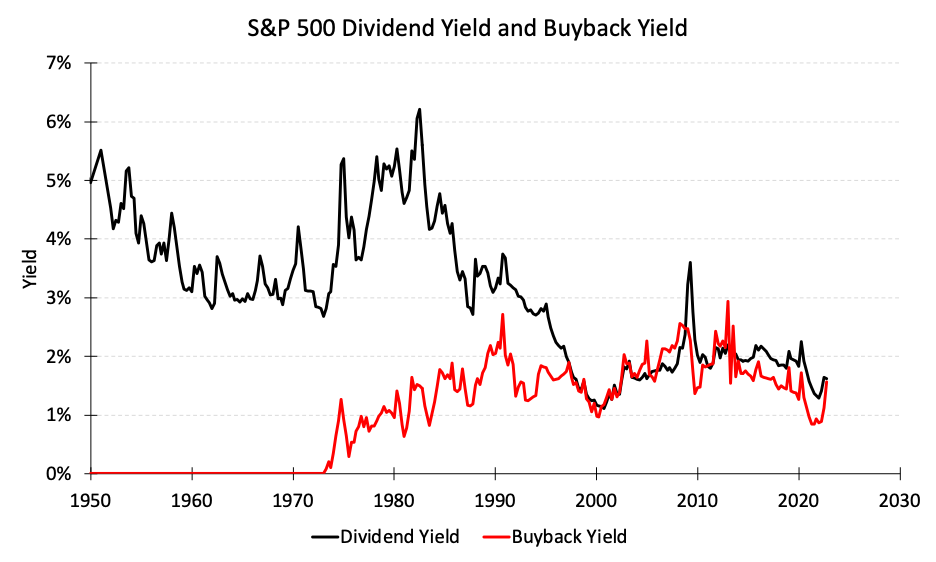

Fear not, because S&P 500 dividend yield data are not descriptive and fail my first test of good financial data. Dividend yield appears to be descriptive of the current return on investment for the S&P 500. In fact, many infamous finance books reference dividend yield as a worthy investment metric. Dividend yield’s shortfall, however, is that share buybacks now rival dividends as a preferred way for companies to compensate shareholders. Since the 1970’s, dividend yield represents only a small fraction of the current return on investment for the S&P 500.

S&P 500 dividend yield data are also not predictive and fail my second test of good financial data. The S&P 500 dividend yield was once predictive of future 10-year total returns for the S&P 500 but, with the aforementioned increase in stock buybacks and decrease in dividends, its signal fell apart during the late 20th century. S&P 500 dividend yield data now paint a gloomy but inaccurate picture of future 10-year total returns for the S&P 500.

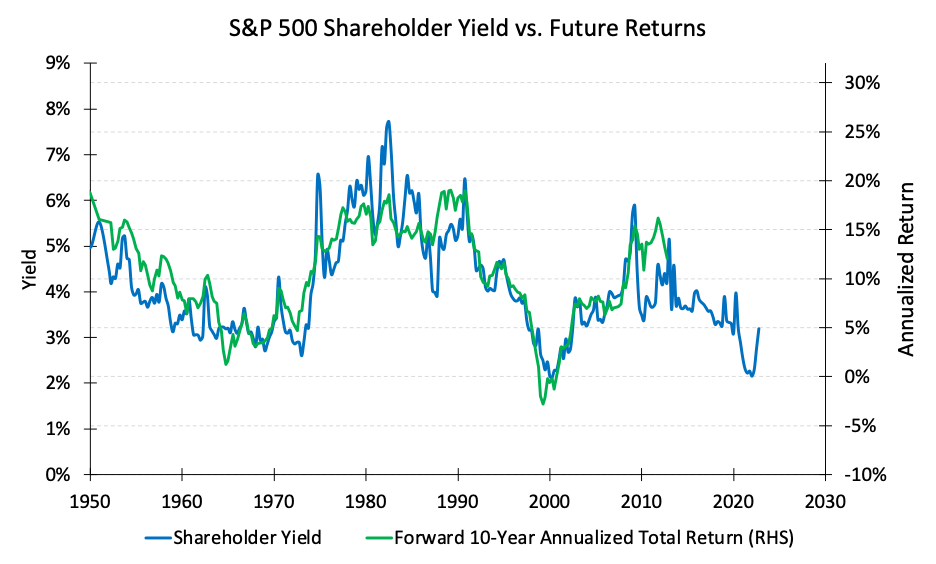

To build a better metric, dividends and buybacks are taken together to form a ratio with market capitalization that I like to call “shareholder yield.” This metric is meant to be more descriptive of the current return on investment for the S&P 500 since almost all investor compensation is now included in the numerator.

Not only is shareholder yield more descriptive of current shareholder compensation, but it is also much more predictive of future 10-year total returns for the S&P 500.

The purpose of this letter is not to unveil shareholder yield as the true holy grail of investment metrics since the long-term nature of its signal is unsuitable for most investors, myself included. Instead, I want to highlight how misleading dividend yield might be to a buy-and-hold investor who is easily spooked by scary looking data. The good news for these investors is that dividends, as well as many other financial data, are misleading metrics that should not cast doubt on an investor’s current strategy.

I will likely cover more examples of misleading data in future letters because it is one of my favorite topics!