Jack of All Trades, Master of None

The S&P 500 is a wildly popular investment benchmark, and I have no problem with that. The United States has long been the best public investment environment in the world, stocks have been the best asset class, and large-caps are higher quality investments than other corners of the equity market. For this reason, the S&P 500 is the benchmark I chose for my portfolio.

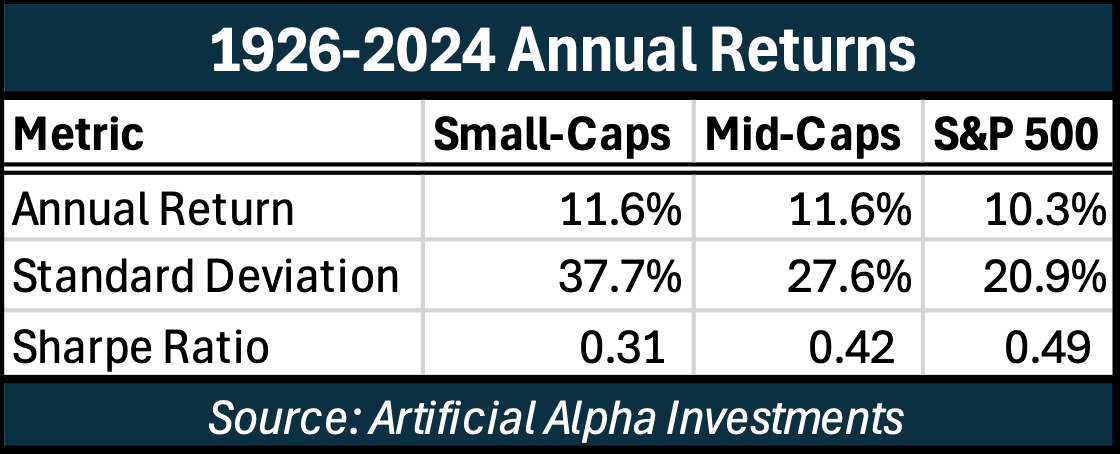

Despite leading other stock indices in risk-adjusted returns, the S&P 500 isn’t the best at anything specific.

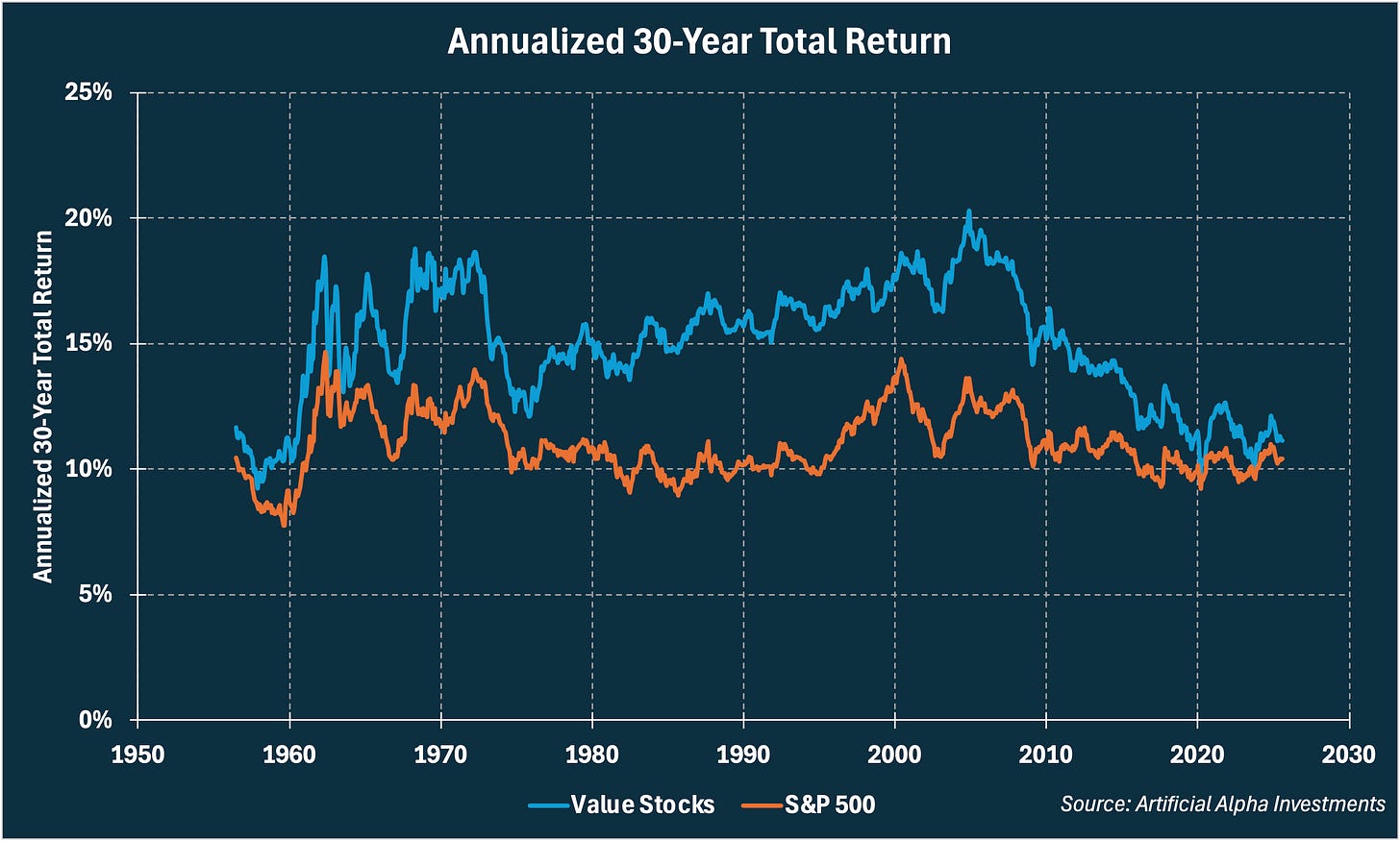

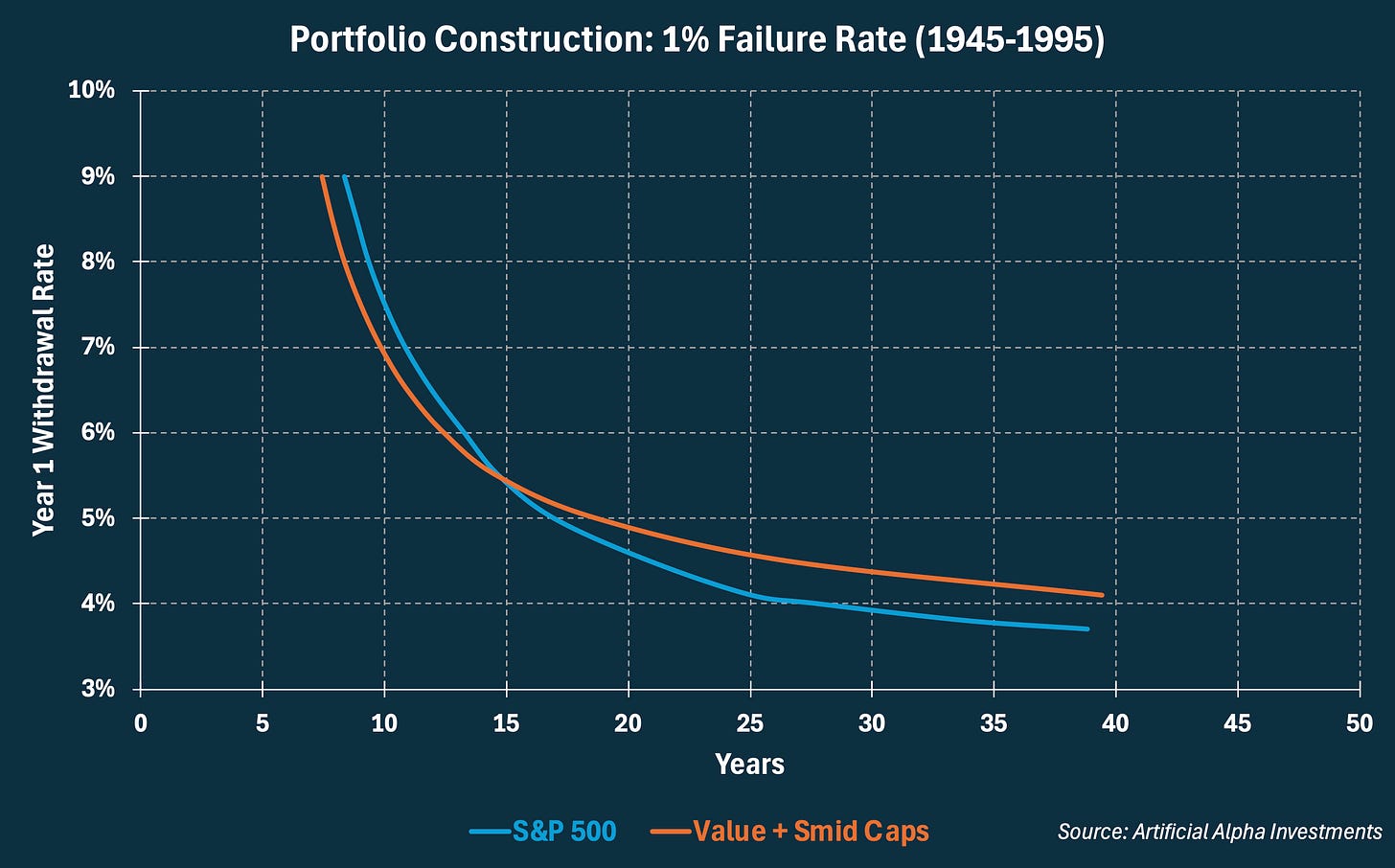

Small-Cap, Mid-Cap, and Value stocks have had higher overall returns than the S&P 500. These economically sensitive stocks have beat the S&P 500 on every 30 year rolling period since 1926. Might these indices be more suitable for growth-oriented investors?

You’d think the S&P 500’s superior risk-adjusted returns would make it the best investment for long retirements, but riskier stocks have better supported long retirements due to their superior average returns. Might these indices be more suitable for newly retired investors?

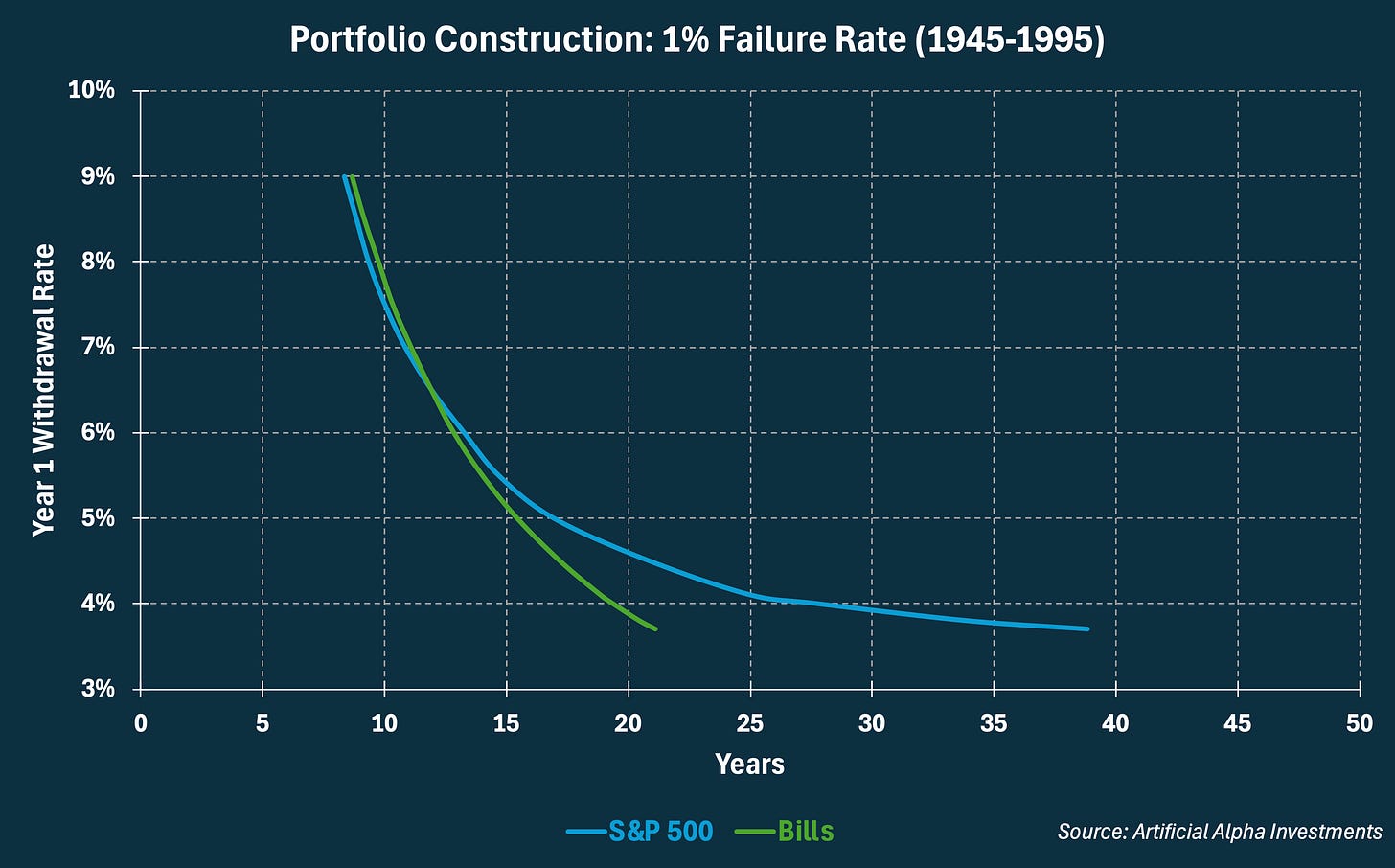

Short-dated Treasuries (bills) have lower volatility than the S&P 500. Safety assets like these are better for protecting capital and have performed better on a standalone basis for short retirements. Might Treasuries be more suitable for extremely risk-averse investors?

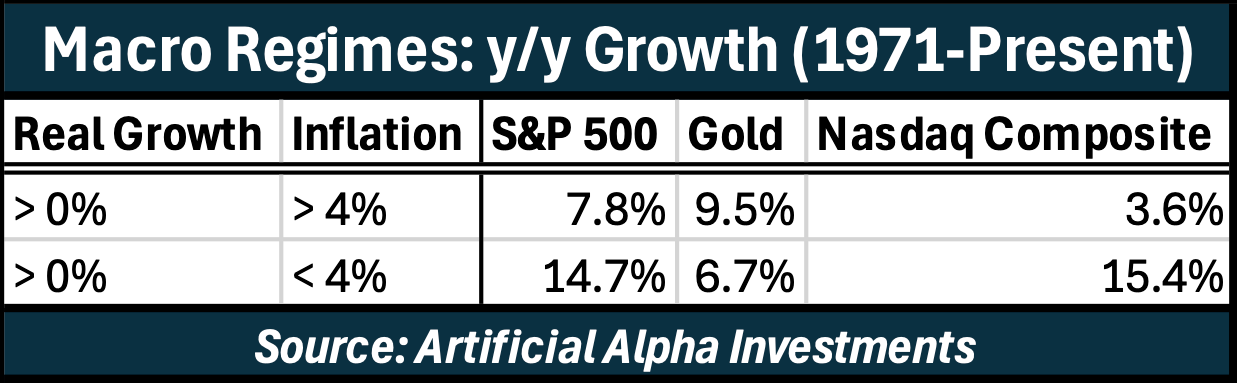

I could expand on this theme by showing the S&P 500’s 2nd place finish in different macro regimes. Like its 2nd place finish vs. gold during inflationary growth. Or its 2nd place finish vs. the Nasdaq during innovative periods of deflationary growth. For active traders, the S&P 500 is usually a close second too.

I will concede on one 1st place finish for the S&P 500. The S&P 500’s top place finish in risk adjusted returns makes it most suitable for leveraged trading, especially in secular bull markets.

Whether an investor is looking for more suitable investments or active strategies, the S&P 500 almost always falls short by itself. These differences are never large though, which is why the S&P 500 has remained so trustworthy and popular.

The S&P 500 is a jack of all trades, master of none. If I had to pick a single investment to grow with an investor throughout their entire life, I would pick the S&P 500. I would start every diversified portfolio with a healthy allocation to the S&P 500. But at no given moment is the S&P 500 the best choice by itself.