Investors Hate Inflation

Originally published on 11/8/2023

These thoughts were inspired by an interview of the legendary investor, Jeremy Grantham. I would highly recommend that interview.

During Grantham’s interview, he casually mentioned that stock valuations primarily vary due to inflation. I started writing this letter over a month ago in response, but my list of questions only grew during that time. Therefore, I just decided to list the largest questions here without much conclusion.

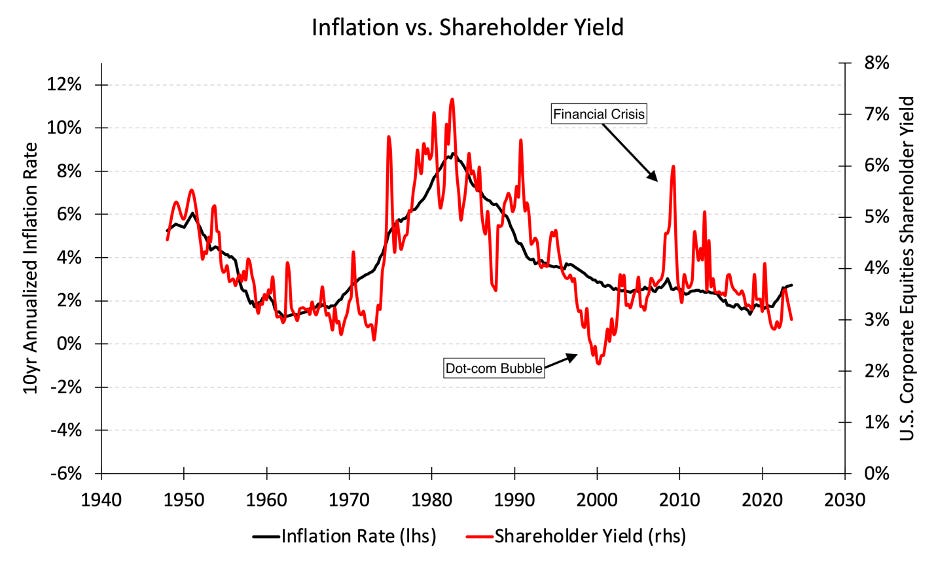

The chart above compares the past 10 years of inflation to the current shareholder yield for equities (dividends plus share buybacks divided by price). Grantham was correct, the price investors are willing to pay for equities is strongly correlated with trailing inflation. Inferior data from 1870 to 1950 even maintain the same relationship, which is rare. This is truly a fundamental relationship.

Some questions…

· Why are valuations largely correlated with trailing inflation? Aren’t investors supposed to demand higher returns when they predict higher future inflation, not trailing inflation?

· Do investors bargain for higher yields based on trailing inflation because future inflation is impossible to predict?

· Do investors bargain for higher yields based on trailing inflation because trailing inflation is the best forecast of future inflation?

· Are stock prices and goods prices fundamentally connected because people are faced with the choice to either buy goods or stocks and the price of each fluctuates depending on what people choose to buy?

· Are stock prices and goods prices fundamentally connected because of demographics?

These questions attempt to answer the largest puzzle I have about stocks: Why do stock valuations fluctuate over time at all? Why can I get better prices one day vs. the next? I’m afraid I’ll have to keep asking questions, but this inflation clue has me much closer to an answer.

Regardless, I’m amused by the thought of investors bargaining for higher stock returns in the same way that I ask for a higher income when the economy is experiencing persistent inflation. I’m not sure that’s the exact mechanism at play here, but it’s a plausible explanation of the relationship.