Interest Rate Hikes

Originally published on 12/12/2022

The hardest part of my day job right now is projecting our budget for next year. For the first time in my short career, the current state of the economy is far stronger than business leader expectations for next year.

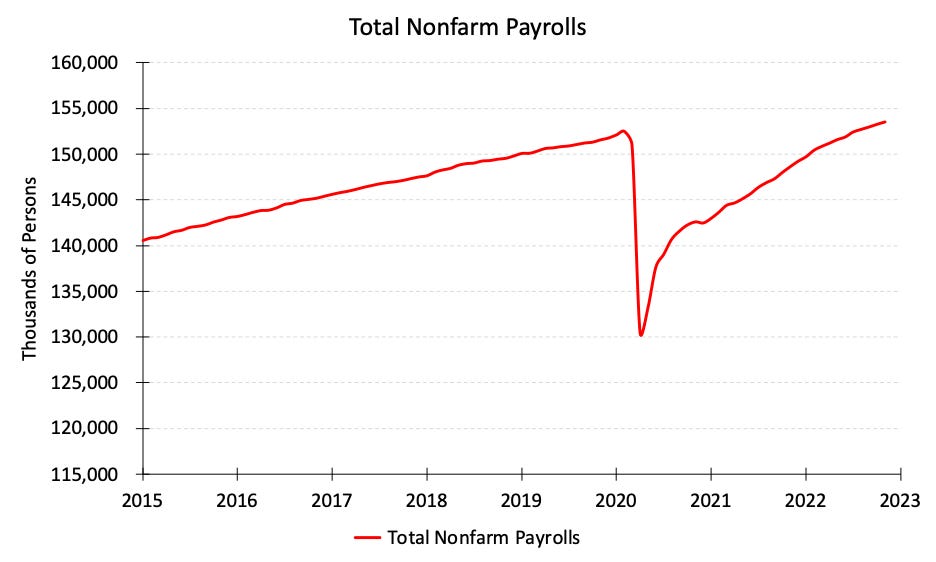

Almost every chart of economic activity continues to improve month over month. Take, for instance, the number of nonfarm workers in the US.

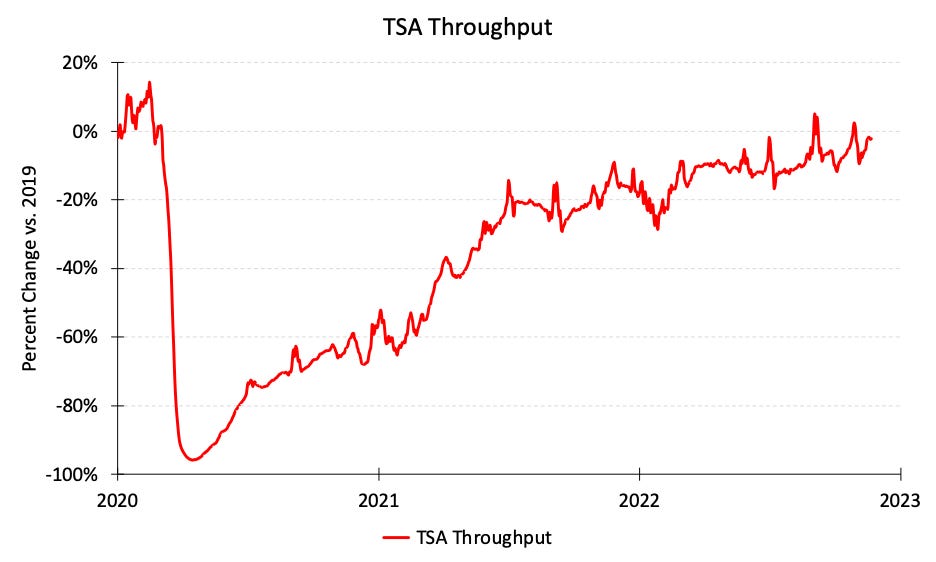

Or look at TSA throughput (air passengers), which is a much more microscopic indicator for the tourism industry.

Nearly every chart I can muster, no matter how macro or micro, shows continued economic improvement month over month. So why then are forecasters so gloomy about 2023? In one word, inflation.

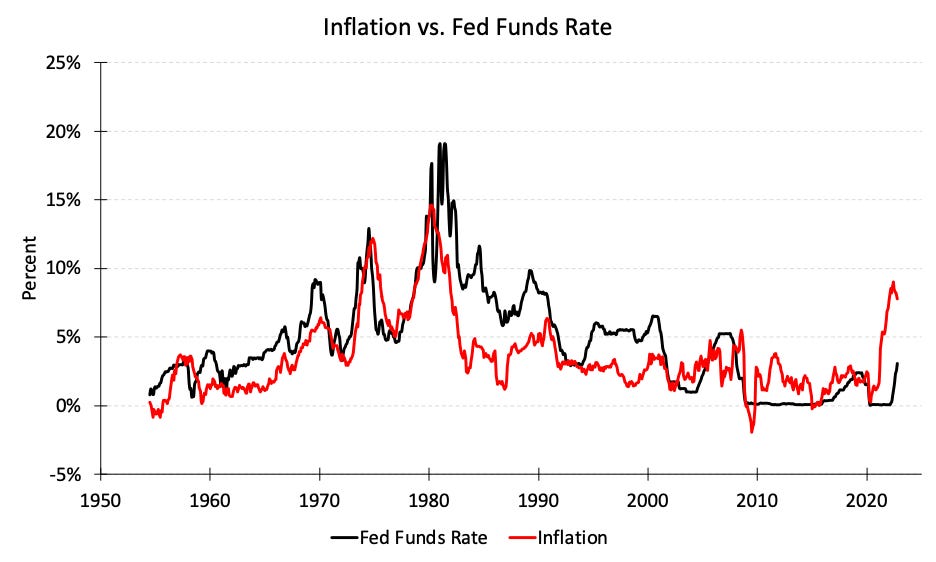

Inflation is high right now, especially when compared to post-Covid interest rates. The gap between the two suggests that the current rate of interest (set by the Federal Reserve) is not incentivizing enough people to save their money as opposed to spend their money.

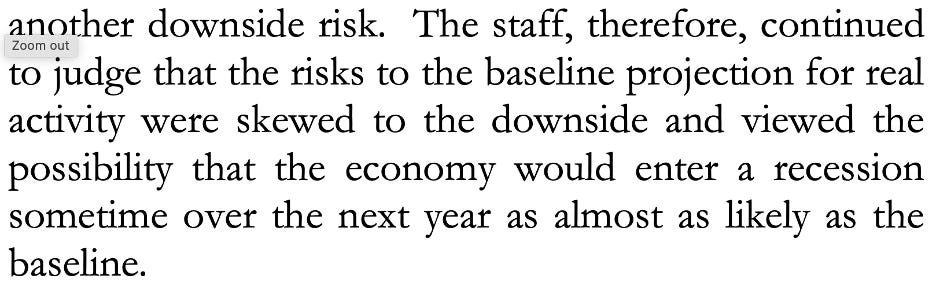

In response, the Federal Reserve has embarked on drastic interest rate hikes to reduce demand and tame inflation. The Federal Reserve’s stated goal is to reduce demand, reduce job openings, and slow wage growth. That sounds awfully like the definition of a recession to me, and the Federal Reserve admitted in November that the possibility of a resulting recession is quite high.

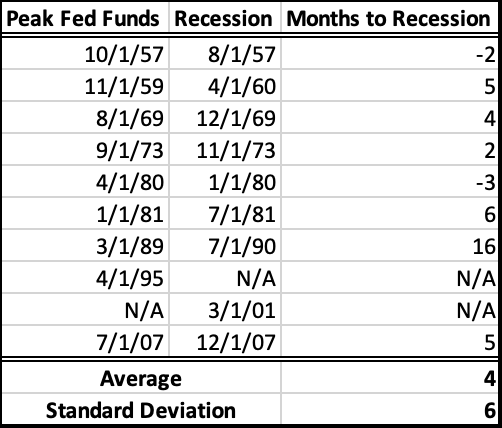

From my quantitative view, increasing interest rates are the strongest predictor of an approaching recession. I logged the starting date of every recession since the 1950s in the chart below (Covid excluded for extraneous circumstances). I also logged every instance that the Federal Reserve raised interest rates by 3% or more within a 3-year period.

Nearly every recession since the 1950s has been associated with an environment of steep interest rate increases. And nearly every round of steep interest rate increases has been met with a recession. On average, a recession follows a completed interest rate hike by 4 months. As observed through the standard deviation, however, exactly when the recession occurs is highly variable.

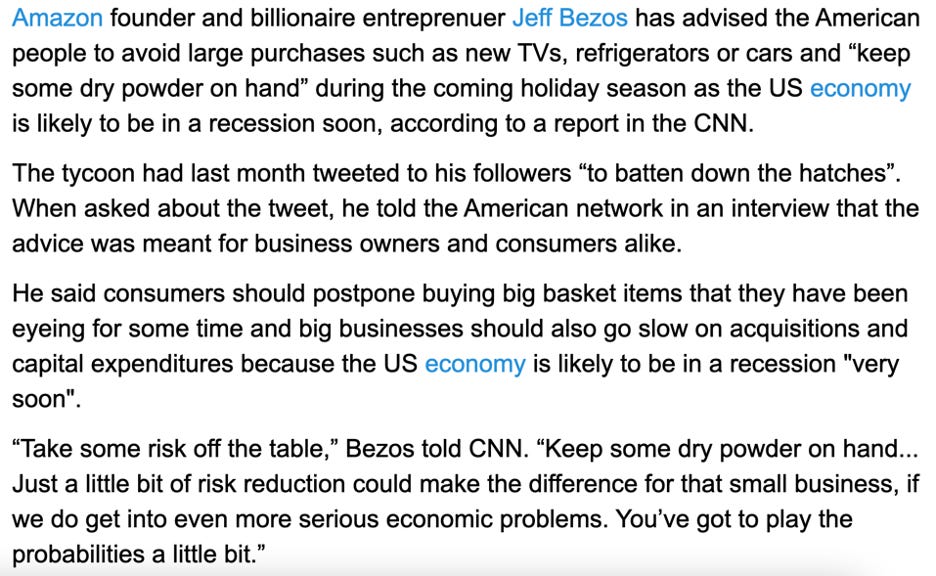

Currently, the Federal Reserve has raised interest rates by 3.73% in the past 10 months. They are planning more hikes in the coming months. Based on past precedent, business leaders see a high probability of a resulting recession. See this interview from Jeff Bezos in November.

So, there is a great paradox looming over 2023. Business seems better than ever, but business leaders are hunkering down.

These uncertainties certainly suggest we should prepare for a volatile investment environment in 2023, but I’m not sure they change my general investment plan. Stock prices are famously unpredictable and often reverse course during the middle of a recession. And why should I care what happens over the next year or two when my time horizon is so many years in the future?

That said, now is a time that every business is asking themselves whether they are profitable enough to survive a recession. Anyone with high single-stock exposure might consider asking those same questions about their own investment(s).