Gold as an Equity Hedge

Originally published on 3/12/2021

Investment diversification can be important for many investors. For young investors, large stock market drawdowns can lead to bad decisions. For older investors, large drawdowns can delay retirement plans. These are just two examples of how an investor can find utility in assets that insure against equities, even if that insurance lowers long-term portfolio returns.

For most investors, and in the two scenarios I described above, asset diversification is meant to guard against short-term equity losses. Importantly then, the chosen diversification assets should be negatively correlated with equities in the short-term. The most common example of an asset like this is a 10yr Treasury bond.

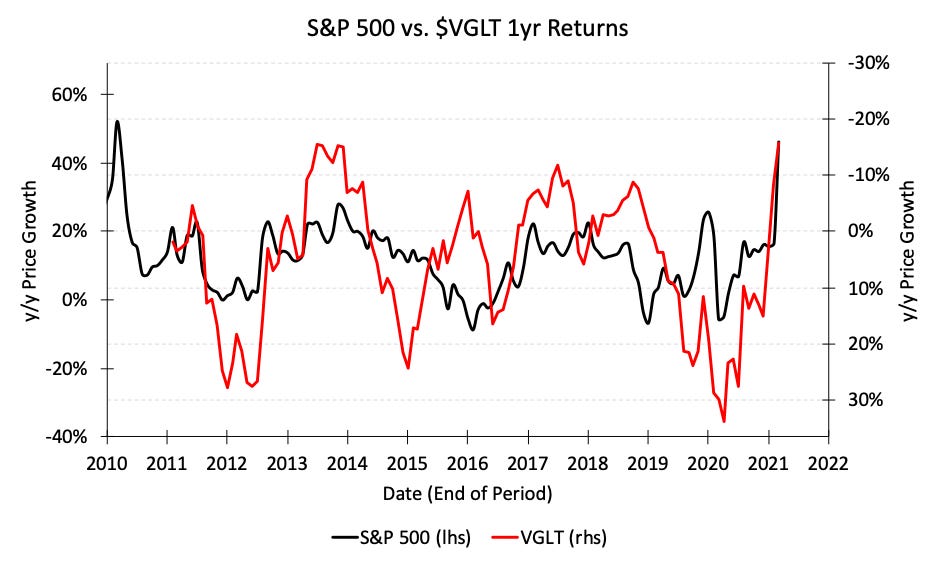

Below is a chart of year over year returns for the S&P 500 vs. year over year returns for the Vanguard Long-Term Treasury Index Fund ETF. Notice that the bond returns on this chart correspond to the right axis, which is inverted to show an inverse relationship. Using these data, we find a correlation coefficient of r = -0.45.

This mathematical finding matches the colloquial claim that Treasury bonds hedge stocks. And though the relationship is weak, a 10yr Treasury bond might be the best example of an asset that hedges against short-term stock losses.

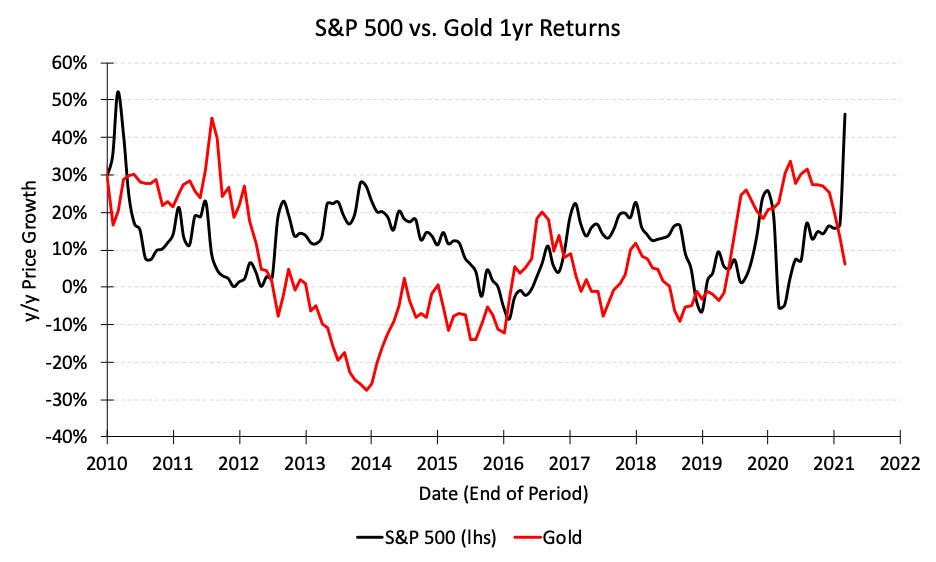

Another asset commonly associated with equity hedging is Gold. Take a look at Gold’s year over year correlation with the S&P 500 though. This relationship is nearly non-existent.

For that reason, Gold is usually dismissed as an equity hedge by practicing investment advisors.

But wait, we’re still assuming an investor who’s looking to insure against short-term equity losses. Practicing investment advisors are usually right to make this assumption, but what about the corner case? What about an investor looking to hedge long-term equity losses?

An investor looking to hedge long-term equity losses is probably an agile investor. An “agile investor” is a term I’ve used in the past to describe an investor who makes small portfolio adjustments to improve their 5yr or 10yr returns.

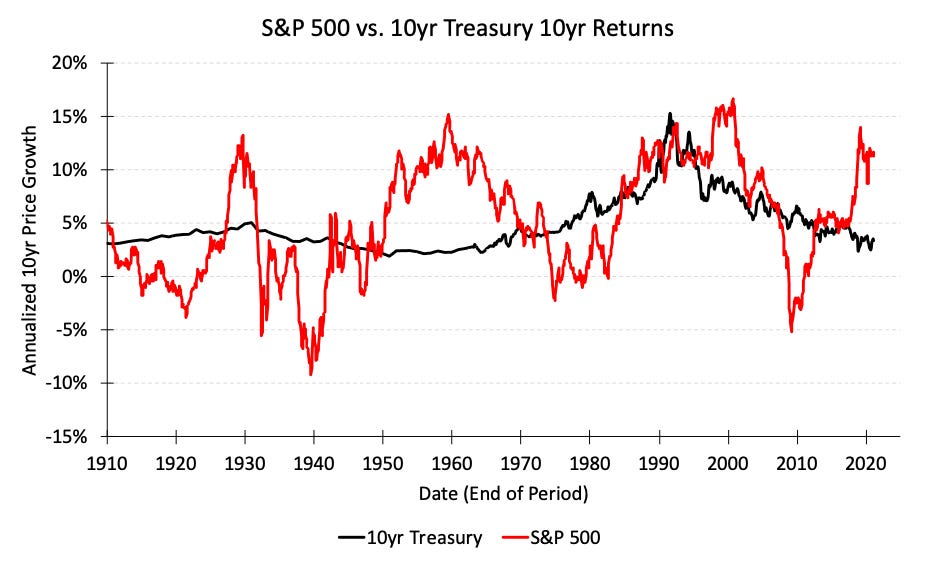

An agile, long-term investor actually has less interest in using Treasuries to hedge stock returns because long-term Treasury returns have a positive correlation with long-term stock returns. Using a larger data set and a 10-year time horizon, we find a correlation coefficient of r = 0.36.

The relationship is weak enough that I’m almost inclined to dismiss it entirely.

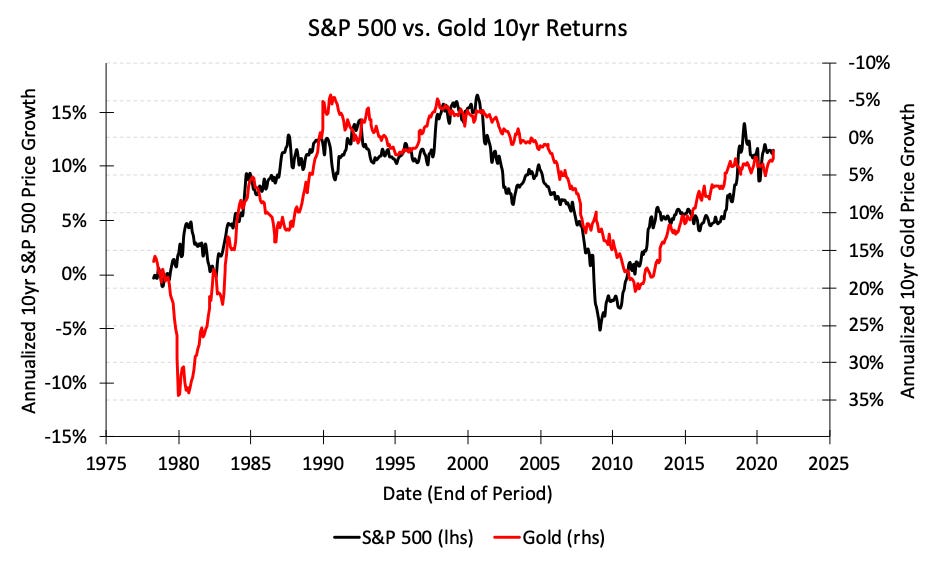

But check out Gold’s relationship to stocks over a 10-year time horizon. Notice that the Gold returns on this chart correspond to the right axis, which is again inverted to show an inverse relationship. For Gold, we find a correlation coefficient of r = -0.77.

With some hesitation, this regression does suggest that Gold acts as an equity hedge. Treasury bonds have acted as a short-term equity hedge and Gold has acted as a long-term equity hedge. I think Gold’s utility gets misunderstood because it doesn’t hedge stocks in a way that’s commonly desired or easily noticed.