Easing Financial Conditions

I’ve had a lot of interesting conversations about diversification over the past few years. From young investors who pushed back on diversification, to retired investors who I encouraged to stay diversified. Both choices worked.

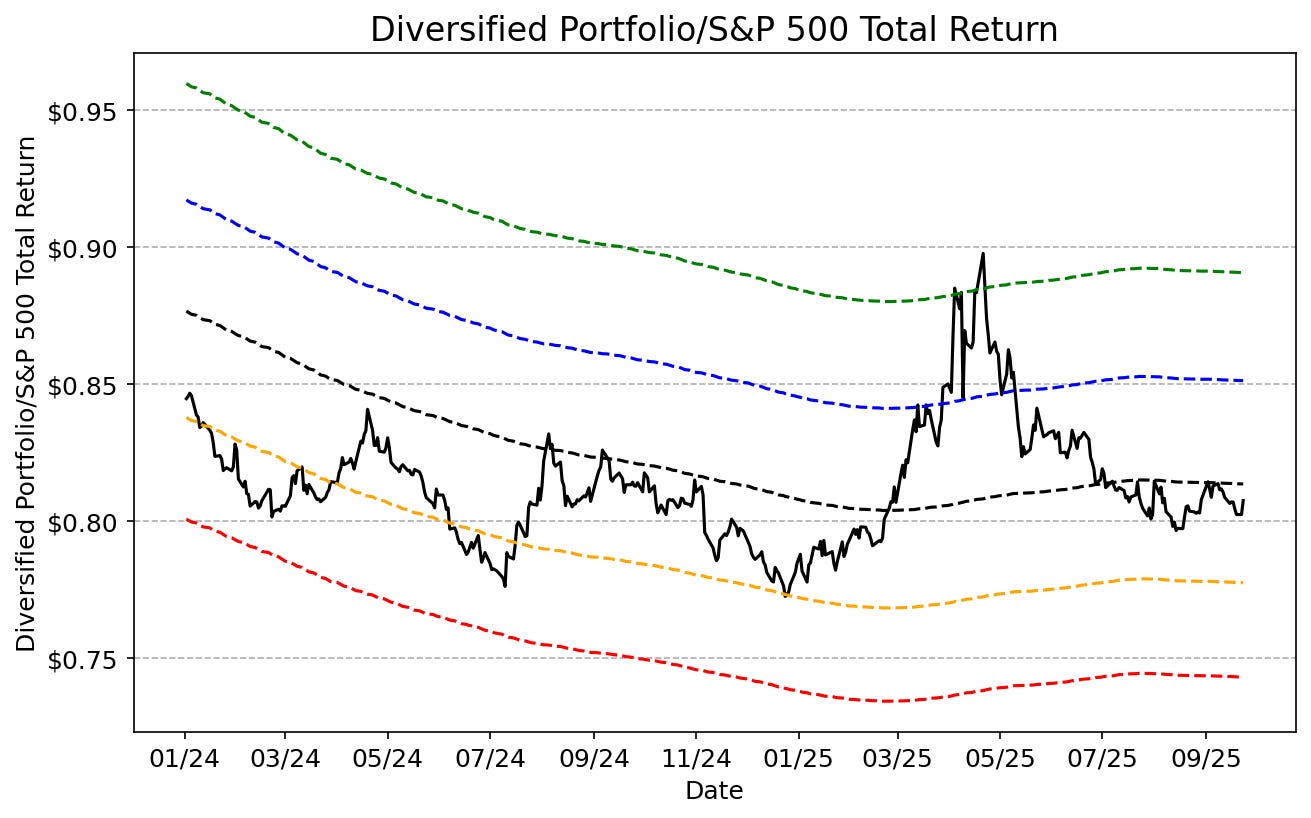

Economic policy has been restrictive for a few years now, and the economy has slowly weakened but did not altogether break. The result has been similar returns for the S&P 500 and a more defensive, diversified portfolio (“diversified” in this case is an equal weighted GLD, IEF, VTV, VO, and SPY portfolio).

The conversation should be shifting, however. Leading economic indicators have been easing and stock market risks are now abating.

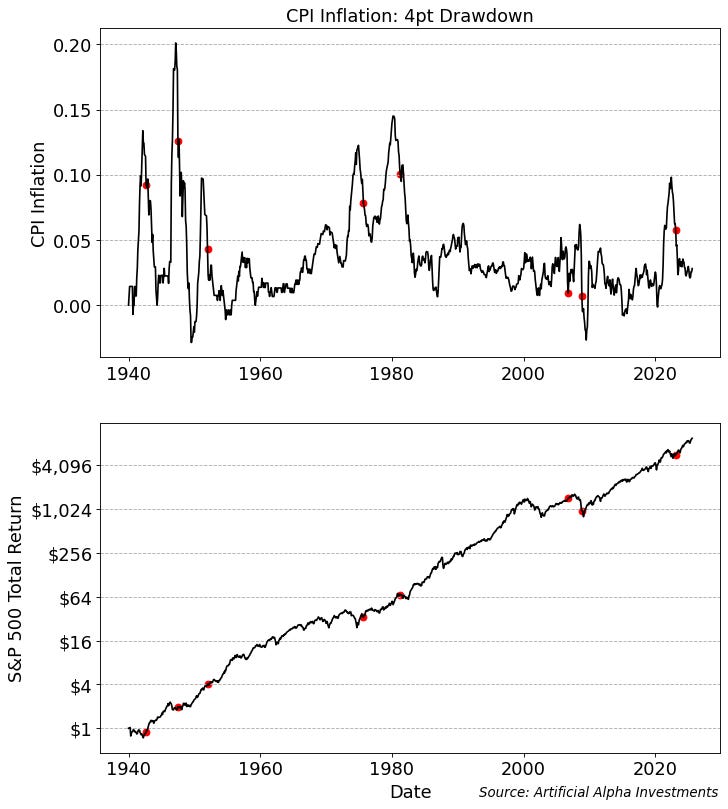

Take inflation, which began easing in early 2023.

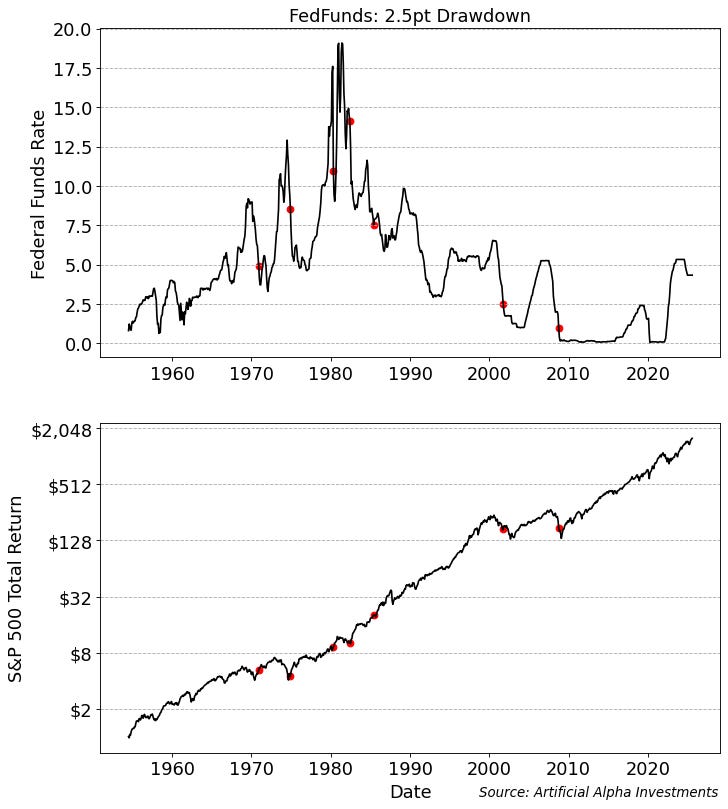

The Federal Reserve first cut rates in late 2023 and continued cutting earlier this month.

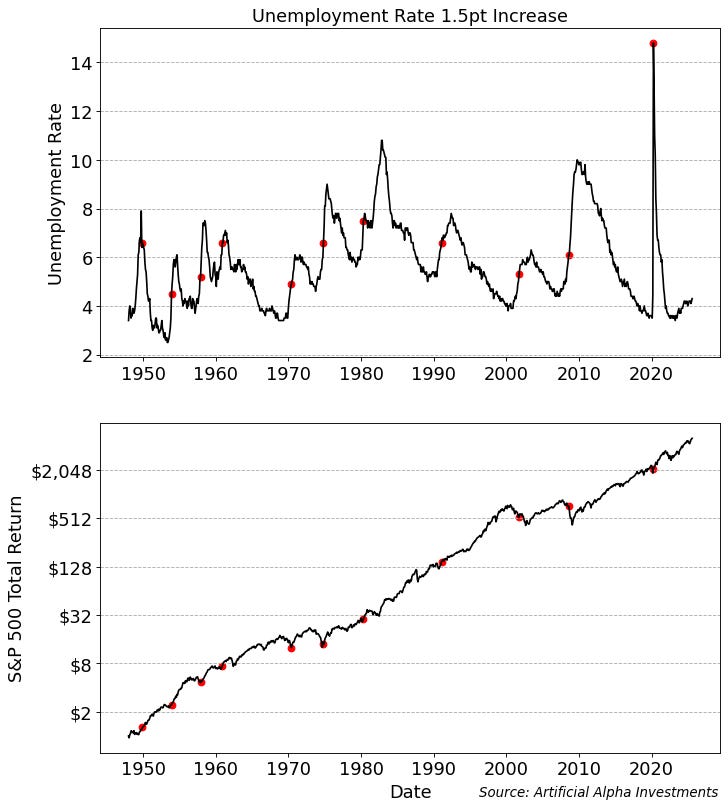

The labor market also started easing in late 2023.

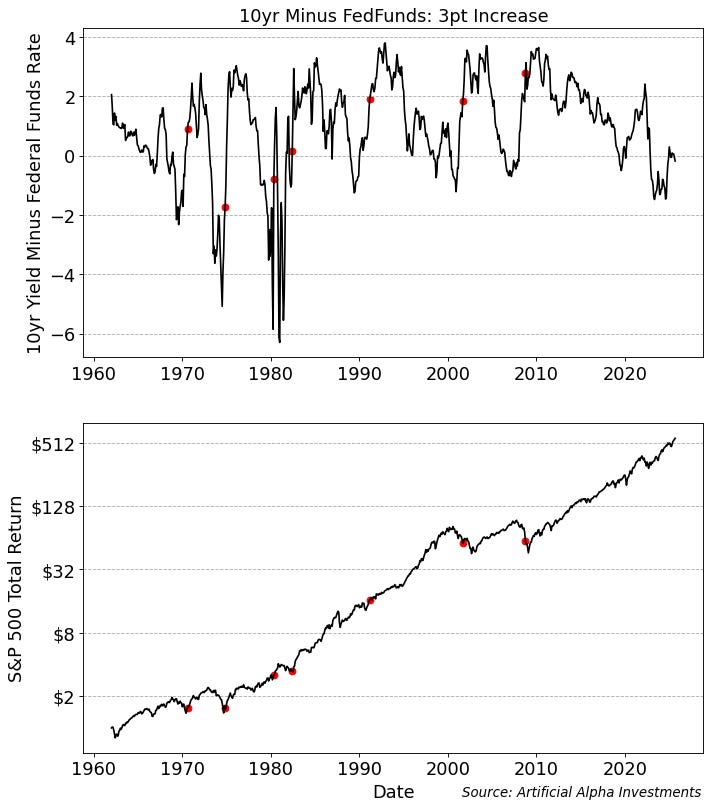

The yield curve un-inverted earlier this year.

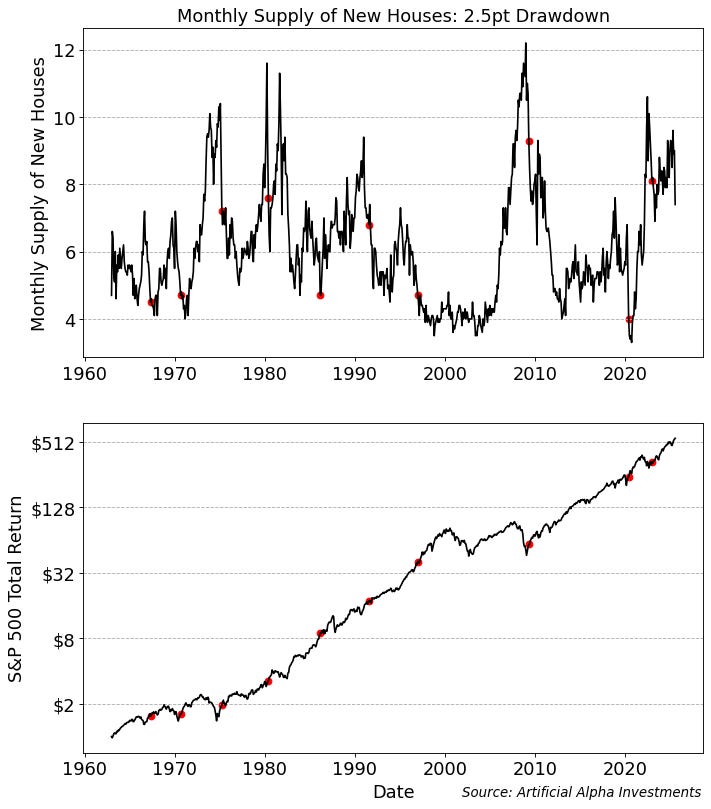

And just today, we got data that suggest the housing market eased considerably in August.

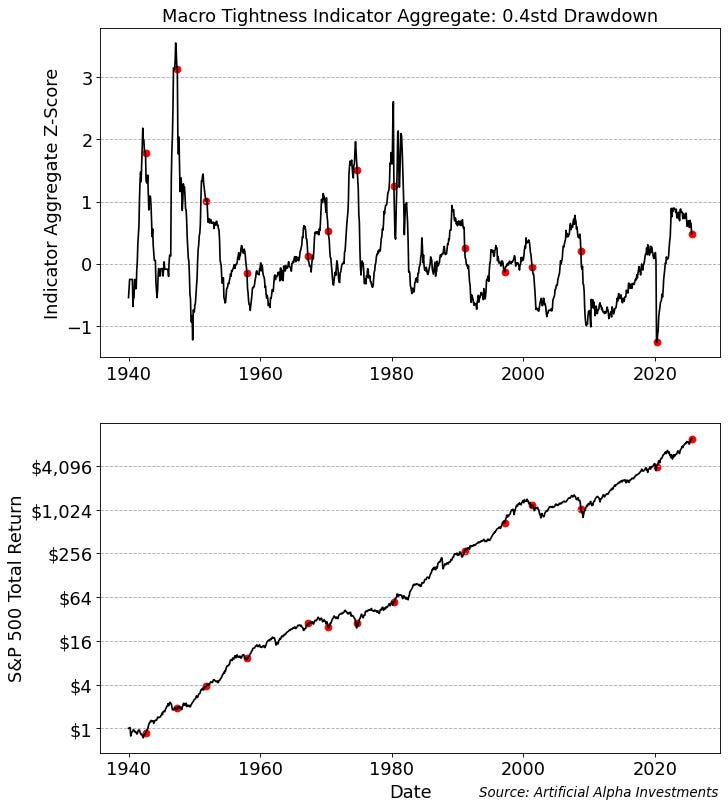

While powerful on their own, I like to combine all of these signals into a single indicator of macroeconomic tightness. This aggregate indicator has now declined by 0.4 standard deviations from its peak a few years ago, signaling an easier economic environment going forward.

Stocks tend to thrive in the year after a 0.4 standard deviation drawdown in this indicator. Because smaller companies are more sensitive to financial conditions, they have had the most extraordinary results.

I think risk is turning to the upside again.

Young investors might rest easier because this macroeconomic environment aligns with a higher risk tolerance. Retired investors could struggle with FOMO because this macroeconomic environment encourages more risk than their boilerplate diversified portfolio.

Passive investors should use this letter to adjust their expectations. Active investors should consider this changing macroeconomic landscape.