Continued Claims

Originally published on 1/23/2023

I really wanted to write a rebuttal against the impending recession narrative, but I can’t find many data to support that argument yet. Instead, I’m finding a bunch of tiny recession snowballs that are just starting to roll downhill.

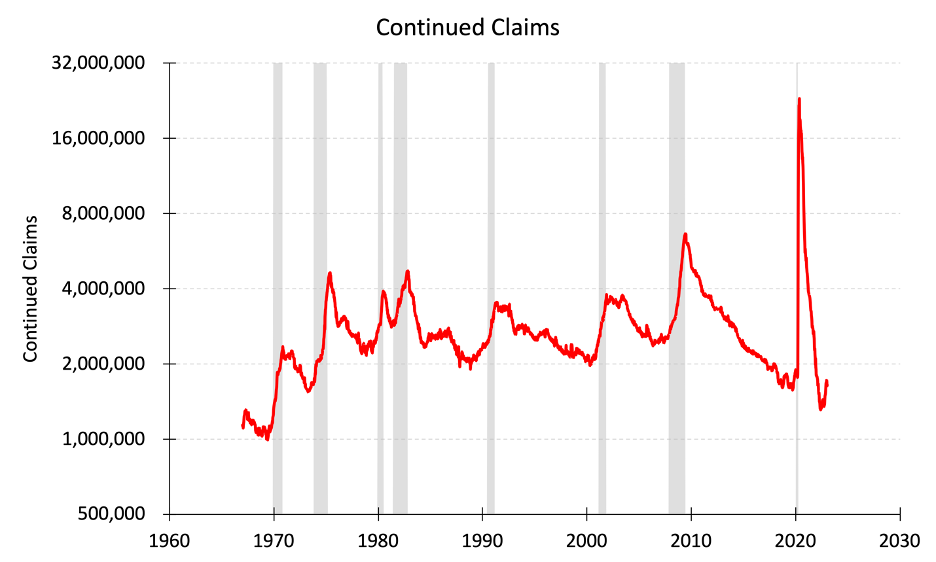

The largest of all those snowballs are continued claims. Continued claims track the number of U.S. residents filing for ongoing unemployment benefits. You may have noticed more layoffs and hiring freezes in the last few months and now unemployment data are starting to show a small uptick due to those cuts.

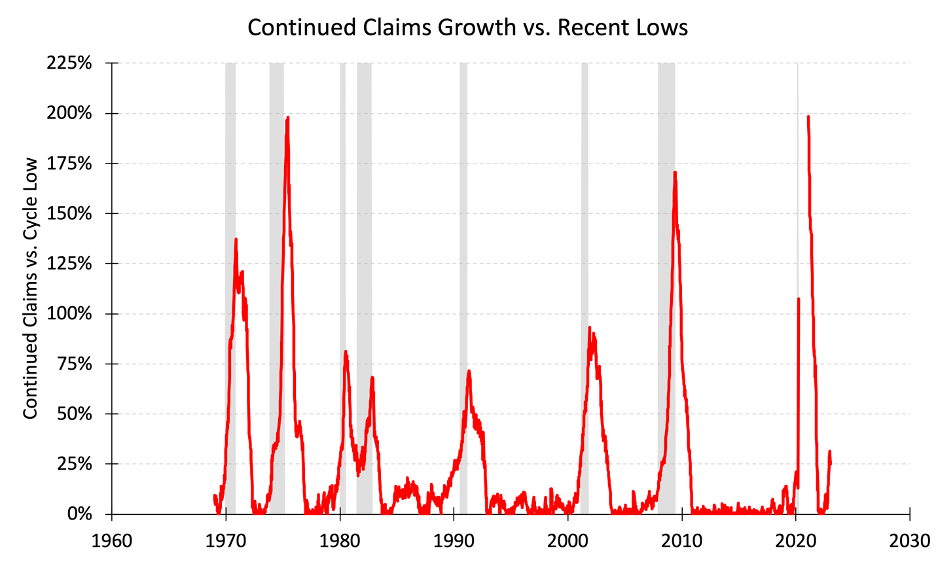

Historically, growing continued claims are strongly associated with recessions (shaded grey areas). But just how sensitive are we to rising continued claims? To take a closer look, I divided continued claims by recent lows to visualize continued claims growth.

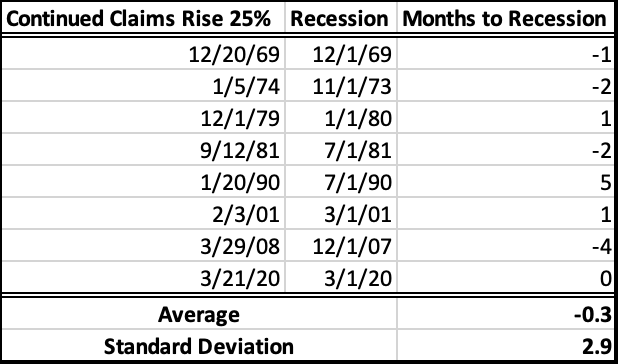

The recent uptick in continued claims seems insignificant at first glance but take a closer look at periods of continued claims growth. Even a 25% increase in continued claims has been associated with a recession every time.

Each instance of continued claims rising by 25% or more is associated with a recession, and vice versa. On average, a recession begins in the same month that continued claims have risen 25%.

Continued claims hit this recessionary threshold in late November 2022. I don’t believe this means a recession is inevitable or that we’ve already entered a recession, but I do think this is a sign that an economic downturn is gaining momentum. If that momentum grows too large, we may look back on this moment as the recession’s beginning.

Investors are facing many economic and financial uncertainties in 2023 and investors with a short-term investment horizon might wonder if they are properly diversified for these uncertainties. It would be unfortunate to be a forced seller during a panic.

But most of us have long-term investment horizons and these economic musings should only temper short-term return expectations as opposed to augment investment plans. Besides, most of us long-term investors are buyers. Lower purchase prices would be good for buyers!