Another Disney Lesson

Originally published on 8/19/2022

Disney’s stock captures the public’s imagination in countless ways. Disney’s media and parks have shaped American ethos for almost 100 years and Disney’s brand is perhaps the most pervasive across the world. Parents and kids hold Disney close to heart. It’s no wonder that so many kids are introduced to investing by their parents via Disney’s stock.

Disney also happens to be an incredibly successful company and currently ranks as the 30th largest stock is the U.S. by market capitalization. Disney is an approachable stock for most discretionary investors, unlike those stocks ranking further down the list.

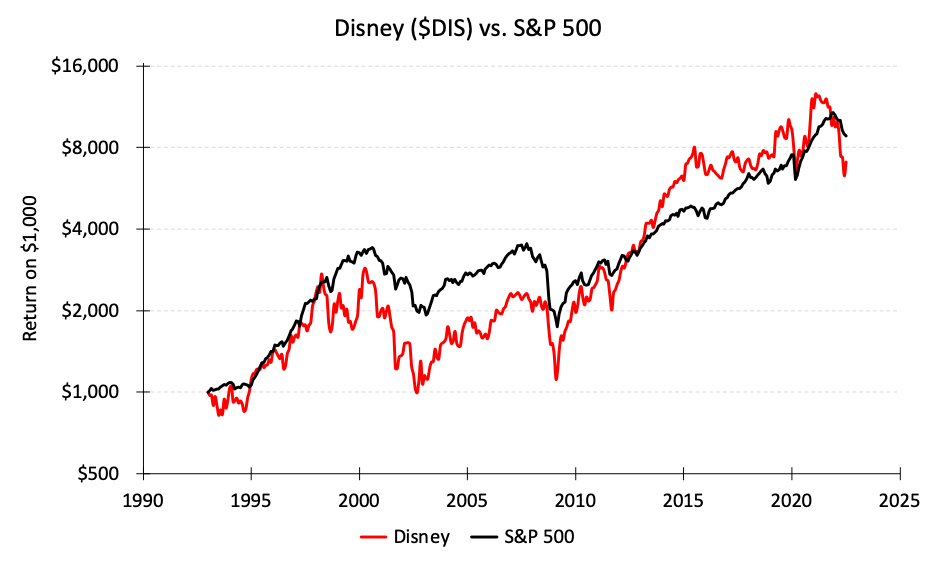

Disney’s countless emotional attachments and its large market capitalization are red flags to me as an investor, however. An approachable stock that attracts so many fundamentals-indiscriminate investors is a stock that is likely over-priced. Would you believe me if I told you that Disney’s stock has underperformed the S&P 500 since 1993?

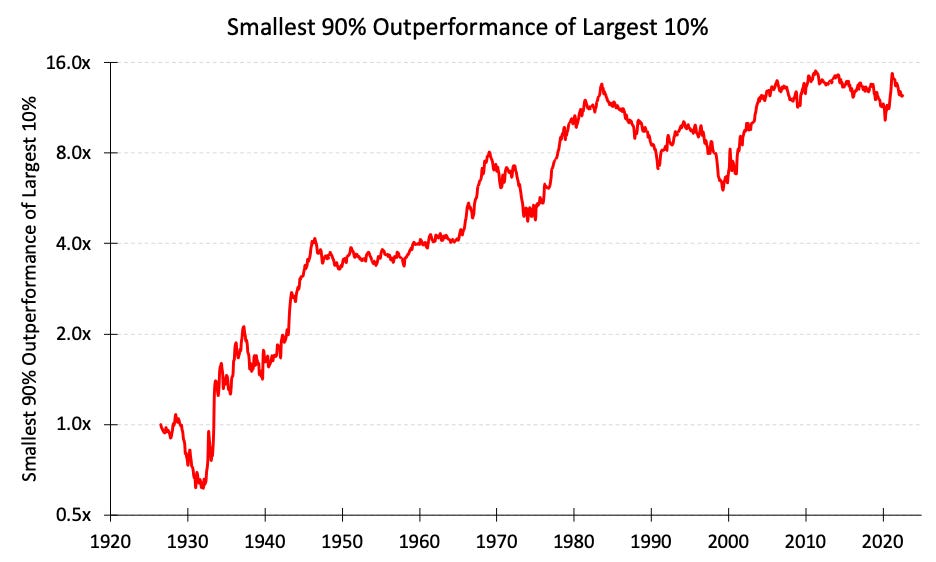

These investor biases for large, well-known stocks don’t only exist for the happiest stock on earth. Large-capitalization stocks underperform their peers on average. The following two charts visualize the performance of the largest 10% of all U.S. stocks vs. the smallest 90% of all U.S. stocks since 1926. Calculations used Fama-French’s publicly available dataset (link), equal-weighted allocations, and monthly rebalancing.

The largest 10% of all U.S. stocks returned 9.4% annually over this period while the smallest 90% of all U.S. stocks returned 12.3% annually, resulting in a 2.9% yearly disadvantage for the largest stocks.

Before opting out of large-capitalization stocks all together, consider that investors are accepting more risk when they invest in those smaller stocks. These volatility differences cannot go understated because individual investment decisions are usually predicated on risk tolerance first and desired returns second. Many investors would not find small-capitalization stocks fitting for their strategy and risk tolerance.

For more risk-agnostic investors however, history suggests those large stocks under-performed even after factoring in their reduced risk (evidence of this finding by request). The “Disney Effect,” as I’ll call it, drives the prices of large, well-known stocks too high and leaves better deals for those who dig deeper.