All Time Highs

Originally published on 1/31/2024

The S&P 500 hit all-time highs this month after two years of headwinds. Conventional wisdom that follows “buy low, sell high” doctrine might suggest some caution when stock prices are at all-time highs. Most of the research I’ve conducted, however, better supports a “buy always, especially at the lows” mentality.

Take, for example, the letter titled ‘When You Hear "Recession"’ that I wrote this past spring, which attempted to identify selling and buying opportunities during recessions. That paper’s conclusion was that no feasible selling opportunities exist during a recession (even if you knew a recession was coming!) but that recessions often result in attractive buying opportunities.

So, would it surprise you if the same were true while stock prices are at all-times highs? No matter how many times I conduct “buy low, sell high” studies, I’m always a little surprised when I look at the results.

*See footer for starting price filter definitions*

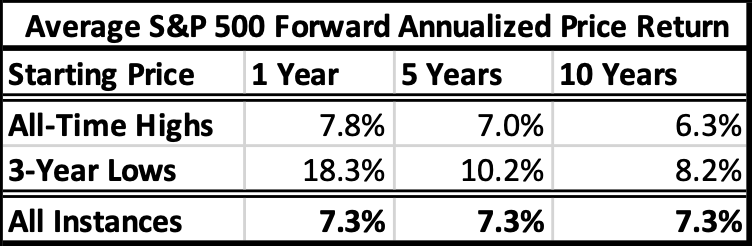

Going back to 1940, the S&P 500 was at an all-time high 20.8% of the time and at a 3-year low 3.4% of the time. The average 1-year forward price return for the S&P 500 was 7.3% overall, 7.8% from all-time highs, and 18.3% from 3-year lows. The average annualized 10-year forward price return for the S&P 500 was 7.3% overall, 6.3% from all-time highs, and 8.2% from 3-year lows.

All-time high prices have carried almost no informational advantage in the short, medium, or long-term. Low prices again represent an opportunity for investors however, and that opportunity is almost entirely realized in the following year.

The “buy low, sell high” heuristics I grew up reading about don’t seem to tell an accurate story about the past century of stock market investing. Ditching the gold standard, embracing the Federal Reserve, and less extreme recessions are all possible culprits for the death of “sell high” ideas.

I’m still learning to embrace the “buy always, especially at the lows” hypothesis. It isn’t a silver bullet, but I do think it is more prescient than other stock market doctrine. I’m not going to make the mistake of pulling back this winter just because the S&P 500 is at all-time highs.

· All-Time Highs: Instances where the price of the S&P 500 had never been higher.

· 3-Year Lows: Instances where the price of the S&P 500 was lower than any price from the previous 3 years.

· All Instances: No filter. The S&P 500 price has grown by 7.3% per year since 1940.