A Simple Allocation

Originally published on 5/15/2021

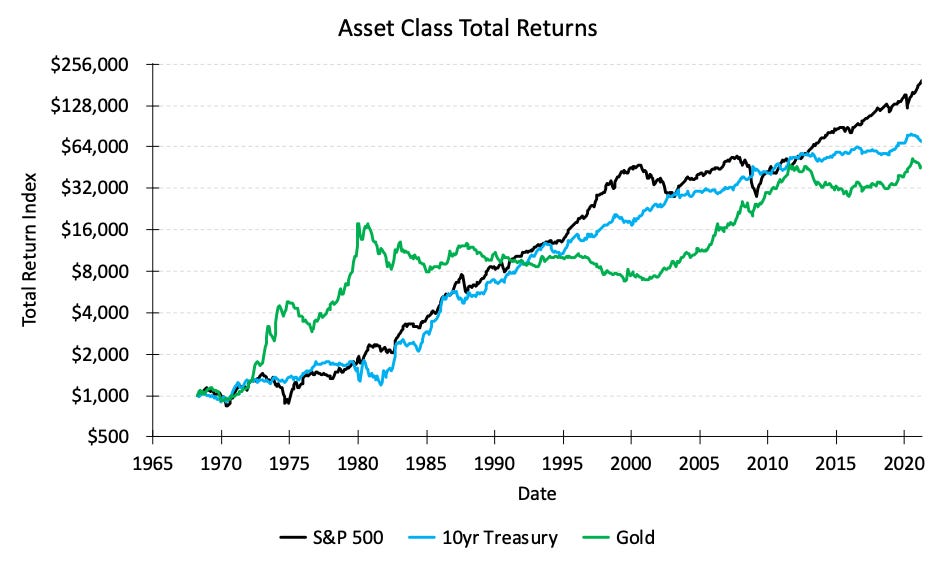

Last month I pointed out that Treasuries tend to protect investors from a bad year in stock markets, but Treasuries don’t necessarily provide protection from a bad decade in stock markets. When stocks and bonds fail in that regard, Gold has historically picked up the slack. Here is a link to that letter, which you should consider reading before digging into this one.

https://artificialalphablog.com/Blog/Articles/Article40/

What investors should do with that verdict might not be so apparent, but I can describe how I might find utility for Treasuries and Gold (and, truthfully, most other asset classes) in my own portfolio.

I’ve made quite a few assumptions in the past that we’ll continue to use for this exercise. Most importantly, I’ve suggested that stocks are the predominant asset class in my own investment portfolio. I’m of the opinion that stocks or real estate should fill this role for most investors. Both enjoy structural advantages over other asset classes because, uniquely, they each make claims on real economic growth. Or, in simple terms, they each pay out dividends. My own tiered rankings of asset classes will have to be another letter for another day.

Regardless, as was likely spoiled in the previous letter, I view both Treasuries and Gold as great stock market hedges. I view their utility in relationship to my portfolio’s predominant allocation: stocks. What does this mean? Why do any other asset classes deserve consideration at all?

A hedge is any asset or strategy that offsets losses in another asset or strategy. Usually, a hedging investment is inversely correlated with the portfolio’s predominant investment.

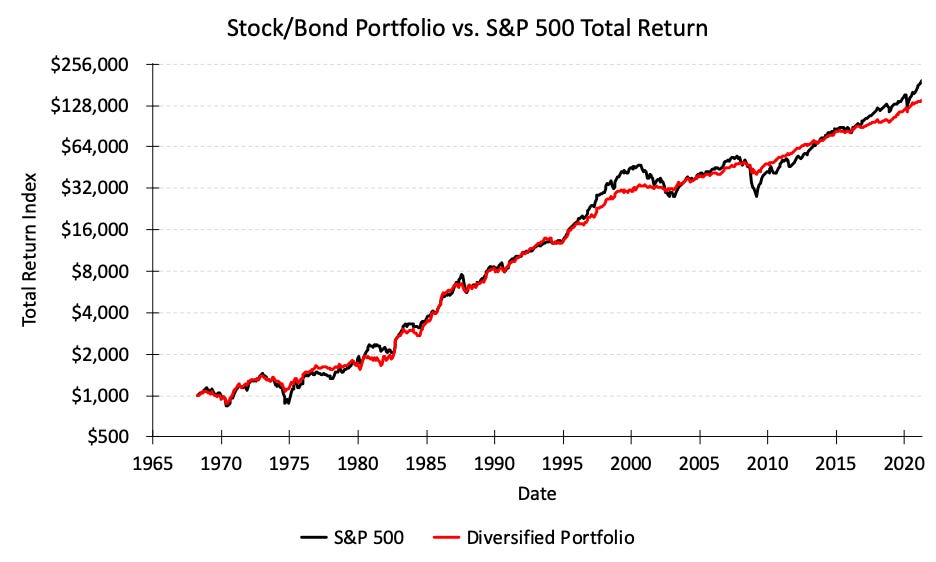

We found in the previous letter that Treasury returns have been inversely correlated with stock returns using a 1-year time period. Notice the practical results this has had for a portfolio holding 50% stocks and 50% 10yr Treasuries since 1968.

The large, short-term stock market losses in 1974, 2001, and 2007 were smoothed out by the portfolio’s Treasury allocation. In those years of stock market pain, Treasuries performed better than average and offset our stock market losses.

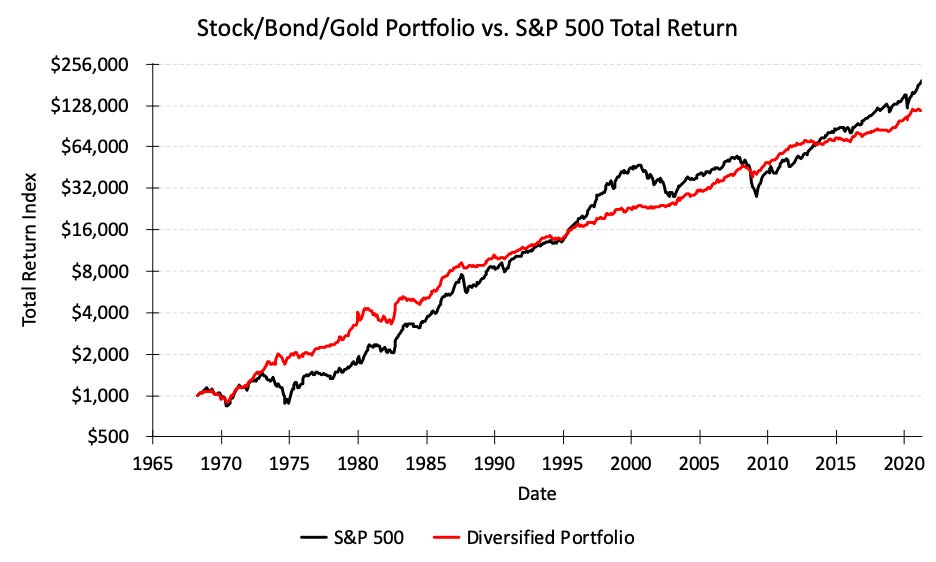

Let’s address those 10-year periods of sideways movement in the 1970s and 2000s though. We discovered in the previous letter that Gold returns have been inversely correlated with stock returns using a 10-year time period. Again, notice the advantage granted by including Gold in a portfolio. This time I’m plotting a portfolio that held 34% stocks, 33% 10yr Treasuries, and 33% Gold since 1968.

This allocation would have given us more consistent year-long and decade-long returns now. Take note of what this allocation strategy did not provide though: higher overall returns.

Frankly, most investors don’t make decisions based on total return. Rather, they tend to make decisions based on volatility. Since many investors cannot stomach the 50% losses or long periods of sideways movement that are often associated with stocks, most portfolios aim for some level of volatility while trying to maximize the return associated with that volatility.

In that case, this diversified portfolio of stocks, Treasuries, and Gold would have been preferred to the S&P 500 by most investors, since the Treasuries and Gold lowered the portfolio’s volatility by much more than it lowered the portfolio’s total return.

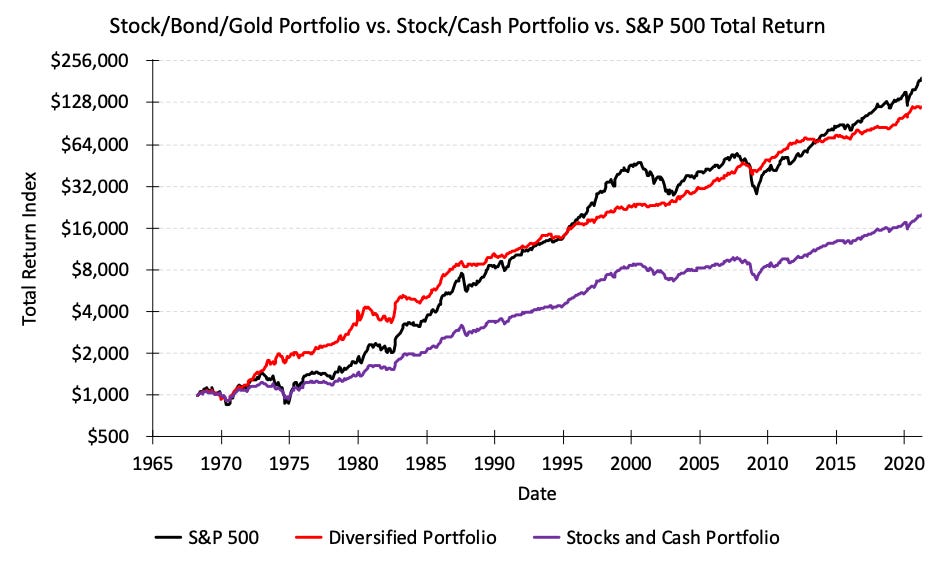

Let’s go back and directly answer the question of “Why do any other asset classes deserve consideration at all?” by comparing our diversified portfolio against a portfolio of just stocks and cash. In this comparison, I built a portfolio of stocks and cash that closely resembles the short-term and long-term volatility characteristics of the diversified portfolio.

We would have been obligated to hold 45% cash and only 55% stocks in order to achieve similar volatility with just stocks and cash, and we would have ended up with a much lower return.

Assuming we were trying to maximize returns and minimize volatility in this portfolio, Treasuries and Gold were very helpful inclusions.

This is not to say that you need to care about volatility or put any hedges in YOUR portfolio! And if you do find this useful, then there are many more asset classes you might want to consider as hedges too. My view? These findings are certainly making me reconsider my own allocations.